Upfront 2022: Sinclair Seeks 20% of Cable Budgets For Its Over the Air Channels

The Stack ratings rise while cable erodes

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Sinclair Broadcast Group wants advertisers to move 20% of their cable ad budgets into its free over-the-air digital networks to capture cord-cutters.

In addition to its slew of TV stations, Sinclair owns Comet, Charge and TBD, collectively branded as The Stack. In its upfront pitch, Sinclair is informing buyers that those cord-cutters leaving cable aren’t just moving to streaming channels; they’re also buying antennas to watch familiar shows — soon to include Buffy the Vampire Slayer — for free on its diginets.

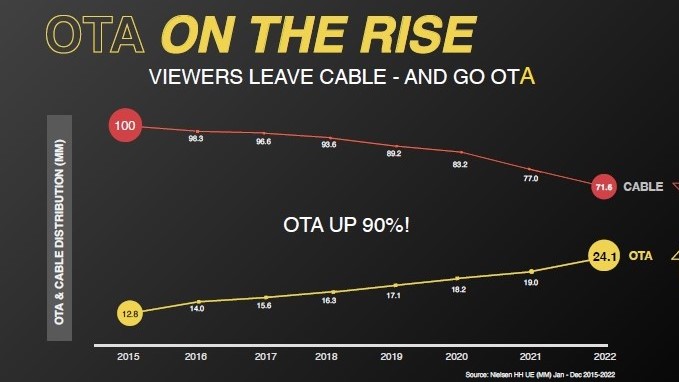

Adam Ware, VP of growth networks and content at Sinclair, told Broadcasting+Cable that ratings in the cable universe are down 28% since 2015, while OTA ratings are up 90%.

More remarkably in primetime among viewers 25-54, just 18 out of 139 channels measured by Nielsen were up last year and five of those were OTA digital multicast channels, including the three channels that make up Sinclair’s Stack. Excluding sports, news and Hispanic channels, six are up, including the three Stack channels and two other multicast networks, Ware said.

The Stack as a whole was up 32%. Comet, the sci-fi channel, jumped 50%; TBA, which offers internet-type content, grew 40%; and Charge!, focusing on action stars, was up 6%.

Sinclair is telling media buyers that if you move $1 out of every $5 now being spent on comparably sized cable networks to The Stack, campaign reach goes up 21% and duplication of viewers is only 3%.

Advertisers looking to maximize reach should buy all three networks in the Stack because only 6% of the audience watches all three, and just 16% watch two.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

"The media buyers are all dealing with the same issue with cable ratings going down,“ Ware said. ”They often think viewers are going to FASTs and we’re saying, yeah, but they’re also going to OTA. These channels can easily fit into any buy. They have content buyers have purchased before, so it’s trusted. There’s no content risk here.”

Some media buyers are already looking at digital broadcast seriously. “We’ve been actively buying OTA nets for several years in the upfront,” David Campanelli, executive VP and chief investment officer for Horizon Media, said. “We consider those networks as comparable to most tier-2 or tier-3 cable networks.”

Like other emerging networks, particularly those on multicast, Comet, Charge and TBD have been supported mostly by direct-response ads. Ware said Comet sold some general market advertising in last year’s upfront and this year, he’s aiming to have 20% of the three networks' ad revenue come from general-market advertisers.

Some advertisers have already taken the plunge, sponsoring programming stunts, like Comet’s recent Planet of the Apes marathon, which was sponsored by Claritin. Other sponsors of special programming on The Stack include Walgreens, Little Caesars and GEICO.

Sinclair is investing in additional acquired programming for The Stack, including Buffy, which will come to Comet with a 10-hour marathon on Sunday, June 5, before settling into its regular timeslots at 7 p.m. and 8 p.m. Monday through Friday, said Ware, who earlier in his career launched Buffy on UPN after the show moved from The WB network.

Buffy will follow Farscape in the Comet lineup and will lead into The X-Files.

Ware said that multicast’s profile has been raised by growing ratings and by the E.W. Scripps purchase of Ion Media. Scripps is using Ion’s stations to broadcast multicast channels including Bounce, Grit and Court TV.

“They brought clarity to the market and started to unlock this space,” said Ware. Too often, media buyers are surprised by the number of viewers over-the-air digital networks attract or unaware that diginets, OTA and free TV are all the same thing.

Ad sales for Sinclair’s digital networks are handled exclusively by T Media Sales, which also represents Fremantle’s Buzzr, NBC's Cozi and LX, Gray Television’s Circle and other channels. T Media has specialized in direct response but has been beefing up its general market capabilities, hiring former Turner sales exec Joe Dugan as president last year.

T Media has already made about 40 presentations to advertisers and buyers, Ware said, with another 30 to 40 scheduled over the next two weeks.

If they don’t remember the presentation, media buyers might remember the Stack Pack swag bag assembled by Ware. It all comes in a laptop sleeve Ware found in a store in Los Angeles. Inside is a new model over-the-air antenna with cord snaps. For Charge, there’s a device charger. For Comet, there are Buffy, Farscape and X-Files collectible trading cards. And there's a red stress ball that should remind buyers of the obstacle course on Wipeout, which airs on TBD.

They also get Knight Rider T-shirts. Some say “Kitt Happens.” During the upfront, media buyers and sellers say that, too. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.