Magna Sees 2023 Video Ad Revenue Falling Despite Big CTV Increases

National linear TV seen dropping 5.8%

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

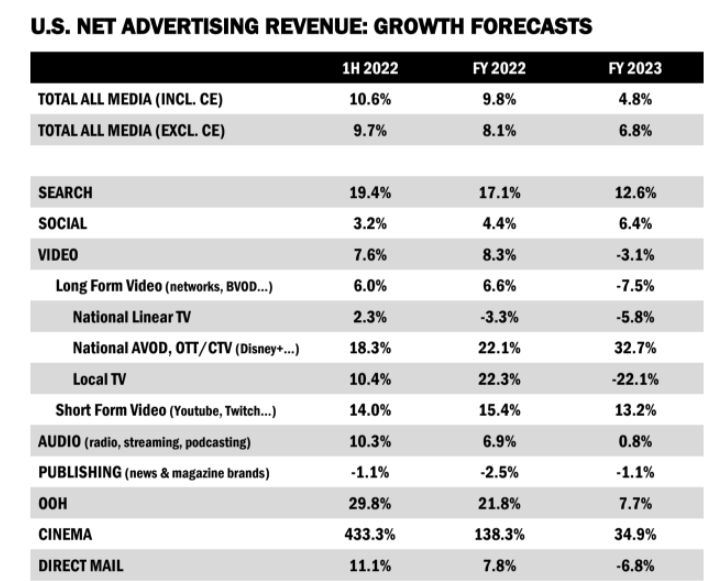

Media agency Magna Global forecasts that video advertising revenue will drop 3.1% next year, with gains in connected TV and other forms of over-the-top and ad supported VOD offset by declining spending on national linear TV.

Magna sees national linear TV falling 5.8% in 2023, following a projected 3.3% drop in 2022. So far in the first half 2022, national linear ad revenue is up 2.4%.

National AVOD, OTT and CTV are expected to jump 32.7% in 2023, when Netflix and Disney Plus will be selling commercials on their previously ad-free services. For 2022, Magna is expecting CTV to be up 22.1% after an 18.3% increase in the first half.

“While the two new offerings may take ad budgets from other media properties [AVOD or linear TV], Magna believes these new offerings will ‘grow the pie’ rather than cannibalize existing budgets or incumbent vendors like Hulu, Peacock, Paramount Plus and FAST channels, which will continue to grow,” Magna said in the report.

Magna also sees retail media network revenue increasing to $42 billion in 2023 from $31 billion in 2022.

In a non-election year, local TV is expected to plunge 22.1%, giving back the 22.3% increase seen for 2022. In the first half, local TV ad revenue was up 14%.

“The bulk of it comes from Amazon’s product search but all other large retailers are now developing advertising sales through keyword search or display ads on their apps and websites,” the media buyer notes.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

For all advertising, U.S. revenue is expected to grow 4.8% including special events like the Olympics and elections. (Magna sees a 6.8% jump with those specials excluded.)

“Following a strong first half, non-cyclical advertising spending is slowing down as several industries are facing an uncertain economic environment,” said Vincent Létang, executive VP, global market intelligence at Magna.

“There are several growth factors that will help stabilize media owner ad revenues in coming months,” he added, ticking off political advertising, retail media, technology innovation and advertising on Disney Plus and Netflix. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.