Magna Forecasts Long-Form National Video Revenue Will Dip 1% in 2023

AVOD and FAST predicted to grow 21.2%

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

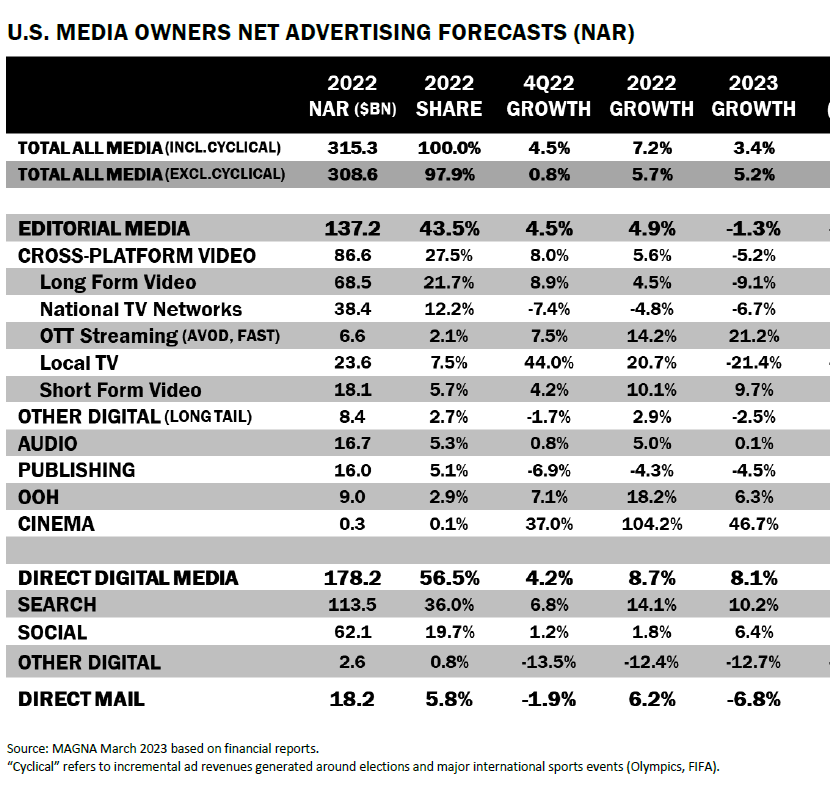

Cross-platform national long-form video advertising is expected to grow 1% to $43.8 billion in 2023, according to a new forecast from media agency Magna.

Magna predicted the organic growth of streaming — both ad-supported video on demand and free ad-supported streaming television (FAST) channels — growing by 21.2%, nearly offsetting the organic decline and weaker pricing of linear ad sales.

Linear ad revenue is expected to drop 5%, Magna said, with national TV networks down 6.7%.

Meanwhile, local television will suffer from the off-year election cycle plus a 5% drop in non-political ad revenues. Together, that will leave local advertising down 21.4.% from record levels in 2022.

Short-form video revenues are expected to increase by 9.7%.

Digital media revenues, including search and social, are expected to increase 8.1%, with search up 10.2% and social growing 6.4%.

Overall, Magna sees total media revenue growth to be 3.4% in 2023 including cyclical spending on the elections and sporting events like the Olympics and World Cup. That’s slightly slower growth than the 3.7% increase Magna forecast for 2023 in December.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Excluding cyclical items, media revenue is expected to increase 5.2%.

Magna said the media outlook is being impacted by mixed economic signals, including slow gross domestic product growth, slowing inflation and a resilient job market. Meanwhile, financial turbulence is generating anxiety among consumers and businesses.

“In a similar economic climate, 10 or 20 years ago, the U.S. advertising market would almost certainly fall off a cliff,” said Vincent Létang, executive VP, global market research at Magna.

“Things are different in 2023 because of media innovation fueling marketing demand,” Létang said. “The organic drivers that boosted the ad market in 2021 and the first half of 2022 are still around and mitigating the impact of stressful economic signals. Such organic drivers include the rise of retail media networks which are redirecting billions of marketing budgets dollars into advertising formats. In addition, with long-form OTT streaming going mainstream and increasingly ad-supported, brands finally find cost-effective solutions to reconnect with audiences that had become hard and expensive to reach through linear television.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.