BIA Lowers Forecast for 2024 Local Ad Revenue To $172 Billion

Political spending expected to hit $11.1 billion, up 15.5% from 2020

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

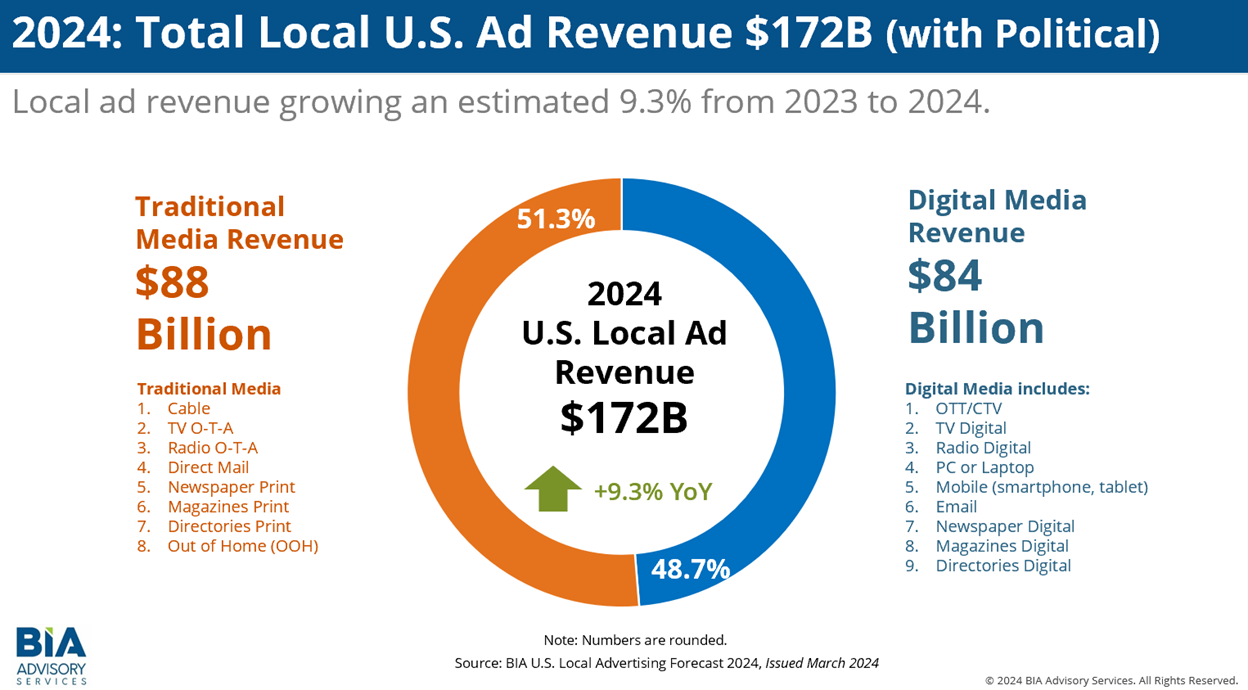

Powered by an election year, local advertising revenues are expected to increase 9.3% year over year to $172 billion in 2024, according to an updated forecast from BIA Advisory Services.

The new forecast calls for 2% less local ad revenue than BIA had forecasted in October.

Over-the-air TV, which continues to get the largest share of political ad spending, is expected to see a 28.3% increase from 2023 in total ad revenue to $20.8 billion. That is 1.2% lower than BIA’s earlier forecast.

Online TV ad revenue is expected to grow 24.9% to $2.2 billion, up 2% from the previous forecast.

Spending on local over-the-top and connected TV platforms is expected to grow 53.8%. BIA said the strong growth stems from the addition of high-quality and more accessible CTV inventory through the programmatic market, as well as increased rates on a cost-per-thousand viewers (CPM) basis.

“As expected, local political advertising will be substantial this year, and it’s fueling spend across the media landscape,“ BIA VP of forecasting & analysis Nicole Ovadia said. “As expected, local political advertising will be substantial this year, and it’s fueling spend across the media landscape.

“Our slight adjustment down for this year is mainly due to mixed economic signals, a slowdown in certain consumer purchases, and lower than expected spending in digital and direct mail advertising at the end of 2023 that may flow into this year,” she added. “However, we still anticipate 2024 to be better for local advertising than 2023 and certain media like TV OTA, TV Digital, and CTV/OTT are growing substantially.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

BIA expects political advertising to reach $11.1 billion in 2024, up 15.5% from 2002.

Reversing recent trends, traditional advertising is forecast to increase its share to 51.3%, while digital’s share slips to 48.7%

“Political and issue campaigns are recognizing that the combination of premium TV and targeted advertising can make a strong impact, using the same kinds of data ad buyers need with digital media,” said BIA’s Managing Director Rick Ducey. “Another factor supporting this growth is that we are observing spending leaking out of search and social and going into CTV/OTT.”

Beside political, the fastest-growing advertiser categories are expected to be real estate, up 12.5%, and leisure and recreation, up 4.7%.

Categories cutting spending include health, down 3.3%; general services, down 2.5%, and automotive, 1% lower.

“Beyond political, one category to also watch is real estate, as there’s been so much pressure around home prices and interest rates,“ Ovadia said. “We believe later this year when rates start to decrease, a flurry of activity will generate increased advertising, especially by realtors. Declining verticals like health are level setting from the pandemic but certain key areas of this vertical are holding spending steady and even increasing. Auto will not make a full recovery to pre-pandemic spending levels through the end of our forecast period in 2027.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.