More Scripps Channels Go FAST In Deal With Vizio

Broadcaster’s over-the-air networks add streaming, pay-TV distribution

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

E.W. Scripps and Vizio said they made a deal that adds four Scripps channels to Vizio’s WatchFree Plus streaming platform.

The agreement is the latest in the last few weeks that give the over-the-air Scripps networks, led by Ion and Bounce, carriage as free ad-supported streaming television (FAST) channels.

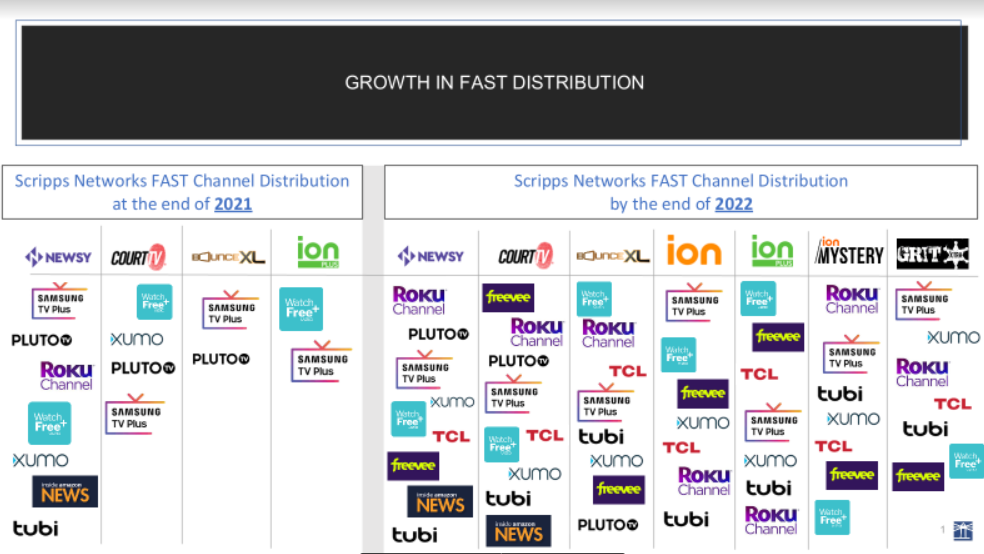

Since acquiring Ion Media in 2021, Scripps has embarked on a quiet 16-month strategy that has turned its over-the-air networks into ubiquitous superchannels that can be found by viewers watching over the air, via streaming or, in some cases, as part of a pay-TV package.

Roku and Samsung recently announced deals adding Scripps Networks to their FAST lineups. Scripps also has agreements with Pluto TV, Tubi, LG and TLC, making the company, a pioneer in the digital broadcast network business, a leader in FAST.

Scripps is expected to complete a deal with DirecTV, which will launch Scripps’s Bounce and Grit networks on direct broadcast satellite, giving Scripps pay-TV carriage as well. Ion is already available via pay TV, over the air and as a streaming channel.

“These networks have grown into multi-platform businesses that can touch every consumer, no matter now they consume media,” Jeffrey Wolf, chief distribution officer at Scripps Networks, told Broadcasting+Cable.

“It's been a pretty good strategy because by the end of 2022 we’ll have seven FAST channels and we’re on basically every single major platform,” Wolf said. “We want mass distribution for our product.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Other over-the-air channels are also signing up for extra distribution. This week Cinedigm said that its streaming channel RetroCrush was being carried by virtual MVPD Philo. Sinclair Broadcast Group’s over-the-air channel Charge is on Dish and Sling TV. Weigel Broadcasting’s digital multicast channels including Me TV are on Frndly TV and its Decades and Start TV channels are on Philo.

But getting multi-platform carriage has been a real focus at Scripps.

In the latest deal, Vizio is adding Ion, Ion Mystery, Bounce XL and Grit Xtra to WatchFree Plus. Vizio already had Scripps’s Newsy and Ion Plus channels as well as the streaming apps for Newsy, Court TV and Brown Sugar.

“We’re pleased to be working with Scripps to expand their content offering on Vizio, helping us deliver on our commitment to provide endless entertainment options and enhanced consumer experiences,” said Katherine Pond, group VP, Platform Content and Partnerships at Vizio.

“Thanks to these popular Scripps channels with some all-time consumer favorite shows, we’re able to offer an ever wider variety of free programming across genres and interests, and bring more options to millions of WatchFree Plus viewers,” Pond said.

Financial terms were not disclosed.

Unlike cable channels, FAST networks do not get carriage fees from distributors. Instead, negotiations revolve around advertising, with deals calling for either a split of ad inventory or ad revenue.

“The biggest challenge is who sells the inventory,” Wolf said. For Scripps’s stronger channels, Wolf seeks ad inventory. When the distributor such as Amazon Freevee or Samsung has strong connections in the ad market, a revenue split can be a good deal. In some deals, Scripps has inventory shares for certain networks, and revenue shares for others.

Wolf notes that in most revenue-share deals, the programmer does not get a share of the viewing data generated by the content. “We’re now working with platforms to find solutions to that so we can also have data,” he said.

Ion, a broadcast network, has proved attractive as a FAST channel, giving Scripps and Wolf a bargaining chip with streaming platforms and smart-TV makers. Ion is on all of the major platforms except Paramount Global’s Pluto TV.

“Being one of the only major broadcast networks that’s available in the FAST space gave us an opportunity to make some favorable deals that we're able to monetize in a significant way,” Wolf said. “It’s no surprise that Ion right out of the gate became one of the most watched FAST channels in the business.”

When Scripps acquired Ion Media, it had a secondary channel called Ion Plus. Samsung put Ion Plus on its Samsung TV Plus platform and it did well, Wolf said..

Scripps is now able to offer distributors a package of Ion, Ion Plus and Ion Mysteries, previously known as Court TV Mysteries and one of the company’s fastest growing networks.

Another channel popular with distributors is Bounce, aimed at African-American audiences. Scripps created Bounce XL as a FAST channel to avoid conflicts with the Bounce broadcast affiliates that sell local ads.

The process of securing rights, creating channels and gaining distribution involved nearly every part of Scripps organization, Wolf said, including research, finance, programming and especially legal services.

“Every platform has nuances. Every agreement is a three- or four-week conversation and six rounds of lawyers going back and forth with everyone trying to figure out the wild, wild west here,” Wolf said. “Our legal folk have stepped up and are experts in that business.”

Wolf said that the FAST business is still a young one, having basically started in 2014 with Pluto TV, now owned by Paramount Global. For Scripps, the FAST genre represents a small share of ad revenue, but one that is growing fast.

“Advertisers are looking for businesses that actually can participate in both linear and connected TV. They don't want one over the other. They want both,” Wolf said.

Scripps Networks had a disappointing second quarter, with revenue flat at $239 million and segment profit down to $73.3 million from $107 million the year before. Wolf blamed a weak ad market and comparison to a strong quarter a year ago for the performance.

At the same time, the platforms are starting to get more particular about the channels and content they distribute.

“What we're seeing is that these platforms are really starting to negotiate hard and they want premium content, content that's going to drive viewership to their platforms,” Wolf said.

Wolf said Scripps aims to work with distribution partners to highlight its content and bring in viewers.

“We look at these things as partnerships versus vendor relationships. And that's an important thing for us in a big way. We are trying to avoid these concepts of vendor relationships where it's us versus them because, you know, these platforms need quality content as much as we need their distribution,” Wolf said. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.