National Linear TV Ad Spending Rose 5% in April: SMI

Warner Bros. Discovery’s share climbs to 28%

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Advertising spending on national linear TV increased 5% in April, compared to the same month in 2021, after a flat month in March, according to new figures from Standard Media Index.

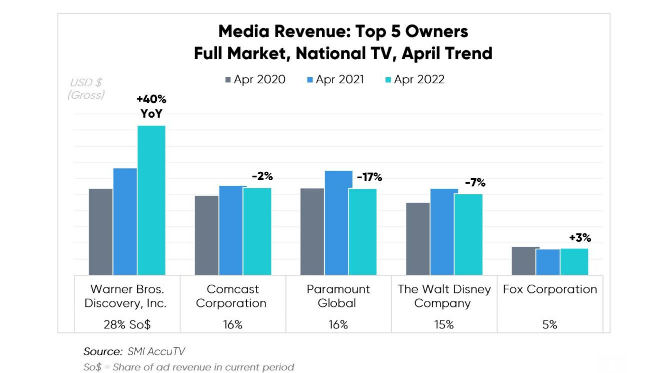

The newly formed Warner Bros. Discovery had the largest share of revenue, getting a boost from the NCAA men’s basketball tournament. WBD’s share of ad dollars rose 40% to 28%.

Also: Upfront: Warner Bros. Discovery Puts Sports in Its Premier Package

Most of the other media companies were down, except for Fox Corp., which was up 3% thanks to a boost from sports that offset decreases in reality and news.

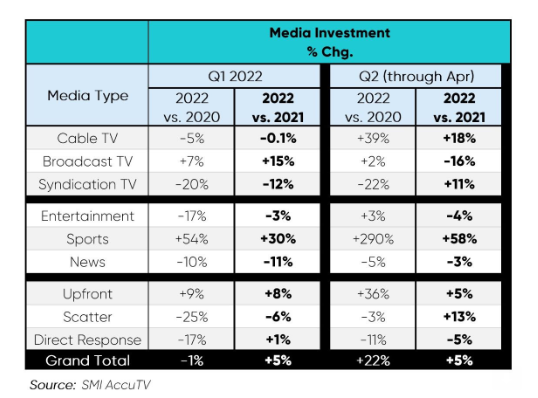

Cable TV accounted for about two-thirds of linear ad dollars — a new high, according to SMI, while broadcast dipped below a 30% share for the first time.

Cable was up 18% in March. Broadcast was down 16%. Syndication was up 11%.

The April increase in linear spending was driven by a 58% jump in ad dollars going to sports programming. NBA and college basketball programming accounted for 57% of sports spending in the quarter. ■

The smarter way to stay on top of broadcasting and cable industry. Sign up below

With the finals of the NCAA shifting from CBS last year to TBS, Paramount Global's sports revenue in the quarter was down 88%. Overall Paramount's share of linear ad dollars was down 17%. Disney dropped 7% and Comcast was down 2%.

Spending on entertainment programming was down 4% and spending on news dipped 3%.

A strong scatter market also contributed to the April performance.

Scatter spending climbed 13% from a year ago. Upfront was up 5% and still accounted for 75% of overall volume. Direct response was down 5%.

Despite the April gain–its biggest this year–linear TV lags 2019 levels, when digital video growth accelerated. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.