Subscribers in Survey Call Ad Loads on Discovery Plus, HBO Max Most Reasonable

Fewer ads mean more attrition for brands, Hub study finds

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

As streamers race to add commercials to their services, a new survey by Hub Entertainment Research finds that subscribers think the number of ads they’re seeing is much more reasonable than live TV or traditional on-demand programming.

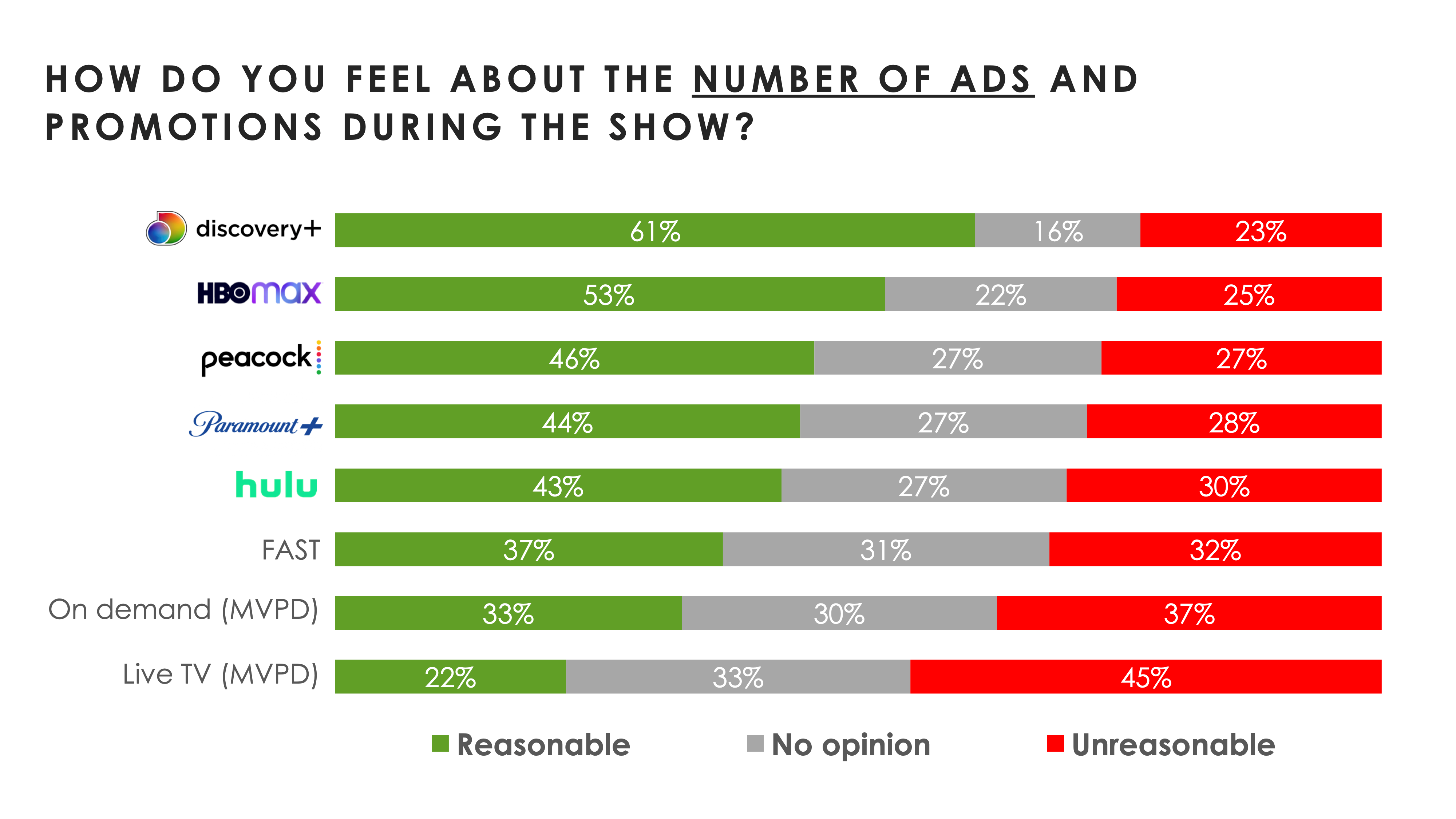

In the study, 61% of subscribers to Warner Bros. Discovery’s Discovery Plus called the number of ads reasonable. Just 23% said the number of ads were unreasonable.

With HBO Max, also owned by Warner Bros. Discovery, 53% called the number of ads reasonable, with 25% labeling the number of commercials on the service unreasonable.

Among other services in the study, 46% of Peacock subscribers, 44% of Paramount Plus subscribers and 43% of Hulu subscribers called the number of ads they see reasonable.

Those are all still better than generic Free Ad-Supported Streaming Television (FAST) channels, with 37% of FAST viewers calling the ad load reasonable and 12% describing it as unreasonable.

Only 22% of respondents said the number of ads on live TV was reasonable, with 45% calling that ad load unreasonable.

The survey didn’t include the two newest major entries into the AVOD sweepstakes, Netflix and Disney Plus, both of which are promising light ad loads.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The light ad loads are not just a benefit for viewers. They also help advertisers, according to the study. The services with the most “reasonable” number of ads also scored highest when subscribers were asked how much attention they paid to ads during shows. For Discovery Plus and HBO Max, 37% of viewers said they paid complete attention to the ads, followed by Hulu, Paramount Plus, on demand programming and Peacock. Scoring lowest in terms of attention were live TV, with 42% of viewers saying they paid no attention to the commercials they see, and FAST channels.

“A better ad experience makes for stronger ad engagement,” Hub said. “Overall viewing enjoyment is closely linked with ad attention, and ads and ad breaks that are shorter are more likely to keep viewers engaged.”

Shorter ad breaks were the top thing subscribers said would get them to pay attention to ads, followed closely by earning rewards for watching, shorter ad lengths and running single ads in a break.

“The industry seems to have finally solved the mystery of how to get consumers to accept ads in TV — and it was as simple as offering a less onerous ad experience and paired with a price break to boot,” Hub principal Peter Fondulas said. “Now that Netflix and Disney Plus have jumped on the ad-supported bandwagon, the question is whether and when the remaining ad-free only holdouts will join in.”

Hub surveyed 3,001 U.S. consumers aged 14 to 74 who watch at least one hour of TV per week. The survey was conducted in November. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.