TV Usage Takes March Dip While College Hoops Help Cable

YouTube takes biggest-ever share

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Television usage took its usual March dip, dropping 3% from February, according to Nielsen,

Last year in March, TV viewing fell 2% and in 2022, it was down 4.6%.

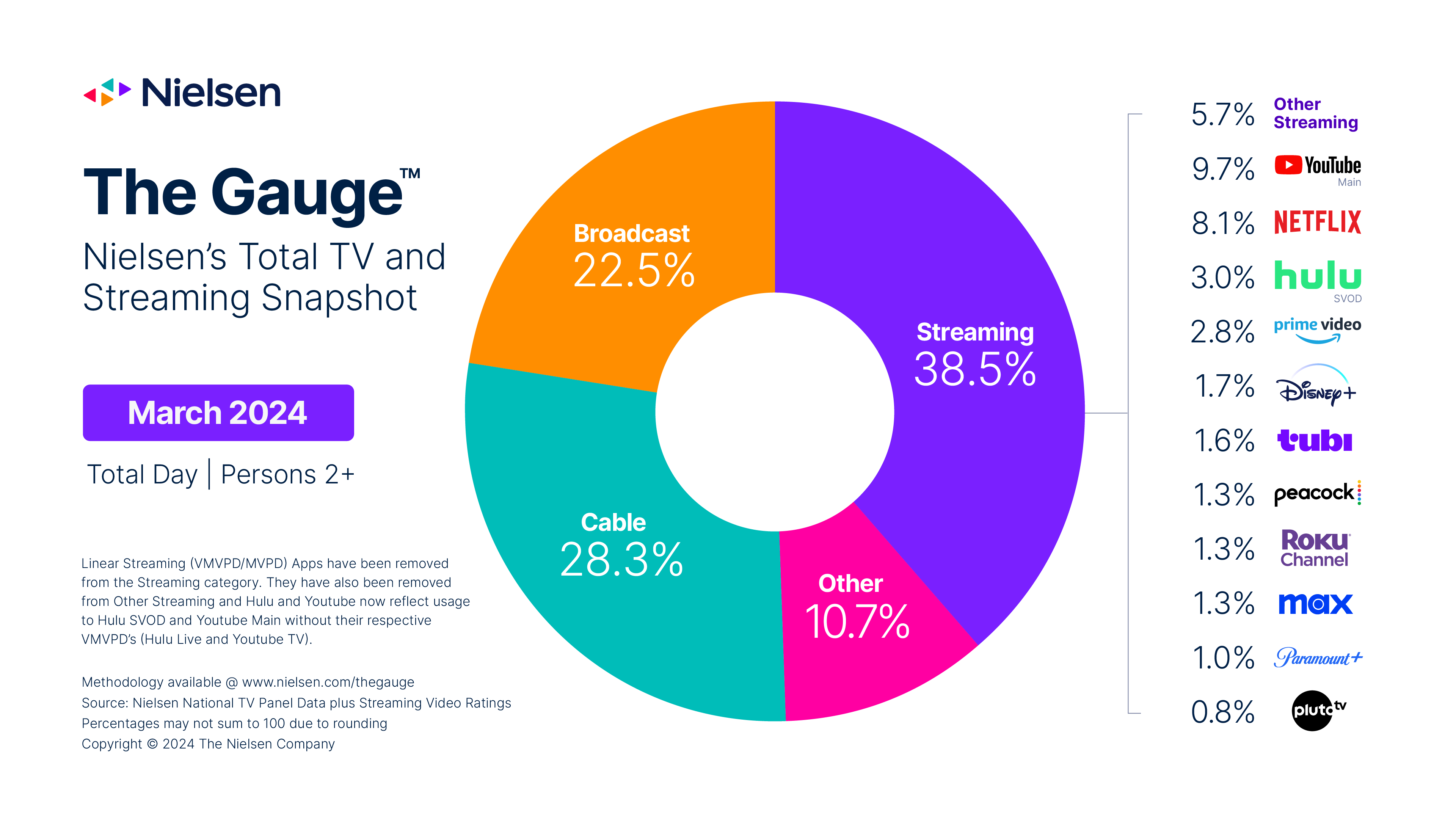

Broadcast usage was down 6% in February. Broadcast’s share fell to 22.5% from 23.3% in February.

Cable usage was flat, so it gained in share, rising to 28.3% from 27.6%. Cable was helped by college basketball coverage–particularly coverage of women’s college basketball, which set viewership records. The State of the Union address boosted cable news channels.

Streaming increased its share of viewing to 38.5% from 37.7% in February. Usage of streaming was down 1% in March compared to February. But compared to a year ago, viewership is up 12%.

YouTube had its biggest share of viewing ever, with a 9.7%.

Netflix’s share of viewing increased to 8.1% from 7.8%, boosted by original series such as Love is Blind, The Gentleman, and Avatar: The Last Airbender, which combined for nearly 15 million viewing minutes.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Hulu was the only other streamer to grow its share in March, moving up to 3% from 2.8%.

Amazon Prime Video had a 2.8% share, flat from February; Disney Plus dipped to 1.7% from 1.9%; Tubi fell to 1.6% from 1.7%; Peacock slipped to 1.3% from 1.4%; Roku had 1.3% up from 1.2%; Max was flat at 1.3%; Paramount Plus dipped to 1% from 1.1% and Pluto TV had a 0.8% share, unchanged.

Linear (live TV) streaming via multichannel video programming distributors (MVPDs) and virtual MVPD apps represented 6.4% of total television usage in March. Linear streaming is included in the appropriate broadcast or cable category, and is not included in the streaming category.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.