David Kenny Says Some Parts of Nielsen One Are Being Accelerated

CEO cites ‘noise’ in the market and says advertisers demand a single currency

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Nielsen, under fire from media companies and a raft of competitors, said its new measurement system Nielsen One is on track, with the rollout of some parts being accelerated.

“We are executing as planned, as committed on Nielsen One,” said Nielsen CEO David Kenny Monday morning during the company’s fourth-quarter earnings call.

Also: Nielsen, Experian Expand Deal For Digital Identity System

Kenny acknowledged the attention challengers are getting. “I would remind you that every major change to expand media measurement has been met with resistance and headlines. This dates back to adding cable to broadcast [00:07:21] in the 1990s and the addition of delayed viewing on a DVR in 2006,” he said.

“The current move to reconcile streaming and linear is perhaps the biggest change in the history of media. Friction can be expected and we are seeing it.”

Last year, Nielsen was found to have undercounted viewing during the pandemic and lost its accreditation from the Media Rating Council. Several media companies announced they were starting tests with alternative measurement companies–iSpot, VideoAmp, Comscore among them–to provide currencies for buying and selling ads in the new cross-platform environment.

Despite the grief it is getting, Nielsen said business was good because Nielsen is the only company in the market that can provide a complete solution.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“There is more noise on the traditional TV side as our clients adjust their business models from linear to streaming,” Kenny said. “But privately the conversations we have with clients and their contracts with us show that our business with them is much more productive than they normally suggest.”

He said Nielsen’s revenue from national media clients grew by double digits in the fourth quarter and in the high single digits for the full year of 2021. He added that Nielsen renewed 100% of its top 100 contacts with clients over the last three years.

“Importantly, advertisers and their agencies want to transact, on one foundational currency that reflects in one number as close to 100% of the media and 100% of the people watching it. This is Nielsen One, which will leverage all of the many points where we are embedded in media planning and buying system,” Kenny said.

Also: Analysis: Super Bowl Could Kick Off Media Measurement Multiverse Mess

He predicted that while media companies are complaining about Nielsen One, it will be adopted because “the buyers are going to demand it.”

Kenny added that Nielsen is one the way to regaining its accreditation from the Media Rating Council.

“We've taken significant steps to improve quality control to meet the MRC accreditation standards and drive sustained quality improvements,” he said.

“We’ve identified with the MRC success criteria required for re-accreditation and we expect to complete all necessary action items by mid-year,” Kenny said. "After which we expect the MRC members to vote on accreditation.”

Kenny added that Nielsen has its of having 41,000 homes in the panel of TV viewers in 2021 and that the company will reach its target of 41,600 by the end of this quarter. During the pandemic, Nielsen was unable to maintain its sample and the number of active homes dwindled.

David Gunzerath, senior VP and associate director of the MRC said "any reconsideration by MRC of the accreditation statuses of Nielsen’s services will need to be preceded by auditing, and we and Nielsen are in discussions on the appropriate scope and timing of the audit work that will be necessary.”

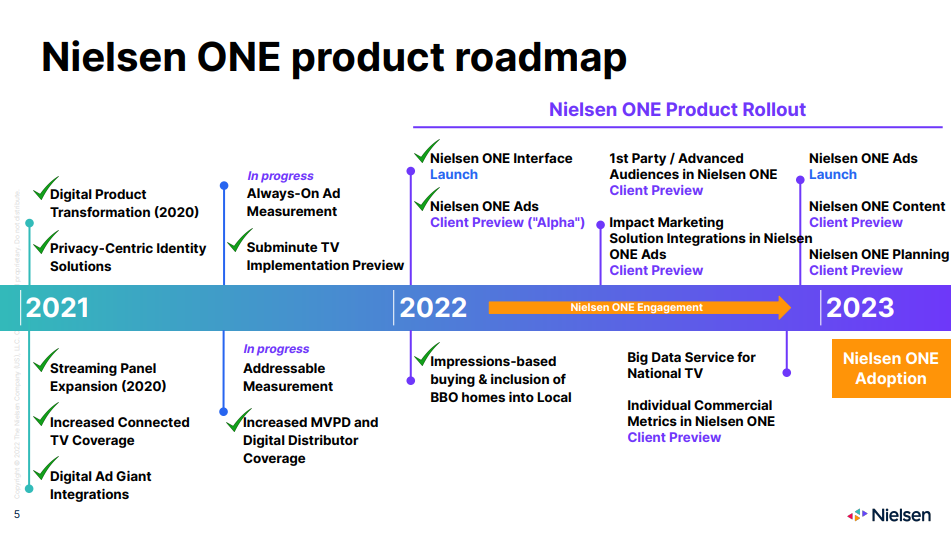

Kenny also updated some aspects of Nielsen product roadmap, leading up to the installation of Nielsen One.

Also: Nielsen Teams With Trade Desk Internationally To Improve Identity Resolution on Internet

A key part of Nielsen One is using big data from set top boxes and smart TVs to supplement the viewing information it gets from its panel.

“In alignment with client feedback we'll launch big data as a standalone service in September in parallel with the existing currency,” Kenny said. “Clients who are ready to transact on new, more robust metrics, will be able to do so this fall.”

He said Nielsen will also be adding addressable measurement. "We're working with addressable providers to help them scale and drive adoption,” Kenney said.

Kenny said that Nielsen launched an alpha version of Nielsen One in January, ahead of schedule.

“Alpha is specific to ad campaigns and gives clients an initial look at the user interface as well as audience deduplication across all screens, adding in CTV for the first time in addition to linear TV, computer and mobile,” he said.

The companies testing the alpha version of Nielsen One including Kimberly-Clark The Walt Disney Co. and media agency Magna.

“In fact, every major agency holding company is now engaged with Alpha. We have received positive feedback on Alpha. Clients like the utility and the interface of Nielsen One,” he said.

“They've also given a suggestion, given the growing role of first-party data in our agency partners’ cross-media strategies, we are prioritizing the measurement of audiences beyond age and gender including first-party audiences in 2022,” he said.

Kenny said that early discussions also highlighted that data about time spent viewing, reach and frequency were important to their attribution calculations. “Accordingly, we are accelerating opportunities to integrate data from our suite of impact marketing solutions into Nielsen One later this year,” he said.

By the end of this year, Kenny said Nielsen will be sharing data from Nielsen One. That will mean the industry will get a two year period with parallel data before fully transitioning to the new cross media metrics by the Fall 2024 season.

Kenny added that Nielsen One was being designed for more than ad buying.

“After Nielsen One Ads, we will launch Nielsen One Content that will provide studios, distributors and streaming platforms unprecedented insight into cross-screen consumption,” he said. “And we'll launch Nielsen one planning, which will empower agency and in-house media buyers to effectively forecast and plan cross-media native campaigns.”

While Nielsen is adding big data, the company is sticking to its guns that its panel is a big reason why its audience measurement methodology is superior to its rivals.

“We're integrating set-top box and ACR data from roughly 30 million households into our national TV measurement,” Kenny said. “Set top box data provides valuable insight into consumption via cable and satellite subscription. That said, nearly half of all households no longer have a set-top box. We expect cord-cutting to continue. So we're focused on connected TV data, which we believe will be more resilient over time.”

He warned that using big data alone can lead to over-estimates of viewing.

“Unvalidated machine data often produces inflated audience estimates,” Kenny said. “We measure people not just devices because people and not machines are who watches video.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.