YouTube's 'NFL Sunday Ticket' ... And the Desperate Drive to Convert Around 6 Million Subscribers

Breaking even on the $2 billion rights package will be one long third-down conversion, so YouTube comes out of the tunnel with some aggressive promotional play calling

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

When they agreed to pay the National Football League between $2 billion - $2.5 billion a season for NFL Sunday Ticket in April, Google and YouTube undoubtedly weighed this National Research Group survey finding -- 71% of NFL fans said they'd consider a subscription to a new streaming service to watch out-of-market NFL games.

And there are a lot of NFL fans out there. According to a Stamford University research study, more than 143 million Americans age 13 or older watched on TV or attended an NFL game in 2021.

So it's safe to assume that at least 6 million folks would pay around $350 a season for NFL Sunday Ticket, the live sports package, long controlled by DirecTV, that delivers live TV access to all the out-of-market games not being broadcast, cablecast or streamed to subscribers in their respective DMA.

With YouTube's first season of Sunday Ticket set to kick off on Sunday, September 10, that's the plan, anyway.

But just getting to break-even in year 1 might not be as simple as it sounds.

DirecTV, which carried exclusive satellite distribution of the out-of-market package since its inception in the mid-1990s, paid around $1.5 billion for the Sunday Ticket license in 2022, its last season as distributor of the residential package.

Before it slipped under the radar of private equity ownership, DirecTV declared having around 1.5 million to 2 million Sunday Ticket subscribers. So even on the high side of the estimate, DirecTV was losing as much as $1 billion a year with the package. (Notably, DirecTV did agree to renew its contract to show Sunday Ticket in restaurants and bars.)

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Can YouTube triple that 1.5 million to 2 million?

Well, let's put it this way -- YouTube launched its virtual pay TV service, YouTube TV, six years ago. It only recently came close to reaching an estimated 6 million subscribers.

Of course, it's a bit apples and submarines to compare YouTube -- which probably spends more aggressively than anyone still left in U.S. pay TV to promote YouTube TV and now operates the only growing concern in the linear pay TV ecosystem -- to the mature DirecTV, which loses around half a million subscribers every 90 days now.

YouTube has diffuse goals and myriad platform businesses to support -- the math for Google/YouTube and parent company Alphabet is quite a bit more complex than simply "number of subscribers times price does-or-does-not-equal-or-surpass licensing fee."

What, for example, is the value of a subscriber that comes through Verizon's recently announced "Sunday Ticket on Us" promotion, which delivers a free season of the package to select unlimited wireless customers?

Certainly, it makes Verizon's 5G and LTE networks more valuable, as well as the Google Android OS software that Verizon customers use to power their phones. And this is before accounting for new Sunday Ticket customers who grow to like the package and are willing to pay full freight for it in 2024, after their promotion expires. (Other telecoms offering Sunday Ticket price promotions include Frontier Communications and WOW!.)

How much does it fuel the growth in scale of YouTube TV to be able to able to offer discounted bundles of Sunday Ticket and Warner Bros. Discovery's Max?

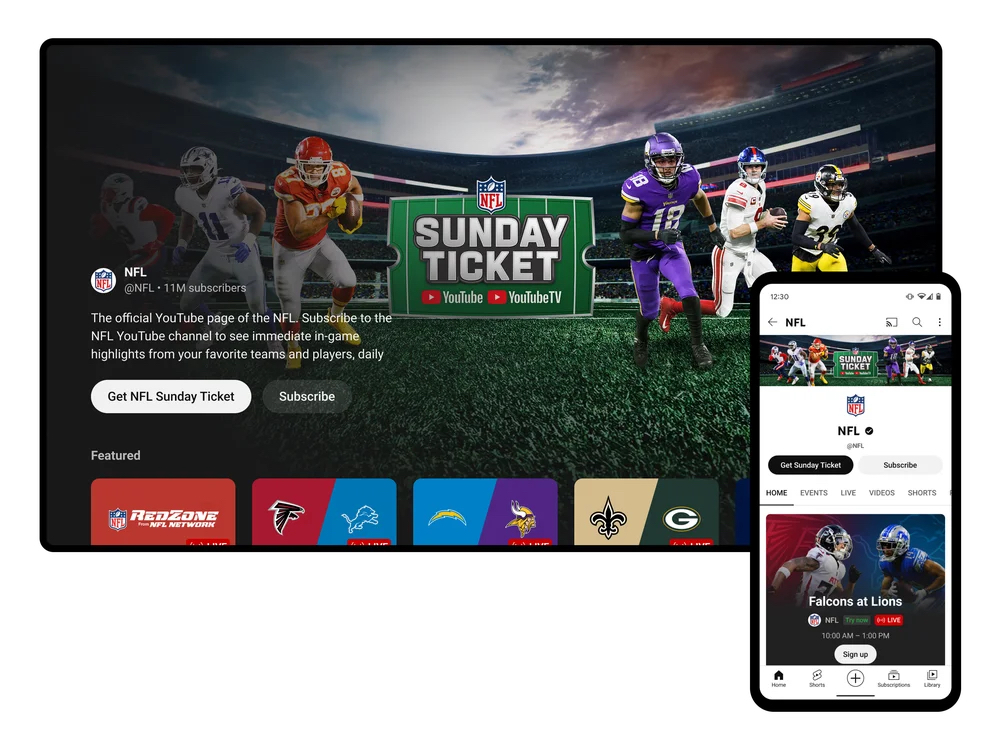

That said, YouTube is trying to expand proliferation of Sunday Ticket by adding new UX features and price promotions, while making the package more flexible and widely available.

YouTube breaks down pricing and features on this landing page.

The package is currently discounted from its regular $349-a-season price to $299 when it is acquired via a $72.99-a-month YouTube subscription. (For an extra $40, you can get a full season of the complimentary NFL Red Zone channel.)

Pivotal to YouTube's play is that Sunday Ticket is available to everyone, not just YouTube TV subscribers. The package is available a la carte for $449 a season (currently discounted to $399), also with a $40 Red Zone option.

This is, ostensibly, a new wrinkle, in that DirecTV supposedly wouldn't let you stream Sunday Ticket unless you were in a situation, such as a Manhattan apartment, where you couldn't receive southern sky satellite access.

As Next TV reported two years ago, however, DirecTV was quietly letting many satellite-eligible non-subscribers stream Sunday Ticket if they wanted to.

The difference now, of course, is that YouTube is freely and loudly letting everyone know that a YouTube TV subscription isn't a Sunday Ticket dealbreaker, and that removes a major point of constriction.

Further goosing sales, YouTube is letting customers pay monthly with no penalties or fees -- you can put $99.75 down on the a la carte version, then fork over three monthly installments of $99.75 for rest of the season. Not cheap, but better than coming up with $400 all at once. (Notably, state laws prohibit this offer in certain jurisdictions, including New York and New Jersey.)

Will all of this translate into a sudden, massive influx of Sunday Ticket customers that puts Alphabet into the black in season 1? Probably not. But Alphabet and Google, which have eyes broadly on live sports, and narrowly and specifically on the NFL, appear to be in this for the full four quarters.

Then again ... $2 billion a season is a lot of money, even by Google's standards. It's twice as much as Amazon is paying for Thursday Night Football. If Sunday Ticket sales are slow out of the gate, expect some aggressive promotional action in the weeks ahead.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!