Magna Sees Ukraine War Slowing U.S. Advertising Market Growth

National TV revenues seen down 1% in 2022; local TV to rise 16%

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Media agency Magna Global reduced its forecast for U.S. advertising spending because of the from Russia’s invasion of Ukraine.

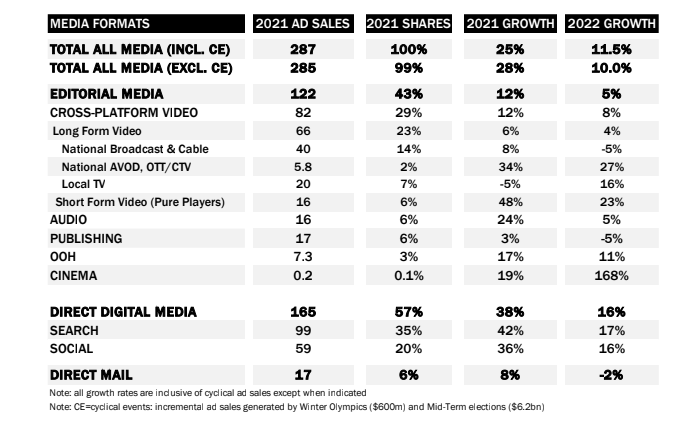

Magna now expects U.S. ad spending to increase 11.5% to $320 billion. Its original forecast was for 12.6% growth. The war in Ukraine has exacerbated supply chain issues and inflationary pressures.

National TV revenues, which Magna defines as cross-platform national long-form video, will be down about 1%. Traditional TV ad sales will be down about 5%, while ad-supported video on demand, over-the-top and connected TV revenues will jump 27%.

Local TV will be getting a huge boost from the midterm elections. Magna estimates that media owners will generate $6.2 billion in incremental advertising revenue from political campaigns, up 41% from 2018 (that’s up from the previous forecast of a 31% increase). Local TV will get $4.2 billion of that, up 26% from 2018, while digital media gets $1.45 billion.

Also: Magna Sees U.S. Long-Form Video Ad Revenue Rising 4% in 2022

Overall, local TV ad revenues are expected to grow 16% in 2022, according to Magna.

“The Ukraine crisis has already hit consumer and business confidence. It will slow down economic growth in 2022 and fuel the inflationary trend. It is too early to assess the depth and length of economic repercussions, but Magna believes the U.S. economy is strong enough to weather this new challenge,” said Vincent Létang, executive VP, global market intelligence at Magna.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Looking at marketing and advertising, the macro-economic headwind will be mitigated by continued organic drivers (innovation, emerging verticals, ecommerce) and stronger-than-expected political fundraising (leading to at least $6 billion in incremental ad spend),” Létang said. “Balancing all factors, Magna reduces its 2022 advertising revenue growth forecast by one percentage point, as media owners’ ad revenues will grow by 11% this year to pass the $300 billion milestone for the first time”.

Technology, telecoms, entertainment, travel and betting are among the categories expected to grow faster than average, while automotive continues to struggle with supply chain issues.

Magna sees digital media growing 16% in 2022. Search is seen increasing by 17% and social will be up 16%. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.