Local Ad Revenues To Grow 8.6% in 2024: BIA

Research firm sees fast growth in connected TV, over-the-top video

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

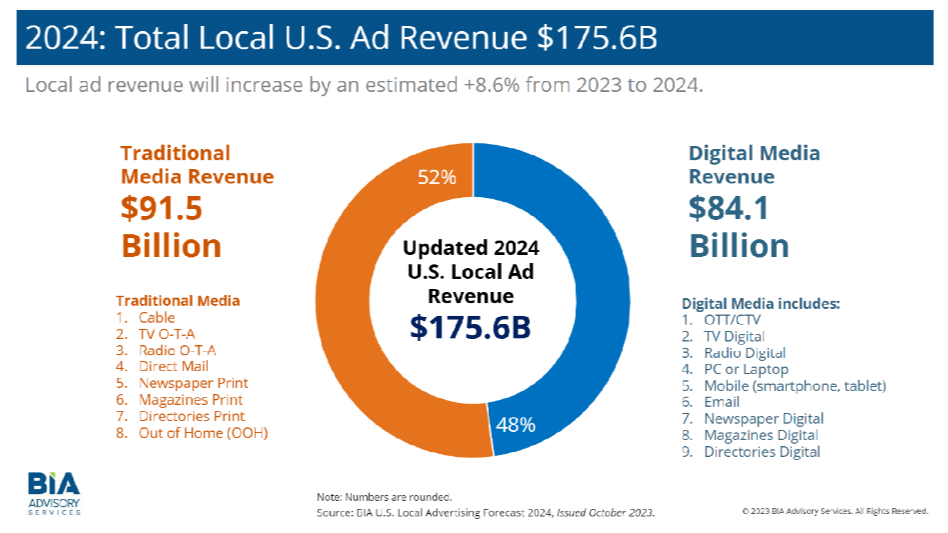

Local advertising revenues are expected to grow 8.6% in 2024, thanks to mushrooming political spending in a presidential election year, BIA Advisory Services said in its latest estimate.

Across all media, local ad revenues will reach $175.6 billion, BIA forecasts.

With the forecasted political revenues removed, BIA’s projection in 2024 is $164.6 billion in total local advertising, only a 2.2 percent increase in local advertising year-over-year.

“As expected, 2024 will be driven by political spending, and, even in markets that are not highly contested there will be a large amount of political advertising,” Nicole Ovadia, VP of forecasting and analysis at BIA, said. “Local political advertising will be fueled by the presidential and Senate campaigns as well as issue-based advertising. When we look at the forecast without political, we expect only a slight increase in ad spending due to both global and local economic trends that may create more cautious spending.”

The swell of political ads is putting a bigger share of dollars into traditional media.

The split between traditional and digital advertising shows that digital has a slightly smaller share, 48%, of the overall advertising spend at $84.1 billion. Traditional media ad revenue is slated at 52% of the ad spend at $91.5 billion.

The media channels showing the biggest gains for 2024 are expected to be connected TV/OTT, up 39.6%; TV over-the-air, up 30%; TV digital, up 24.3% and cable TV, 19.7%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Digital isn’t growing as fast as it once was. Meta, Alphabet, and others lowered their advertising revenue expectations several times throughout 2023, which in turn has caused us to reflect these reductions in the digital ad spend we track across 96 business categories,” Ovadia said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.