Magna Sees National TV Network Ad Revenue Down 6.3% in 2023

AVOD, OTT forecast to post 31.6% gain

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

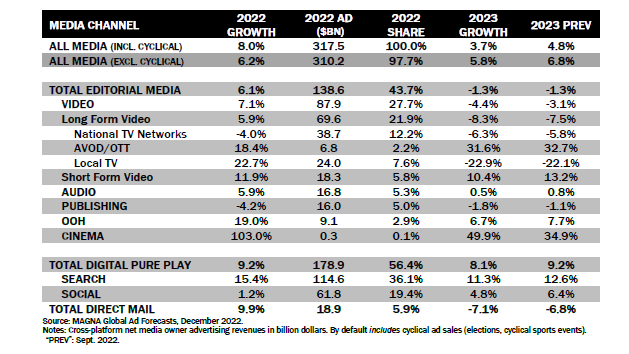

Media buyer Mediabrands’ Magna unit issued a more bearish forecast for advertising revenue in 2023, predicting spending on national TV networks will drop by 6.4%, while ad-supported VOD and over-the-top video increases by 31.6%.

In its previous forecast Magna in June said it expected ad revenue for national TV networks to fall by 5.8% and AVOD/OTT to rise 32.7%.

Overall Magna sees video ad revenues down 4.4 % (compared to its previous forecast of 3.1%) with long-form video down 8.3% and short-form video up 10.4%

Magna said the growth in broadcaster AVOD is not enough to offset the lack of political spending in a non-election year.

Local TV, which takes in the most political advertising, is expected to be down 22.9% in 2023, Magna said.

The weaker ad forecast reflects macro economic trends in addition to political cyclicality.

"The U.S. economy has been sluggish for most of the year, even before the Ukraine war, and will remain slow through at least mid-2023 (fiscal year gross domestic product growth 0.7%), while consumer confidence has hit a 20-year low (index 55) and inflation a 40-year high (8%). On the bright side, the job market is expected to hold next year (unemployment 4.2%) and inflation is expected to slow to just +3%," Magna noted in its report.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Total U.S. advertising revenues are expected to be up 3.7% for 2023, compared to a previous forecast of 4.8% growth. Excluding cyclical factors including political spending and the Olympics, revenues will be up 5.8% (the earlier forecast was 6.8%).

Pure plays digital ad revenues are seen increasing 8.1%, according to Magna.

Magna is expecting several advertiser categories to show flat or decreasing advertising spending in 2023: Consumer packaged goods and finance will be among the verticals most negatively affected. Entertainment/media, travel and betting will continue to grow under organic factors, while automotive may finally grow again as supply issues gradually improve, Magna said.

Globally, Magna pegs TV revenue down 3.6% in 2023.

"Television continues to suffer from the long-term erosion of linear reach and live viewing (time spent and ratings decreases between 5% to -5% per year depending on targets and markets), still not fully offset by rising audiences and ad sales on non-traditional platforms or formats," Magna said.

Cross-platform television ad revenues grew by 1.7% in 2022 to $172 billion but will decrease by 4% in 2023, Magna said.

"To mitigate audience erosion and weaker demand from key industry verticals television companies can count on a few strengths and drivers," Magna said. Those drivers included strong growth for non-traditional ad sales including AVOD and linear addressable, resilient pricing, and rising concerns about brand safety and media responsibility. Sports audiences also continue to be large, attracting spending by advertisers.

Magna’s global ad forecast calls for a 5% increase to $830 billion revenues for 2023. The growth will be lower than the 7% increase seen in 2023 and 1.5 percentage points smaller than Magna forecast in June. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.