Magna Sees National TV Ad Revenue Down 4.7% In 2024

Premium long-form streaming ad revenues to hit $10 billion

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

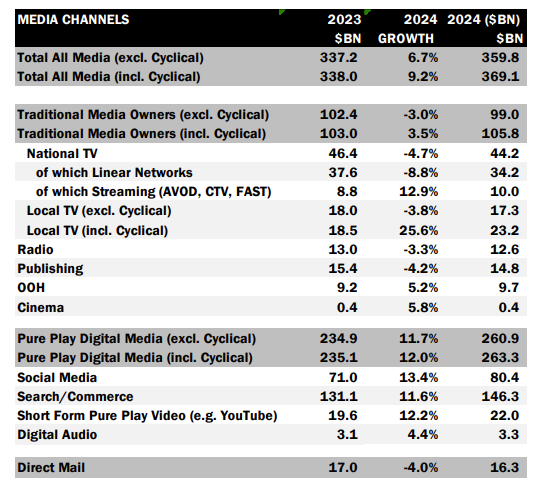

Despite an improving economic outlook, media buyer Magna forecasts that weakness of linear networks will result in national TV ad revenues falling 4.7% to $44.2 billion in 2024.

Magna sees spending on linear networks dropping 8.8% to $34.2 billion, while streaming, including ad supported video on demand, connected TV and free ad-supported streaming television is expected to jump 12.9% to hit the $10 billion mark, accounting for 22% of national TV ad market.

Streaming growth will be buttressed by Amazon adding commercials to Amazon Prime Video, Magna said.

Cyclical events will have a big impact on 2024, with the presidential election generating about $9 billion in additional ad revenue (up 13% from 2020) and the Olympics about $1 billion. Magna cut its estimate for political spending from its previous forecast of 18% growth from 2020 because of a slowdown in candidate fundraising.

Magna said linear TV continues to struggle from eroding reach and poor ratings.

“This is despite the resilience of sports and tentpole events so far this year and eroding pricing power as brands diversify their video budgets towards streaming and digital media. However, when including cyclical spending, total cross platform ad sales will drop by just 2%, thanks to incremental viewing and ad spending around the Olympic games,” Magna said..

Magna sees local TV spending growing 25.6% to $23.2 billion including the Olympics and presidential year political advertising. Excluding cyclical spending, local TV is seen dipping 3.8%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Magna says that in the fourth quarter of 2023, non-cyclical ad revenues across all media grew by 9.1% in the fourth quarter of 2023, the strongest quarterly growth in almost two years. Full year ad market growth was 5.7% in 2023.

Across all media including cyclical events, U.S. ad spending is expected to be up 9.2% to $369.1 billion. Excluding cyclical spending. The U.S. ad market will grow 6.7% to $359.8 billion.

That’s stronger than Magna’s previous outlook.

“Several factors led Magna to increase its U,S, ad market growth forecast,” said Vincent Létang, executive VP, global market intelligence at Magna.

“That includes an improved macroeconomic outlook with GDP growth raised from 1.7% to 2.4% in the last few months, the momentum of digital media formats: social media, retail media, and streaming. The latter is driven by a strong expansion in the reach and marketing opportunities offered by ad-supported streaming," Létang said. "That leads Magna to raise the non-cyclical growth forecast to 6.7%. We are slightly reducing the forecast for cyclical spending (due to a slowdown in political fund-raising) but, overall, we now expect total media owner ad sales to grow by 9.2% this year (compared to 8.4% in our previous update) to reach $369 billion.”

Pure play digital media is expected to absorb much of the spending increases. Including cyclical spending, digital media will grow 12% to 263.3 million. Excluding cyclical spending, spending on digital media will be up 11.7% to $260.9 billion, Magna forecasts.

Short-form pure-play digital video (think YouTube) is expected to see 12.2% growth to $22 billion. Social media ad spending is seen increasing 13.4% to $80.4 billion.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.