Kantar Sees 2Q Streaming Rebound After Flat First Quarter

113 million households accessing streaming services as of June

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Streaming resumed its growth in the second quarter, reaching 113 million households in the U.S. as of June, following no growth in the first quarter, according to Kantar’s Entertainment on Demand streaming analytics.

The second-quarter increase gave streaming a penetration rate of 88%, up 2 percentage points from Q1.

The number of streaming services per household also grew, reaching five subscriptions in the quarter, up 0.2 per household. The downside to households having more options is that churn is also up with 8% of subscriptions cancelled.

Also: Streaming’s Share of TV Viewing Rises to 33.7% in June: Nielsen

Meanwhile cable continues to erode, losing more than 1 million customers with penetration dropping to 44%.

Growth in streaming penetration came from SVOD (up 1.5 percentage points to 82.9%), AVOD up 1.6 to 26.5% and FAST, up 2.1% to 22.3%. While AVOD growth accelerated in the quarter, FAST slowed down by 2 points.

Netflix, which reported losing less than 1 million subscribers globally in the second quarter, saw its penetration drop to 61% of U.S. streaming households from 67% a year ago, mostly because of a 6% churn rate.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

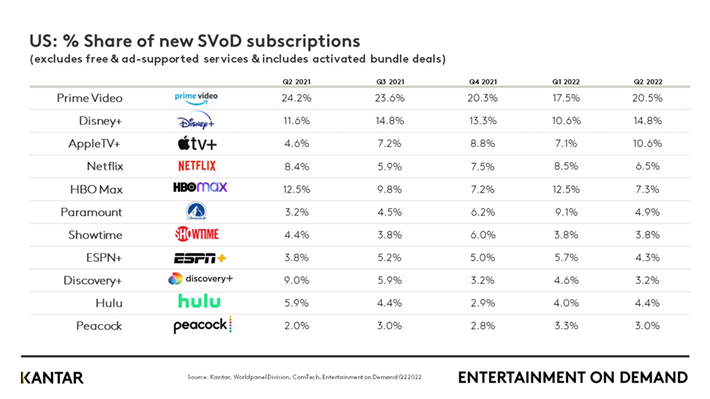

According to Kantar, Netflix had just 6.5% of new SVOD subscriptions in the quarter.

Kantar said Netflix still has a large number of loyalists and outscores competitors on satisfaction when it comes to both content and interface. Because of price increases, however, Netflix’s subscribers are seeing less value in the service, and planned cancellations remain above the levels seen before the price increase.

“Netflix’s introduction of an ad-supported tier is a suitable strategy to combat losing subscribers due to its cost and value,” Kantar said. “Netflix can expect to continue retaining its consistently large group of Promoters, but an AVOD offering can help win back its lost subscribers. Both an SVOD and AVOD offering also creates an alternative to churning from the platform for those who planned to cancel to save money. Netflix has proven it has significant strengths in the market, despite losing subscribers. It has the content and easily navigable interface to keep subscribers engaged.”

Amazon Prime Video was the leader in new subscriber signups for the fifth consecutive quarter, but Disney Plus and Apple TV Plus were giving Prime more of a run for its money in the second quarter. Prime had 20.5% of new signups, with Disney Plus at 14.9% and Apple TV Plus at 10.6%.

Kantar also noted that HBO Max now is in 20% of U.S. streaming households, up 8 percentage points this year.

“HBO Max is unique in that its growth is coming from both its SVOD and AVOD tiers,” Kantar said. “HBO Max is driving satisfaction across both viewer types, as indicated by its Net Promoter Scores. HBO Max now has the highest NPS score of all streaming platforms, at 46 in Q2’22. This breaks down to 45 among its SVOD subscribers and 50 among its AVOD viewers.”

"HBO Max’s SVOD subscriber tends to be more satisfied with HBO Max’s new release films and original content. Its AVOD viewer tends to be more satisfied with its quality and variety of TV series,” Kantar noted.

Looking ahead, Kantar expects to see high rates of churn continuing, particularly among consumers opting for AVOD subscriptions.

“This reflects the new normal of platform hopping. Platforms that prove their value via lower costs and a wide selection of content are better positioned for retaining subscribers. Yet, expect more consistent switching behavior and high rates of churn ongoing,” Kantar said.

“The U.S. streaming market is not showing signs of slowing down. Platforms today should focus their strategies around this new normal of boomerang behavior. This means retaining the loyal core of streamers, marketing trending titles to win streamers leaving other platforms, and communicating the content variety available on the platform to retain the boomerang subscribers,” Kantar said. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.