How Sinclair’s Compulse Looks To Grow in Crowded Ad Tech Market

New ad manager product coming to market

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Being the in-house agency for broadcast giant Sinclair Broadcast Group wasn‘t ambitious enough for Compulse.

As media companies and advertisers look to dive deeper into advanced advertising, Compulse has been working to become a marketing technology company that services the industry, not just Sinclair.

In July, Compulse staged something of a coming out party behind its Compulse 360 software, pitched as an all-in-one, software-as-a-service platform that handles digital media planning, execution and analytics.

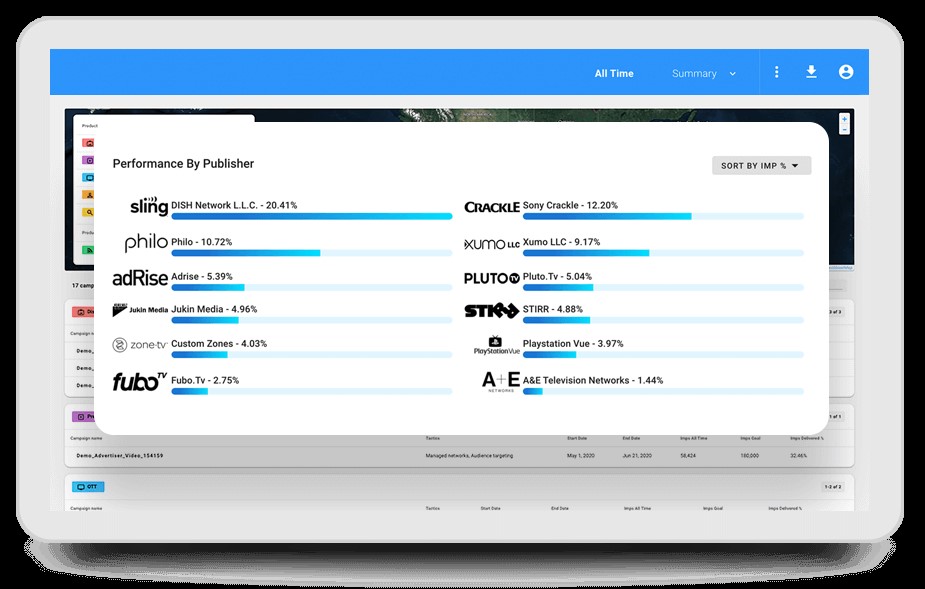

To get there, Compulse bought Sinclair’s preferred programmatic platform, ZypMedia, in February. Compulse also built its own technology and incorporated services such as Compulse OTT, an over-the-top offering.

While Sinclair remains Compulse’s biggest customer, the unit also is working for major media companies including Univision, EstrellaTV and Azteca.

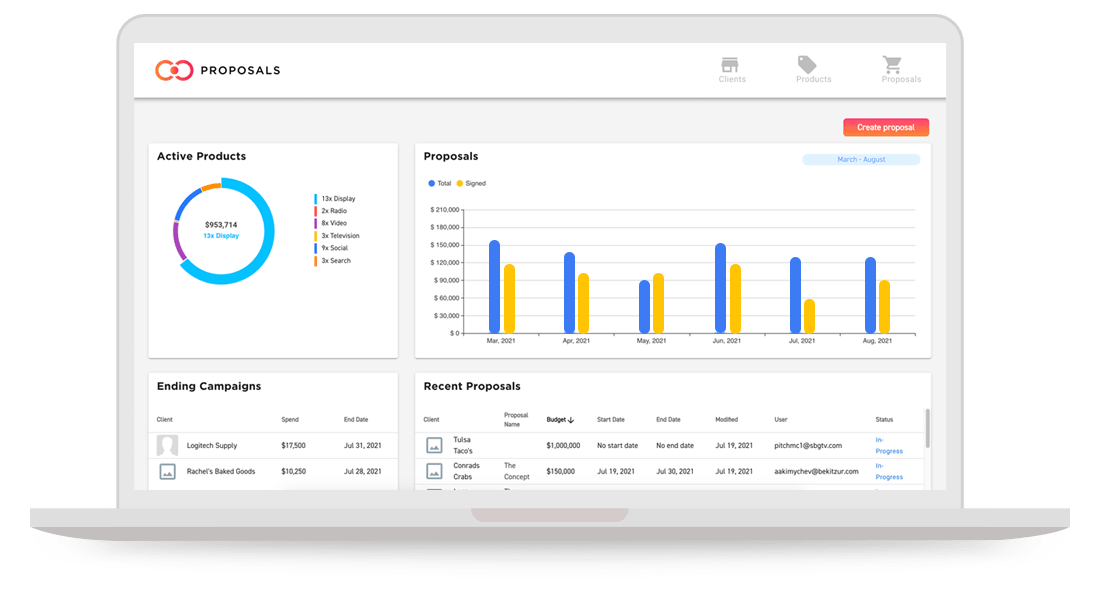

Now Compulse plans to roll out its Ad Manager product, which will allow buyers to mount omnichannel campaigns rather than bolting connected TV and OTT onto linear campaigns.

“What we’re trying to do, from the proposal layer all the way through order entry and fulfillment and reporting, is to enable media companies to sell omnichannel,” Compulse managing director Martin Kristiseter told B+C.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

That makes Compulse different from the ad-tech companies owned by other broadcasters, such as Tegna’s Premion or Cox Media Group’s Gamut, he said.

Kristiseter said that the majority of advertisers are spending more money on digital than they’re spending on linear TV. “It’s about a $200-billion plus opportunity,” he said.

Compulse’s media manager is designed to work with the legacy systems that TV buyers are already using without having to re-enter data, interact with various demand-side platforms and provide reports through its user interface.

“We want to capture more of that local ad spending by simplifying and streamlining the workflow,” Kristiseter said.

One client using Compulse 360 is Local Page Pop, a digital marketing company that helps smaller traditional agencies provide digital services.

“What Compulse has been able to do for us is consolidate our omnichannel campaigns into a single dashboard that makes it really easy to be able to look at everything in one place,” Chris Stumph, VP of partnerships at Local Page Pop, said. “It makes it easier for our campaign team to go in and see how things are performing.”

Compulse has also been flexible about integrating other tactics, such as email marketing, to the dashboard, enabling Local Page Pop to offer services that clients request, Stumph said. “If we decide to start offering TikTok, we’re confident they can set that up so we can manage that. In the past, we had to say no to that sort of opportunity.”

Local Page Pop has also been able to get access to inventory through Compulse, particularly over-the-top and connected TV video. “We’ve been able to bring our prices down and save some pretty good money and pass that on to our clients,” Stumph said.

Cutting Out the Middleman

Kristiseter said Compulse can help media sellers and buyers avoid the arbitrage that goes on with tech middlemen, who increase the rates buyers pay for ads while putting pressure on the price sellers get.

“You see rapidly growing digital revenue numbers, but profitability is not following. There’s a lot of compression on margins,” he said.

Compulse has preferential rates with many big publishers because of its scale. “We’re bringing those savings out to the media companies and tier-two agencies to really help future proof them to ensure that digital doesn’t just become a rapidly growing top-line business, but also very profitable,” Kristiseter said.

Streamlining workflow also benefits clients, he said. “It’s a lot quicker from pitch to pay. Proposals that used to take three hours are now taking three minutes. There is a lot of time saved in this value chain. Hopefully the sales people can spend a lot more time prospecting rather than the manual labor they used to do.”

Rather than arbitrage, or taking a percentage of deals, Compulse offers the 360 platform on a software as a service basis with a fee that can save medium-sized companies up to 30% compared to whatever they’re using today, Kritseter said.

Ad Manager will enable self-serve campaigns, letting media companies capture smaller campaigns from small- and medium-sized businesses. Media company sales reps now don’t call on advertisers that plan to spend less than $5,000 on a campaign, losing opportunities that can add up but are hard to exploit if the amount of manpower required to service those campaigns is limited.

Ad Manager can hook up to Compulse’s demand-side platform or to other DSPs. “There is a very large cohort of those advertisers in every single market that you want to capture,“ Kristiseter said. ”Now we have a self-serve solution that can help you get there.”

Kristiseter acknowledged the ad-tech space is only getting more crowded. But he thinks Compulse’s approach to trying to reduce friction and make buying multimedia companies simpler will pay off.

Kristiseter said Compulse now has about 200 people on staff. “It still smells and looks a little bit like a startup, but it’s starting to be a bit more sizable than it used to be,” he said.

Compulse will also be amping up its marketing message in the ad-tech industry — a mission made a bit harder with the cancellation of NAB Show 2021. “We’ve been pretty hush-hush,” Kristiseter said. ”There’s a bit of a land grab out there right now. We’re trying to make sure we get in front of all the usual suspects.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.