Viewers Spending More Time with AVOD Than SVOD: TVision

Attention lower for CTV than for linear television

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

As more people stream their television programming, the use of ad-supported video has surpassed the use of the higher profile subscription video services.

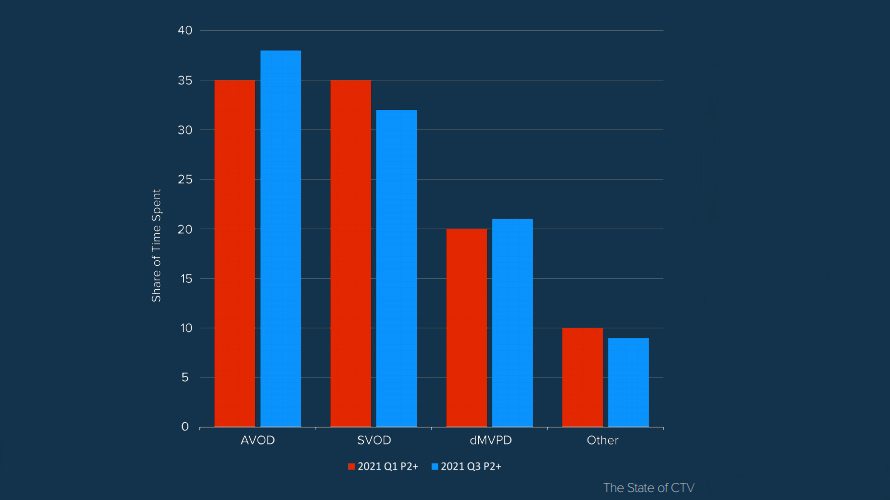

Time spent on AVOD increased 9.3% from the first quarter of 2021 to a 38% share for the third quarter of 2021. During the same time period, SVOD’s share of viewing decreased by 8.6% to a 32% share, according to a new The State of CTV report from TVision Insights.

TVision said this is important to advertisers and media buyers, who have been concerned about being able to reach consumers if they cut the cord and shift to ad-free services like Netflix and Disney Plus.

“Questions of whether consumers would embrace ad-supported streaming television largely dissipated as viewers now spend more time with AVOD than SVOD, and dMVPD providers also represent a growing share of streaming viewing time,” the TVision report said. “It became clear during the Upfronts in Spring that advertisers and media sellers were ready to move on CTV in a big way - as CTV advertising became a real component of both advertisers media strategies and media sellers inventory offerings.”

Unfortunately for advertisers, attention rates are lower on CTV than on linear TV at this point in time. But TVision said there are remedies for those who want to reach streaming viewers.

“Our data suggests that as advertisers make increasing investments in CTV, they can work to optimize their media plans to increase attention. Overall, CTV ad attention rates are lower than linear TV advertising norms. Advertisers can find more engaged viewers by optimizing for frequency, ad length, content alignment and more,” the report said.

As more streaming services enter the field, Netflix’s share of viewing fell to 22% in the first half of 2021 from 27% in the first half of 2020, TVision said. While Netflix is still No. 1, YouTube is getting closer.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Among the streaming apps, Amazon Prime Video moved up to No. 4 (behind Hulu) from No. 5 and Sling jumped to No. 5 from No. 8. Disney Plus moved up to No. 6 while YouTube TV fell back to No. 7 and HBO Max fell from sixth to eighth. Peacock jumped three spots to No. 11 and Apple TV Plus moved up nine slots into the top 20 at No. 19.

Ranked in terms of attention, HBO Max was No. 1, followed by YouTube TV, Discovery Plus, Peacock and Prime Video.

“Streaming-only viewers are more likely to be younger, but seniors are cutting the cord as well now, too. Advertisers should embrace CTV to reach these viewers,” the report said.

TVision measures TV and CTV engagement for every second of programming and advertising. The data for this report was collected from Jan. 1, 2020, to Sept. 30, 2021, from 5,000 homes across the United States. All data is weighted to represent the country. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.