Engine Survey Finds Paid Streaming Services Draw Most Consumer Usage

Many customers interested in ad-supported Disney Plus and Netflix

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Paid subscription streaming TV services still have a big lead over free, ad supported options, according to new research from Engine.

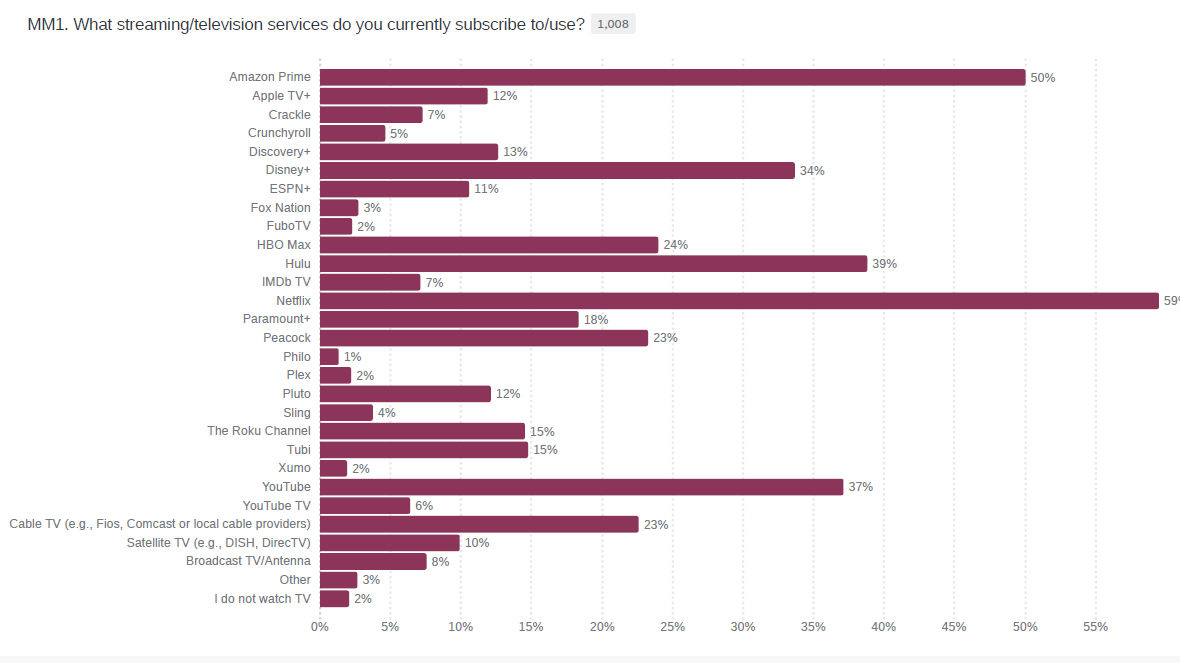

The Engine study, conducted March 30 through April,1 is interesting because it combines all forms of TV distribution, free streaming, paid streaming, broadcast and cable. Netflix is the top service, used by 59% of those participating in the survey. Netflix is followed by Amazon Prime Video at 50%, Hulu with 39%, YouTube at 37% and Disney Plus at 34%.

The top free streaming service is Tubi, used by 15%, followed by Pluto TV at 12%.

Jake Kelley, director, Engine Insights said the free services seem to be growing a bit faster than the paid services. “There’s a lot more options out there that are becoming available,” Kelley said.

HBO Max and Peacock were growing particularly fast, he noted.

Among the virtual multichannel video programming distributors, YouTube TV had 6% of users and Sling had 4%. (Hulu Plus Live was not broken out separately).

Cable TV was named by 23%, satellite TV was cited by 10% and broadcast TV using an antenna was used by 8%. There were 2% of respondents who said they do not watch TV.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Consumers may be open to ads, if it will lower their monthly payments. But not too many ads, according to Engine’s study.

When asked about the appeal of plans with and without commercials, 37% were most attracted to a service that cost between $4 and $8 a month with limited commercials. A $12 to $18 a month service with no commercials was favored by 36%, while just 27% than that free service with frequent commercials was appealing.

Disney recently announced that it would launch an ad-supported, lower-priced version of Disney Plus. Engine asked Disney subscribers how likely they were to switch to the new version and 20% said that was very likely, 27% said it was somewhat likely, 23% were ambivalent, 14% said they were somewhat unlikely to switch and 17% said it was very unlikely they’d switch.

Among people who use streaming services, cable or satellite TV, don’t have Disney Plus, 11% said they were very likely to sign up for the ad supported version of Disney Plus when it becomes available and 20% said they were somewhat likely. There was 15% show said they were somewhat unlikely to subscribe and 35% very unlikely to.

Netflix doesn’t have commercials and most of its senior executives are against them. But last month, Netflix CFO Spencer Neumann took a “never says never” stance when it comes to advertising. Engine asked Netflix subscribers if they would switch to an ad supported version if it were available and 18% said that was very likely and 28% said that was somewhat likely. Among TV watchers not subscriber to Netflix, 11% said they’d be very likely to sign up for Netflix with ads and another 27% said that was somewhat likely, while 27% said that was very unlikely.

“People like to have options in their streaming service plans,” Kelley said. “I think if Netflix were to [launch an ad-supported stream, there would likely be some cultural blowback. But I think it would get embraced by a lot of people who want cheaper options and are willing to watch commercials.”

CNN just launched its CNN Plus streaming service and 7% said they were very likely to subscribe and 10% said the were somewhat likely to sign up. That compares to 3% of respondents who said they use Fox Nation.

Engine also asked if consumers were interested in YouTube’s new service streaming TV shows free with ads, and 23% said they were very likely to use the new service, with another 33% somewhat likely.

Asked to estimate how much they paid monthly for streaming services, 26% said between $10 and $19.99 a month. There were 14% who said between $20 and $29.99 and 17% who said between $30 and $49.99 per month. There were a handful of very big streamers, with 8% of respondents saying the spent between $50 an $74.99 a month, 4% spending $75 to $99.99 a months and 4% spending more than $100 a month.

Kelley noted that the spending figure was probably more “aspirational than realistic.” With many off those surveyed saying they take four more more services and some using vMPVDs, the self-reported monthly spending figures are probably low.

The Caravan survey was conducted by Engine Insights among a demographically representative U.S. sample of 1,018 adults 18 years of age and older. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.