47% Of Buyers In Go Addressable Survey Say Addressable Ads Were Upfront Key

Go Addressable Summit set for November 29

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

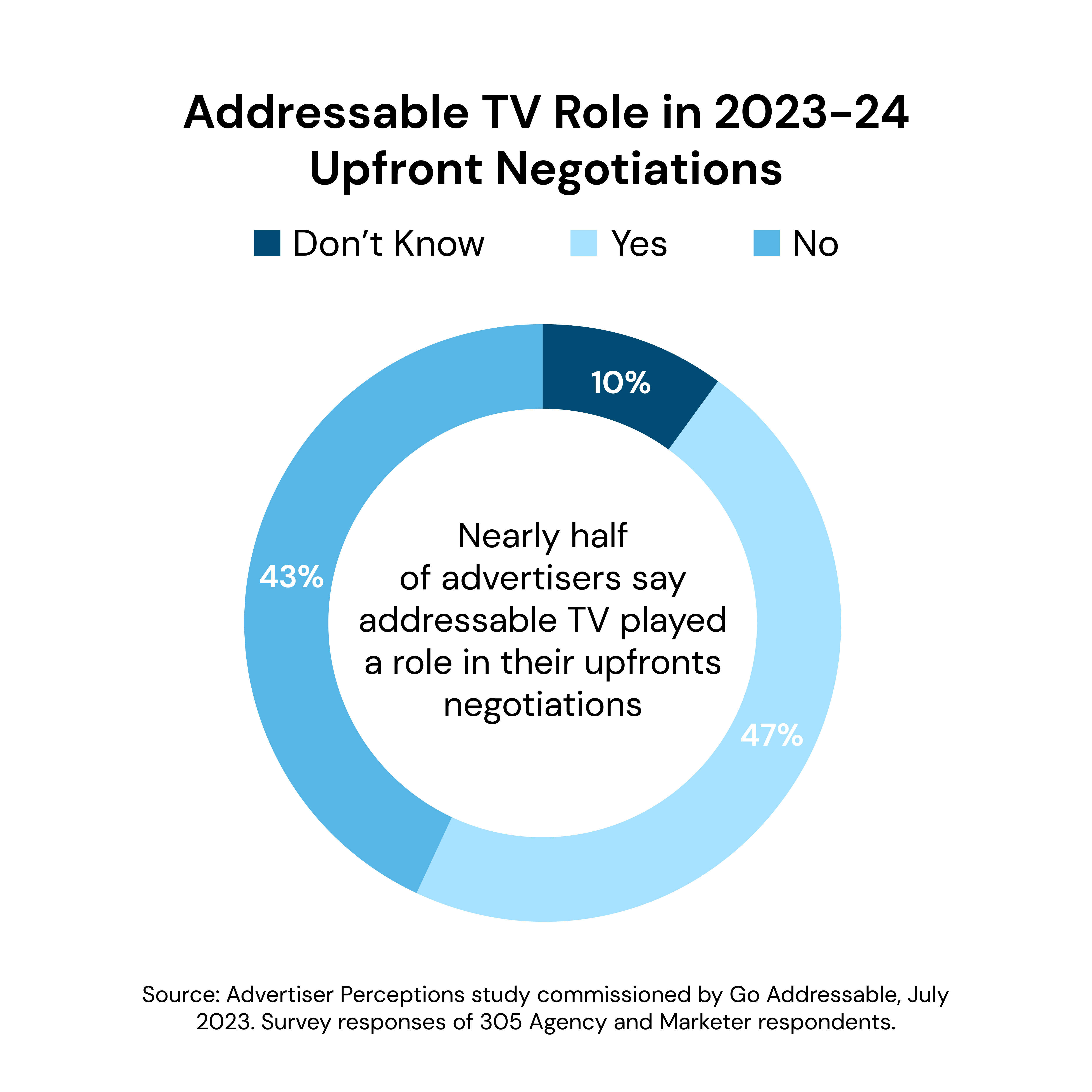

A new survey conducted for Go Addressable, an industry group dedicated to pushing addressable advertising, found that addressability was a big topic during the upfront TV market.

In a survey conducted by Advertiser Perceptions, 47% of advertisers said that addressable TV played a role in their 2023-24 upfront negotiations, with 80% those saying addressable advertising an important and extremely important part of their negotiations.

“Go Addressable’s main goal is to educate buyers on the benefits of addressable TV and make it easier to implement into the media planning process,” said Larry Allen, VP & GM, Data & Addressable Enablement, Comcast Advertising. “These findings on the role addressable TV played in the recent upfronts demonstrate that the medium is becoming mainstream, largely as a result of the work Go Addressable has done to showcase how it can be used to achieve optimal results for TV advertising. We are committed to continuing our work to further its adoption.”

A deeper dive into this recent data, along with additional insights, will be presented at the second annual Go Addressable Summit on November 29, 2023.

“Addressable advertising has become an increasingly important part of the TV mix,” said Michael Piner, executive VP, Advanced Advertising, Mediahub Worldwide. “The whole is greater than the sum of its parts. Using data and addressable tech to serve TV ads to qualified U.S. households – regardless of their content choices – is a valuable strategy for increasing the effectiveness of TV plans.”

Members of Go Addressable include Altice USA’s a4 Advertising, Charter Communications’ Spectrum Reach, Comcast Advertising, Cox Media, DirecTV Advertising and Dish Media.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.