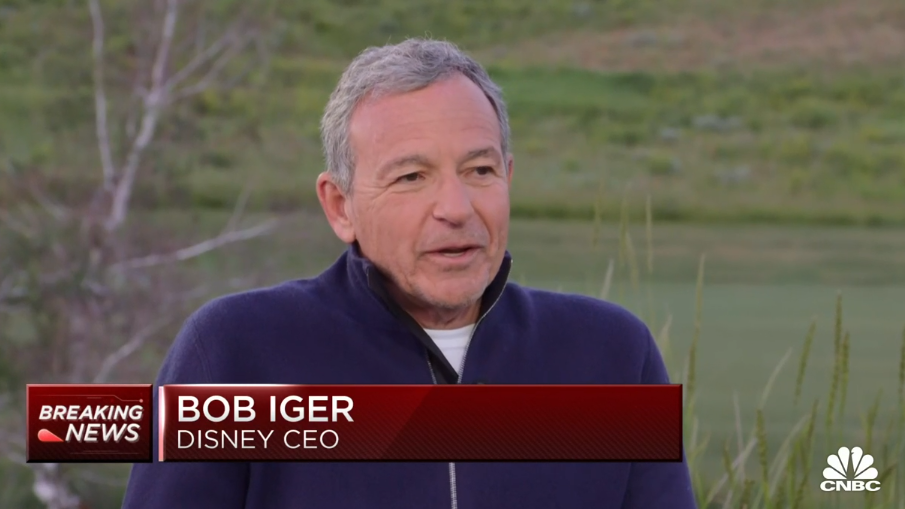

Bob Iger Says ABC, Stations May Not Be ‘Core’ for Disney

Partner might be brought in when ESPN goes direct-to-consumer

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Bob Iger, since returning as CEO at The Walt Disney Co., has determined that linear television — including ABC, local television stations and entertainment-focused cable networks — may no longer be core businesses for the company.

“They may not be core,” Iger said, speaking on CNBC from the Allen & Co. conference.

“Yeah, there’s clearly creativity and content that they create that is core to Disney, but the distribution model, the business model that forms the underpinning of that business, and that has delivered great profits over the years is definitely broken,“ he said. “And we have to call it like it is, and that’s part of the transformative work we're doing.”

Also Read: Disney Board Extends Bob Iger’s CEO Contract Through 2026

Since returning to the company last year, Iger said, he found that the linear TV business has been more disrupted than he expected, becoming what he termed “no-growth businesses.”

Iger did not say when he might dispose of Disney’s TV businesses or who might buy them.

Iger continued to say that Disney will inevitably create a stand-alone, direct-to-consumer version of ESPN.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“ESPN: If you look at today's media landscape, sports stands very, very tall in terms of its ability to convene millions and millions of people all at once,“ he said. “There’s almost a guarantee that that occurs. It's an advertiser’s dream. There’s a great demographic there and it lends itself to technology in many ways, both in terms of coverage, distribution and consumption. And our position in that business is very unique. We have a great brand. We've had a great business, and we want to stay in that business. That said, we’re going to be open-minded there, too, not necessarily about spinning ESPN off but about looking for strategic partners that could either help us with distribution or content, but we want to stay in the sports business.

“There’s so much more that can be done with it in terms of the way it's distributed, the way it’s consumed,“ he added. “It’s interesting just thinking about the Apple announcement of a few weeks ago, and what the possibilities there — that device lends itself to in terms of sports. So I think it's a business that, you know, we want to stay in.”

Disney already has a partner in ESPN with Hearst, which owns 20% of the sports business.

Iger said a new potential partner for ESPN would have to come to the table with value.

“Whether it’s content value, whether it’s distribution value, whether it’s capital, whether it just helps de-risk a business to some extent, but that wouldn't be the primary driver,“ he said. “But if they come to the table with value that enables ESPN to make a transition to its direct-to-consumer offering, then we’re going to be very — we’re going to be very open-minded about that.”

Iger also reiterated that Disney would prefer to own Hulu rather than sell it, possibly to Comcast, which owns a third of the streaming service.

“I spent a lot of time looking at that as part of the future of our streaming business, and ultimately concluded that we would be better off having Hulu than not having Hulu,” Iger said. “And in fact, the plan is for Hulu to be available starting the end of this calendar year as part of the Disney Plus offering. So in terms of the path to profitability of that business, which obviously has tremendous amount of focus on and a lot of attention, combining Hulu and Disney Plus is a major step in that direction.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.