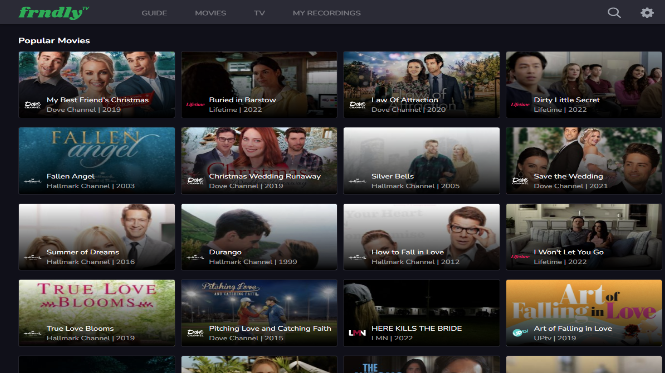

vMVPD Frndly TV Grows 40% To Top 700,000 Subs

Low-priced streaming TV service features family-friendly channels

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Low-priced, G-rated streaming TV service Frndly TV said it surpassed 700,000 subscribers, an increase of 40% from the last time it released a subscriber number just over a year ago.

The gains come at a time when people are cutting the cord and giving up pay-TV. virtual multichannel video programming distributors like Frndly TV are to some degree offsetting losses of traditional cable and satellite subscribers.

Over the past year, Frndly TV has added to its channel lineup, but has raised its monthly price only once -- and then just by $1. It now offers 40 channels, up from 12 at launch.

“This is another banner day in the growth of Frndly TV,” said Bassil El-Khatib, Co-founder and chief marketing officer of Frndly TV. “We have focused on providing the best live TV service available at the most affordable price. We have more than tripled our channel offering and have done so with only a single $1 price increase since our launch.”

Frndly TV offers three levels of service starting at $6.99 monthly.

“One of our philosophies in creating Frndly TV was to work hand-in-hand with our programmers in bringing consumers who were priced out of the larger linear video bundles back into the pay TV ecosystem,” said Michael McKenna, co-founder and chief programming officer at Frndly TV. “The by-product of the limited offering is that our targeted subscribers are loyal to both Frndly TV and its programming partners. The result is higher viewing consumption of our partners’ content and lower churn for Frndly TV.”

Also: Frndly TV Sees Growth In Q3 Viewing, Ad Sales

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Frndly TV said it has seen increased engagement with consumers on its platform, with viewership per subscriber up almost 10% vs. 2021.

Reactivations have increased 33% versus 2021. Annual subscriptions have grown to more than 22% of Frndly TV customers. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.