iSpot Buys TVision Stake in $16 Million CTV Ratings Deal

iSpot gets exclusive person-level data from TVision panel

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

iSpot, which has built its TV-measurement business on big data, has bought a stake in TVision as part of a $16 million funding round, and will get exclusive access to person-level data on connected TV viewing from TVision's audience panels.

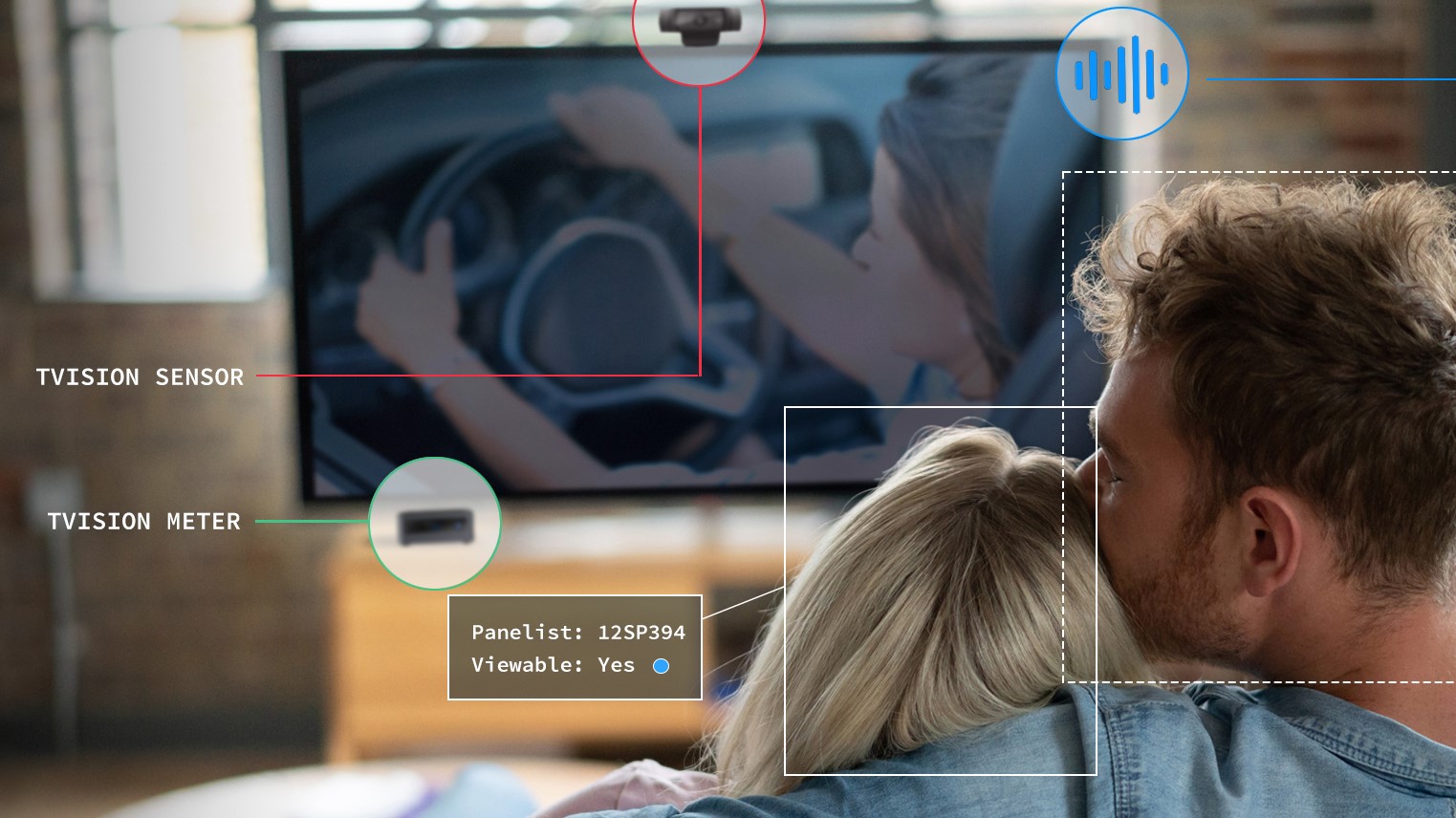

TVision is best known for measuring viewer attention, but the technology it uses to see how intently people in a household are watching a particular show or commercial, is also used to count how many people are watching to calculate co-viewing, and which members of a household are watching to generate demo information.

The investment, led by iSpot with longtime TVision investors SIG Capital, Accomplice and Golden Ventures also participating, comes at a time when CTV viewing is growing and marketers are shifting ad dollars to CTV to reach those viewers, but ad buyers say there is no reliable way to measure it.

The investment also comes at a time when TV measurement Goliath Nielsen is being challenged by high-tech alternatives — led by iSpot — that are using data from smart TVs and set-top boxes to better count viewers in a more complex TV landscape in which streaming and fragmentation are becoming a bigger factor.

Also: Viewers Spending More Time with AVOD Than SVOD: TVision

“The $90 billion TV and CTV marketplace cannot transact on methods developed decades ago and expect to give today’s advertisers real visibility into how multiscreen TV drives their very modern brand KPIs. The industry needs ever-more investment in new technologies capable of capturing the reach, engagement, and audience insights that boost advertiser confidence in escalating their ad investment with multiscreen TV publishers,” Video Advertising Bureau president and CEO Sean Cunningham said. “We applaud the work iSpot and TVision have done to advance the industry and are encouraged by the investments each are making to develop more accurate and representative cross-platform measurement capabilities.”

iSpot CEO Sean Muller, who will become a TVision director, told Broadcasting+Cable that iSpot and TVision have been working together for three years. Earlier this year, iSpot got a $325 million investment from Goldman Sachs.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“We really wanted to expand our relationship and partnership with TVision,” Muller said.

“We also wanted to invest in panel technology, which we believe continues to be important for the industry,” Muller said. “We are a huge believer in big data as the front line of measurement and that continues to be the case. But we also believe in being able to get to the person level in the household to supplement that measurement.”

Together, iSpot and TVision will be able to bring a new standard and new currency to a TV world in which linear TV and connected TV are unified in the way they’re planned, bought and measured, Muller said. “This partnership can accelerate the process,” he said.

Before the upfront, there was much clamor about alternative measurement companies and new currencies. After the upfront, it looked like Nielsen remained dominant. But with Nielsen looking to roll out its new Nielsen One system later this year, the industry may get another chance to weigh its options.

"We really hope that people make further Investments in these new currencies and especially in the unification of linear and CTV because ultimately, it just helps the industry,” Muller said. “Come the 2023-24 upfront it's 100% new currency. We see 2023-24 as a pivotal year.”

The TVision panel has 5,000 homes and about 14,000 people. Panelists let TVision mount a camera-like device on top of their TV sets, enabling TVision to monitor who is in the room when the TV is on and precisely what they’re looking at. Originally TVision focused on measuring how much attention people were paying to specific elements of shows’ commercials but the company realized this asset could be used for other purposes, including measuring co-viewing.

“We believe our panel has a lot of potential to produce even more products,” TVision CEO Yan Liu told B+C. He said the TVision panel is more cost-efficient and user-friendly for panelists, who don’t have to push buttons to have their viewing registered as they do in Nielsen’s panels.

With iSpot’s investment, TVision might increase the size of its panel, but Liu said he doesn’t believe it has to be as big as Nielsen’s, which has 30,000 to 40,000 homes because TVision doesn't use its panel to measure all viewing. Viewing is measured using big data and TVision's panel is used to answer questions and calibrate that big data.

”The future of currency is combining big data sets with panel data,“ Liu said.

If big data can show how many households are tuned in, TVision's panel provides a view as to how many people in those households were watching and which members of the household.

“We already know who lives in the household,” Muller said. ”Using the TVision data we know The Voice on Tuesday night had an average of 1.35 viewers on a second-by-second basis in front of the TV and also gives us a distribution of the age and gender of those.“

That means ad buyers can get the demo data they've long depended on, particularly for CTV.

“Right now, there is no currency for CTV,” Muller said. “The publishers are essentially self-reporting in many cases. They're not even selling on people or co-viewing.

"We’re highly focused on unified measurement and the idea that CTV and linear should be transacted together,” he continued. “Unified measurement is going to much more granular demos across 900 different streaming publishers.”

Some media companies said they were encouraged by iSpot and TVision getting together.

“This partnership is a step towards accurately counting every individual in front of the TV screen,” said Andrea Zapata, executive VP, ad sales research, measurement and insights at Warner Bros. Discovery. “TVision’s modern measurement approach is more precise in identifying who is in front of the screen. With investments towards panel growth and the inclusion of multiple TV sets in a household, there is a real possibility of having a representative panel that relies less on additional panel(s) for calibration.”

NBCUniversal has been particularly aggressive in vetting potential alternatives to Nielsen and a big backer of iSpot.

“Combining iSpot's massive panel with TVision’s modern approach to counting real people helps advertisers measure co-viewing across linear and CTV with greater accuracy across households and diverse audiences,” said Kelly Abcarian, executive VP, measurement and impact at NBCUniversal. “A cross-platform currency, based on the exact ad and powered by fast and accurate co-viewing metrics, will also bring a completely new approach to valuing premium content.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.