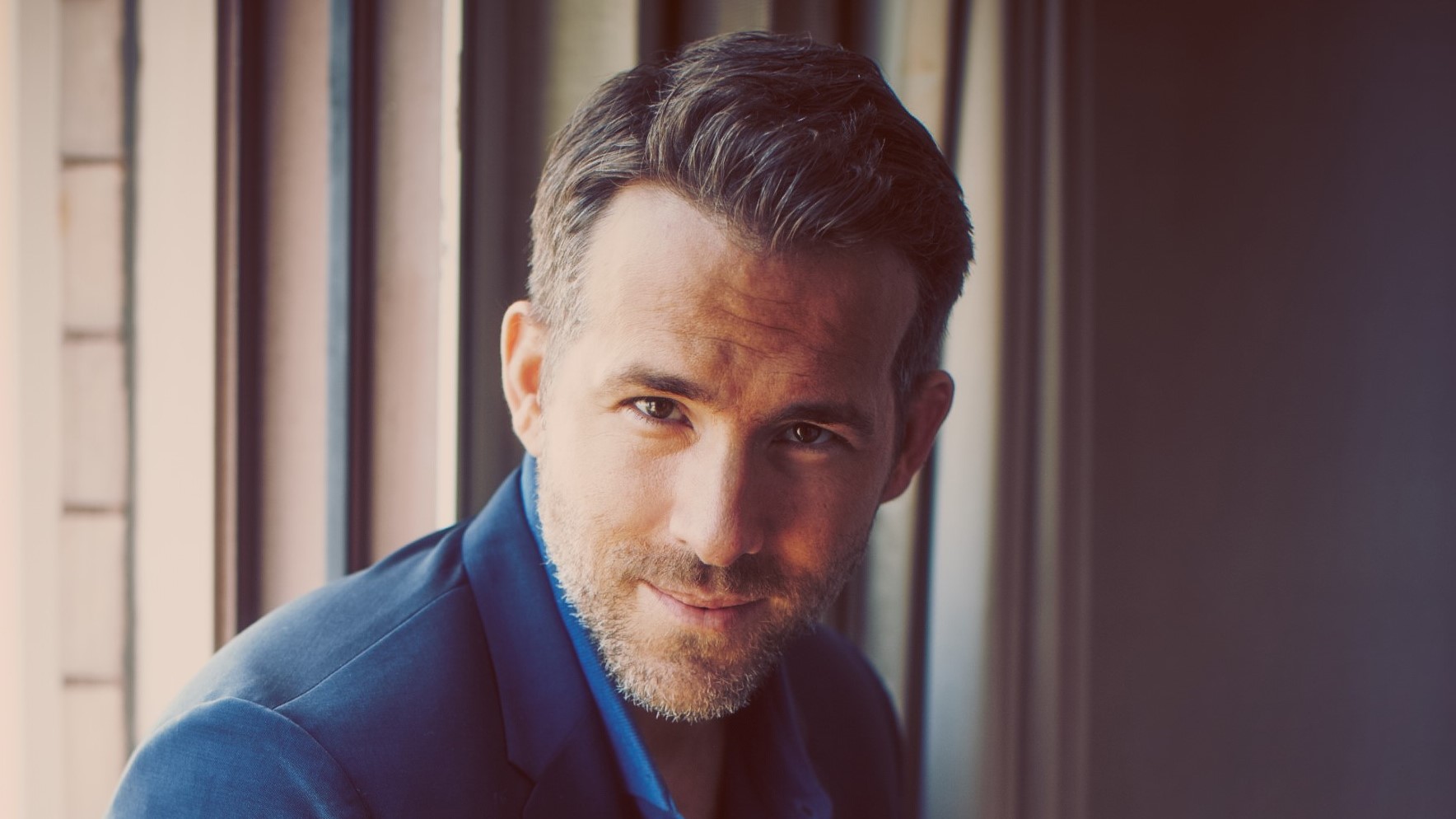

Ryan Reynolds Gets Channel, Stock in Deal with FuboTV

‘Deadpool’ actor’s Maximum Effort Productions in first-look unscripted deal

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Actor Ryan Reynolds’ production company Maximum Effort Productions will get $30 million worth of stock in FuboTV in a three-year deal that gives the streaming platform first-look at unscripted programming from Maximum Effort and creates a Maximum Effort channel on FuboTV.

FuboTV shares rose 10% on Monday, after the deal was announced.

Reynolds is best known as an actor, starring in the Deadpool films, but he’s also been involved in a number of business ventures. Maximum Effort, founded in 2018, spun off its marketing division and sold it to MNTN Software and Reynolds has acquired stakes in Aviation American Gin, Mint Mobile, and with actor Rob McElhenney took over the Welsh football team Wrexham AFC.

“Maximum Effort’s mission is to bring people together in fun and unexpected ways and we think today’s announcement with Fubo will help do just that,” said Reynolds, co-founder of Maximum Effort Productions along with George Dewey. “FuboTV has taken a fresh approach to developing and delivering content in the digital age and the entire team is passionate about thinking differently and taking chances. I genuinely can’t believe Maximum Effort gets to program our own network. I am beyond excited and grateful to Fubo.”

Maximum Effort Productions has creative control over the content on the Maximum Effort Network. In addition to the first-look deal on unscripted programming it also has a blind scripted deal with FuboTV.

Fubo is a sports-oriented streaming service that is looking to cash in big on legalized sports betting by building an integrated sports book that can be accessed by subscribers. The company’s revenues have been growing, but it is burning through cash, with a net loss of $116 million in the second quarter. It also lost 109,000 North American subscribers in the quarter, after breaking through the 1-million mark in Q1.

“Ryan is not only an A-list Hollywood star but also a serial entrepreneur with a stellar track record across sports (as owner of the Wrexham soccer club), advertising, content and marketing,” said David Gandler, co-founder and CEO of FuboTV.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“We plan to leverage Ryan and George’s expertise, creativity and advertiser relationships to underwrite network programming through innovative marketing partnerships that leverage Fubo’s data capabilities and interactive technology stack,” Gandler said. “Ryan and Maximum Effort have demonstrated their confidence in FuboTV and what we plan to create together through an equity agreement encompassing stock at higher than today’s trading price. We can’t wait to get started.”

According to documents filed with the Securities and Exchange Commission, Fubo will issue 2 million shares worth $10 million at $5 a share to Maximum Effort and MEP FTV Holdings. Fubo stock closed at $3.47 on Friday. MEP FTV Holdings will get another $10 million in stock in a year and $10 million more in two years. Optimistically, Maximum Effort will also get warrants to buy another 166,667 Fubo shares at $15 a share, if Fubo stock tops $30 a share between now and Aug. 2, 2032.

Fubo and Maximum Effort will jointly own all original content produced under the arrangement.

All advertising sales for the Maximum Effort channel will be managed by FuboTV, the companies said.

Maximum Effort Productions will maintain its three-year first-look development deal with Paramount Pictures announced in May of 2021 for feature projects,

Fun fact: Here’s the way Maximum Effort describes itself in the release announcing the deal:

Maximum Effort makes movies, tv series, content, ads, and cocktails for the personal amusement of Hollywood Star Ryan Reynolds. We occasionally release them to the general public. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.