Light-Ad Tiers of Major Streaming Services Drew $438 Million in 4Q

MediaRadar tracks 5,530 advertisers across five SVOD platforms

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The light-ad versions of the big direct-to-consumer subscription streaming services are drawing heavy interests from advertisers, according to MediaRadar’s ad sales intelligence platform.

MediaRadar said that during the fourth quarter, Discovery’s Discovery Plus, AT&T’s HBO Max, The Walt Disney Co.’s Hulu, Paramount’s Paramount Plus and Comcast’s Peacock attracted $438 million in ad spending in the fourth quarter.

Over the course of the year 5,630 total advertisers ran ads across those five platforms. In the second half of the year, they placed almost 500,000 ads.

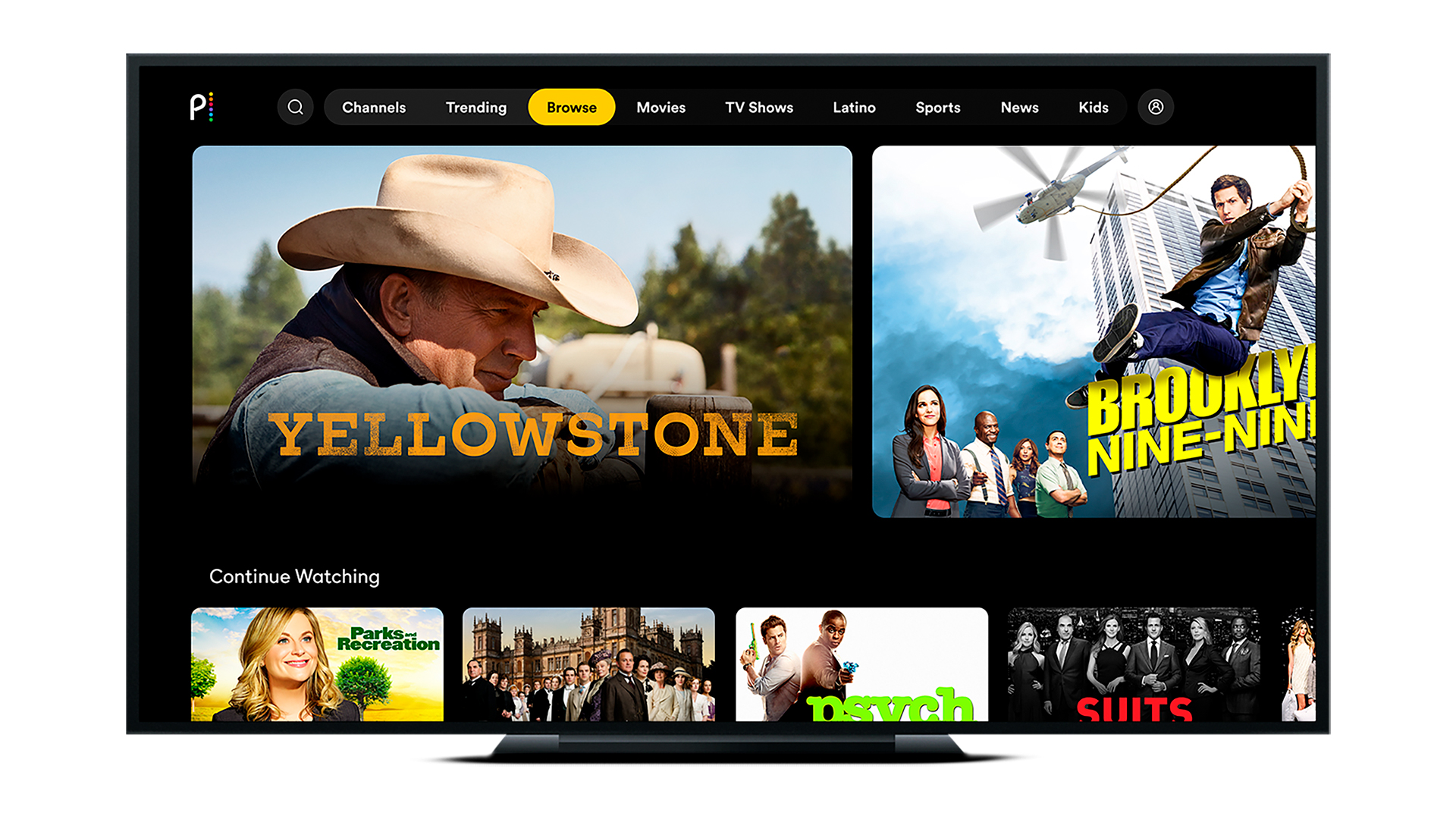

Once, Hulu was the go-to AVOD platform. Now, it has competition on all sides. Peacock, HBO Max, Discovery Plus, Paramount Plus and others all serve ads to bring in revenue, MediaRadar noted.

“Advertisers are increasingly enhancing their ad buys with OTT,” said Todd Krizelman, CEO & co-founder, MediaRadar. “The rise in viewership coupled with limited advertising per show is a great place for brands to get noticed and not be lost among many ad messages.”

Programmers are also finding that services with lower subscription fees and light ad load generate more revenue per user.

Also: Peacock Pulls In $500 Million During Record NBCU Upfront

The smarter way to stay on top of broadcasting and cable industry. Sign up below

How light are the streaming services’ light ad loads? MediaRadar found the lightest commercial loads on Peacock and HBO Max. Peacock had 4.6 ads per show and 8.7 ads per hour. HBO Max had 4.4 ads per show and 9.3 ads per hour. “This may be a way to win over subscribers with a better viewing experience, but also win advertisers,'' MediaRadar noted. “Less ads may be a signal to advertisers that they’ll have a less cluttered space to get their message out.”

Discovery Plus showed 7.2 ads per show and 12 ads per hour.

Hulu had 7.4 ads and 12 ads per hour in its original shows. In its licensed shows it had 10.1 ads per show and 13.8 ads per hour. “Hulu has been lifting frequency, from 9-10 ads per hour in January to 12 ads per hour currently. The company continues to post the highest number of total advertisers and ad dollars. Increasing inventory is likely helping them realize revenue goals,” MediaRadar said.

Paramount Plus, which brings CBS network programming to some subscribers, had 17 ads per show and 23.8 ads per hour, highest among the group. “This may imply ViacomCBS is giving more to advertisers to entice them to the platform or possibly bundling more actively, MediaRadar said. “It’s also possible they’re trying to improve sales by packing-in ads.”

The ads on SVOD also tend to be 30 seconds or shorter, with spots 15 seconds or less accounting for between one-third and one-half of the inventory.

Media advertising—movies, video games, television, and streaming—is the largest ad segment for the SVOD players streaming commercials. For Peacock, media ads accounted for 33% of its ads. They were 26% of the ads on Paramount Plus, 24% on Hulu, 22% on Discovery Plus and 19% on HBO Max.

These platforms also use a 12% to 15% chunk of their in-house inventory to promote programming on their parent company’s other outlets. For example, Paramount will promote CBS shows on Paramount Plus. MediaRadar noted about 30% of Peacock inventory is used to promote Comcast NBCU properties. “This is likely a signal of the platform’s desire to build cross-platform audiences for its programming,” MediaRadar said.

Other than media, the streaming services have strengths in attracting advertising from different categories.

Discovery Plus–which carries programming from Food Network and the Cooking Channel– sells five times more food advertising than most of the competition, MediaRadar said. Discovery Plus is also tops among the streamers with retail advertising, which makes up about 22% of the service’s ad revenue, twice any of its competitors.

HBO Max is the leader in the financial & insurance categories. Those advertisers make up 19% of HBO Max’s advertising volume, two to three times it top rivals.

Paramount Plus outperforms when it comes to pharmaceutical advertising, “This could be due to older audiences that watch CBS content and are good fit for pharma advertisements,” MediaRadar said. “It could also be that Paramount ad sales team benefits from significant experience and long-term relationships they have as they build Paramount Plus. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.