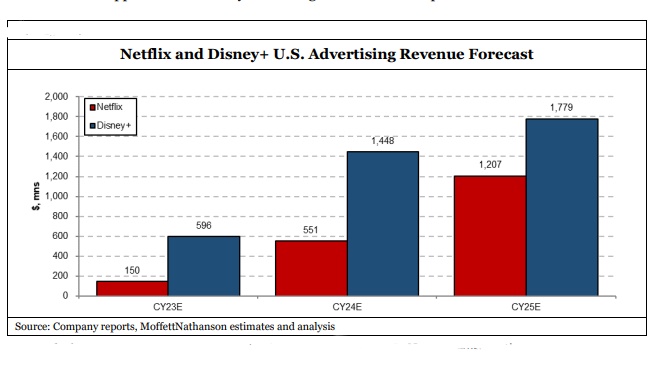

Analyst Sees Ads on Disney Plus Bringing $1.8 Billion and Netflix Getting $1.2 Billion

Michael Nathanson sees Disney Plus as big domestically while Netflix has more global potential

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

MoffettNathanson analyst Michael Nathanson has weighed in on the opportunities for Netflix and Disney Plus in the advertising world, estimating Netflix could see $1.2 billion in ad revenue by 2025 and Disney Plus could generate $1.8 billion in the same time frame.

“Netflix has the potential for much larger global ad growth, yet the domestic advertising opportunity for Disney,” Nathanson said, adding that Disney Plus can take advantage of a more-developed advertising infrastructure, demand for Disney content and Disney’s ownership of a large share of that content.

For both companies, a big share of ad revenue will drop to the bottom line, with margins for Netflix increasing by 200 basis points and Disney Plus gaining 300 basis points.

Also: Analyst: Adding Commercials Will Boost Netflix Subscribers by 6% and Earnings by 20% in 2025

“While we are excited by the opportunity that advertising creates at those two streaming giants, the devil will be in the details of how each company prices these new offerings and how much of the available content impressions will be available and suitable for advertising. In general, we feel that the growth of these ad offerings will be mainly sourced by non-sports and news linear cable and broadcast network dollars,” Nathanson said.

In making his calculations, Nathanson said he expects Netflix to price its ad tier at $6 per month, or $4 less than its lowest-cost ad-free tier. He expects that by 2025, Netflix will have 15 million subscribers for its ad-supported tier in the US. and 75.6 million subs overall. Netflix subs opting for ads will get six 30-second commercials per hour.

Nathanson predicts Disney Plus will charge $7.99 per month for its ad-supported tier at the outset, raising its ad-free price to $11.99 a month. (The unbundled ad-free version now costs $7.99.) By 2025, he sees Disney Plus having 37.1 million ad-supported subs out of 53 million total. Those subs will see five 30-second spots per hour.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

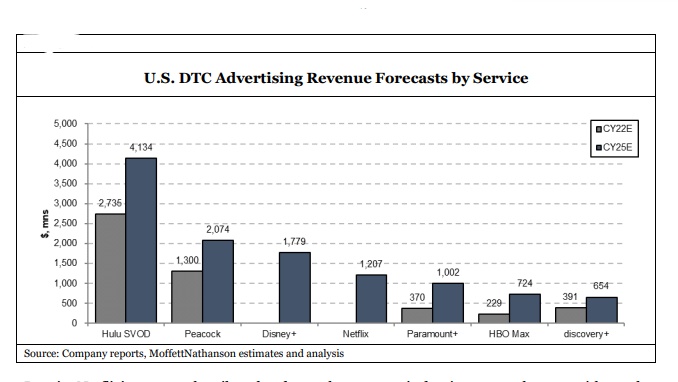

Nathanson compared the advertising newcomers to the ad-supported versions of streaming services that already exist. He estimates that Hulu (excluding its vMVPD service) will be the leader in 2025 with ad revenue of $4.1 billion, up from $2.7 billion this year. By 2025, Comcast’s Peacock could be generating $1.8 billion in ad revenue, Paramount Plus slightly more than $1 billion, HBO Max $724 million and Discovery Plus $654 million.

In terms of profitability, Netflix will have to invest in its ad business, while Disney is more ready to go right away.

“We see the launch of Netflix’s domestic ad-supported tier having no impact on earnings per share in 2023 and 2024 before providing a benefit beginning in 2025, with our hypothetical 2027 EPS reaching $22.55, 12% or $2.50 higher than our current forecast,” Nathanson said. “For Disney, we expect the launch of a domestic ad-supported tier will have a meaningful positive impact on calendar years 2023 EPS (up 8% or 44 cents), with that impact waning through 2025 down to 3%.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.