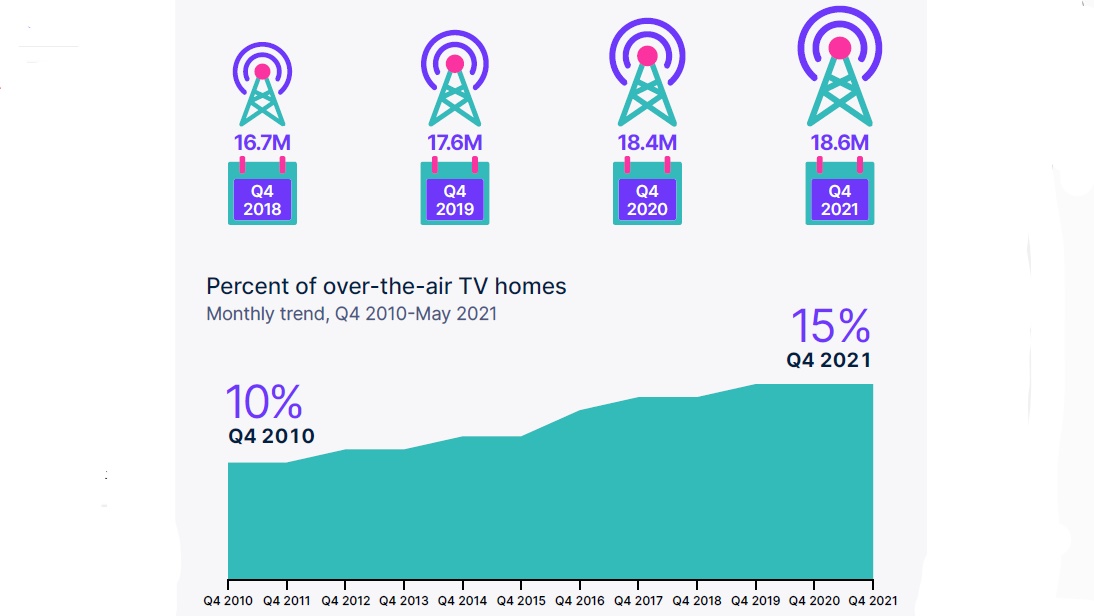

Nielsen Sees Uptick in Over-the-Air Households

18.6 million homes using antennas, or 15% of the U.S.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Rabbit ears are multiplying.

With cord-cutting continuing, the number of U.S. homes that get content over-the-air through an antenna has grown to 18.6 million in the fourth quarter of 2021, up from 18.4 million a year ago, according to a new report from Nielsen.

Those 19 million homes represent 15.3% of households, up from 14.3% in the fourth quarter of 2018, when there are 16.7 million over the air homes and just 10% in 2010.

While over-the-air homes have grown, the share of homes with cable, satellite or telco pay-TV services -- what Nielsen calls Cable Plus has shrunk to 57% in the fourth quarter from 76% in 2018. Broadband only homes increase to 27% from 9% over the same interval.

The increase in over-the-air homes and viewing is supporting the growth of diginets launched by broadcasters including E.W. Scripps, Sinclair, Tegna and Weigel.

Nielsen took a closer look at those households over-the-air households in its Local Watch Report titled "The Over-the-Air Evolution."

Nielsen divides OTA home into three segments, those with no streaming subscription VOD services (and maybe no broadband); those with SVOD, but without a virtual multichannel video programming distributor, such as Hulu Plus Live TV, YouTube TV or Sling TV; and those with SVOD and vMVPDs.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The largest group uses OTA and SVOD at 9.3% of the country, up from 7.2% in 2018. The OTA homes with vMVPDs rose to 1.9% from 1.2%, while the OTA only home fell to 4.1% from 5.9%.

People in homes that go over-the-air but don’t stream have an average age of 61, only 13% of them have children and their median income is $22,800.

Also: Nielsen Executive Shows Support For Expanding Age Demo to 25-64

People in homes that combine over-the-air viewing with at least one streaming service have an average age of 45, 40% of them have kids and the median income is $49,000. In the homes that have OTA and a vMVPD, the average age is 49, 35% have children and the median household income is $77,000.

Over-the-air homes spend 3 hours and 50 minutes a day watching TV, more than the 2:53 of viewing time in broadband only homes. Cable plus subscribers spend 5:07 with TV.

Among the three OTA groups, those that are OTA only watch the most at 4:58 a day. That compares to 4:11 for the homes that combine OTA with vMVPDs and 3:26 for OTA homes with one SVOD subscription.

In the report, 68% of OTA viewers say they speed less than $100 on TV services. Among all TV viewers 45% say they spend less than $100 on TV.

The majority of OTA viewers say they can access fewer than 20 channels, while most other TV viewers say they can watch more than 50 channels.

Nielsen said the top OTA markets are Albuquerque, Milwaukee, Kansas City, Phoenix and Oklahoma City.

“Austin is the 8th ranked metered market in OTA penetration, but is the No. 1 market for OTA homes with an SVOD and vMVPD service at almost 7%. Given Austin’s reputation as a young, growing city, and the recent transplant of Tesla, it makes sense that this OTA segment is so large,” the report notes.

News is important to OTA consumers. They also watch a lot of weekday daytime TV, according to Nielsen.

“OTA viewers are an important segment of the media landscape as there is less concern for advertisements than other TV consumers. ‘Ad-free’ and ‘skipping ads features’ were at the bottom of the list for all TV viewers when choosing a TV service, but within the OTA segment, only 1 in 3 found these attributes 'extremely’ or ‘very' important," the report said.

The bottom line: “Broadcasters still have a lot to gain from the OTA universe,” the report said. “These consumers are still interested in staying up to date with news, less concerned with skipping ads, and practice a budget-conscious lifestyle. Couple that with diversity, family status, increased HH income, and media savvy, and that makes OTA audiences a key cog in the media wheel of the future.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.