Upfront: Warner Bros. Discovery Puts Sports in Its Premier Package

Ad sales chief Jon Steinlauf sees demand for streaming, but 'linear moves products off the shelves'

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Sports and news will be a big part of Warner Bros. Discovery’s pitch to compete with the broadcast networks at its first upfront presentation as a combined company.

Both Discovery and WarnerMedia had planned to make their separate presentations during what has traditionally been the week the broadcasters show off next season’s new programming to advertisers and media buyers. Now the new company will introduce itself at the Hulu Theater at Madison Square Garden on May 18.

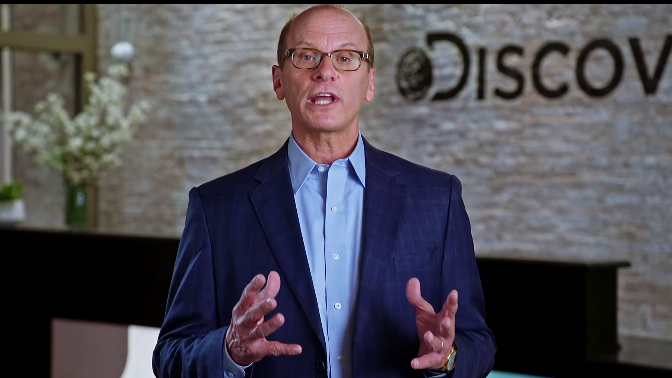

“Being in broadcast week as a newly merged company fits the strategy of being part of the broadcast marketplace,” Jon Steinlauf, chief U.S. advertising sales officer, told Broadcasting+Cable.

Already Stieinlauf is seeing strong demand for sports and streaming. WarnerMedia and Discovery separately tested new metrics and currencies that will come into play in the upfront. And Warner Bros. Discovery will be among the media companies encouraging buyers to use broader demographics that include older consumers, a move that will increase the supply of eyeballs.

With portfolios filled with cable networks, both Discovery and WarnerMedia received pricing considerably lower than broadcast pricing.

“We think all of our top inventory is undervalued relative to what people are paying for broadcast primetime entertainment,” Steinlauf said.

To change that, Steinlauf created Discovery Premier, which put the first runs of the company’s top rated shows into a package that offered audiences and reach comparable to broadcast.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“We’re expanding Discovery Premier. It will just be called Premier. We’re going to keep all of the top 30-40 Discovery legacy lifestyle shows when they’re in first run. We’re just adding to it the best of Warner,” he said. “We we have great audiences that come up to comparable reach to broadcast at a lower CPM.”

The best of Warner means sports, AEW wrestling, the best of CNN’s brand-safe specials and originals documentary films.

“And we’re looking at the entertainment side of Warner closely as well. Special events, high-rated off-network shows like Big Bang Theory and Young Sheldon, and Warner Bros. syndicated series like the new Jennifer Hudson talk show could make the cut," Steinlauf said.

“We call it a modern mix of the best of all genres, the highest-rated, biggest brand name series. The point of this is to position it as a new entrant at the primetime table at a time when there isn’t a lot of highly rated supply any more,” he said. “But I would say Discovery legacy lifestyle programming and sports will lead these packages, and they’ll be supplemented with scripted, news and some syndication talk.”

When football season ends, sports will make Warner Bros. Discovery an important player, with the NBA’s All Star Weekend leading into March Madness, the NBA Playoffs, the NHL’s Stanley Cup Playoffs and Major League Baseball through the playoffs.

“We don’t think an advertiser can really effectively market on national television over those months without sports. We look at sports as the new primetime. It just decimated everything in its sights from an audience perspective. Even marketers aiming for women have to take a hard look now at the reach of sports for female demographics,” Steinlauf said.

“The demand for sports advertising on television is growing faster than the supply, even with a good ratings year behind us,” he said. "That's where a lot of the big numbers are and it's viewed live. When you see an ad live, it's quick reach. Clients want quick reach.”

Steinlauf also said he plans to announce from the stage that Warner Bros. Discovery is willing to give price incentives to clients willing to buy based on 18-plus or 25-plus demographics rather than the narrower ones that don’t count those older consumers who have spending power and watch cable TV.

“Advertisers are reluctant to give up on those young demos. We’re only writing about 10% of our guarantees on broader demos,” he said.

Both Warner Bros.'s HBO Max and Discovery’s Discovery Plus have ad supported tiers, and that inventory will be on sale in the upfront.

Both services have very light ad loads, with HBO Max averaging 2 to 3 minutes of ads per hour and Discovery Plus averaging 4 to 5 minutes of ads per hour. Even with a lower subscription price and limited inventory, the average revenue per user (ARPU) in the ad-light households is higher than the non-ad households for both Discovery Plus and HBO Max.

HBO Max’s programming is predominantly scripted drama with some comedy, while Discovery Plus is mostly lifestyle.

Warner Bros. Discovery execs have said they plan to combine HBO Max and Discovery Plus into a single service. But Steinlauf said sales will continue to sell their ad inventory separately, if that’s what clients want.

“We’re going to keep both brands in place. What happens with subscribers is a different story, What happens with ad clients is we want to give them optionality. Not just within streaming, but with video on demand, authenticated apps, social, Bleacher Report, CNN.com, March Madness live. It’s a very deep, rich offering of digital and streaming options. People talk about HBO Max and Discovery Plus the most, but there’s a lot more to our digital menu.”

He added that “these are by nature targeted ads because a lot of them are sold programmatically to reach specific targets.”

Steinlauf sees streaming as the TV ad business' new frontier. “Streaming is on a growth trajectory, but the demand for streaming outstrips the supply for our kind of streaming, the very top end of high quality content. There's a limited supply even with Disney Plus taking a step into ad light and maybe Netflix, too. But high quality streaming supply is still very tight,” he said.

In the weeks since the merger was closed, Steinlauf and his team have been studying what the two companies sold in the 2021-22 upfront,

“We’re going to each of the holding companies right now as a single sales organization and making recommendations as to how to rebalance some of that spending to take advantage of where there’s growth, where there’s demographic strength and curate the holding company portfolio to match what we see as being optimal across not just linear but linear plus streaming plus digital. The game plan is to create a win-win scenario," he said.

It’s a complicated process. “We can do it and we’re using some of the new currency options to help us,” he said. Both companies before the merger were working with iSpot, Comscore and VideoAmp to test new currencies, and with Nielsen as well. “And now we have the benefit of best practices and combined learnings," he said.

Some media buyers and advertisers will want to use those new currencies.

“I think on the one hand, it's extra work for research teams and for our inventory management teams,” Steinlauf said. “But it may be well worth it to get more accurate, more stable measurement across all 24 networks. In the end we hope that with that world comes the good news that there’s more people watching our networks than we're currently reporting.”

Steinlauf is expecting this year’s market to be another fast-moving one.

“What I’m seeing in these registrations we’re getting from the agencies is that there’s really strong demand for sports. There’s demand for DEI [diversity, equity and inclusion] platforms and advanced advertising and streaming,” he said.

“Overall, there is a lot of uncertainty about the stock market, about the virus, about the supply chain issues,” Steinlauf said. "This is a future market and a lot can happen between now and then. I think when all is said and done, they want the inventory, they want the flexibility. Linear is important. It moves products off the shelves.”

With Warner Bros. Discovery CEO David Zaslav promising Wall Street $3 billion in cost savings, headcount at the company’s ad sales staff is expected to be sharply reduced.

“I can’t really get into that,” Steinlauf said. “We’re business as usual with both sales forces working together on the upfront.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.