Discovery Claims 11 Million Total Streaming Subscribers

Net income down 43% in fourth quarter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Discovery reported higher than expected subscriber numbers for its direct-to-consumer streaming services, but reported lower profits for the fourth quarter.

Discovery said it currently has more than 11 million streaming customers, up from 5.2 million in December before the launch of Discovery Plus on Jan. 4.

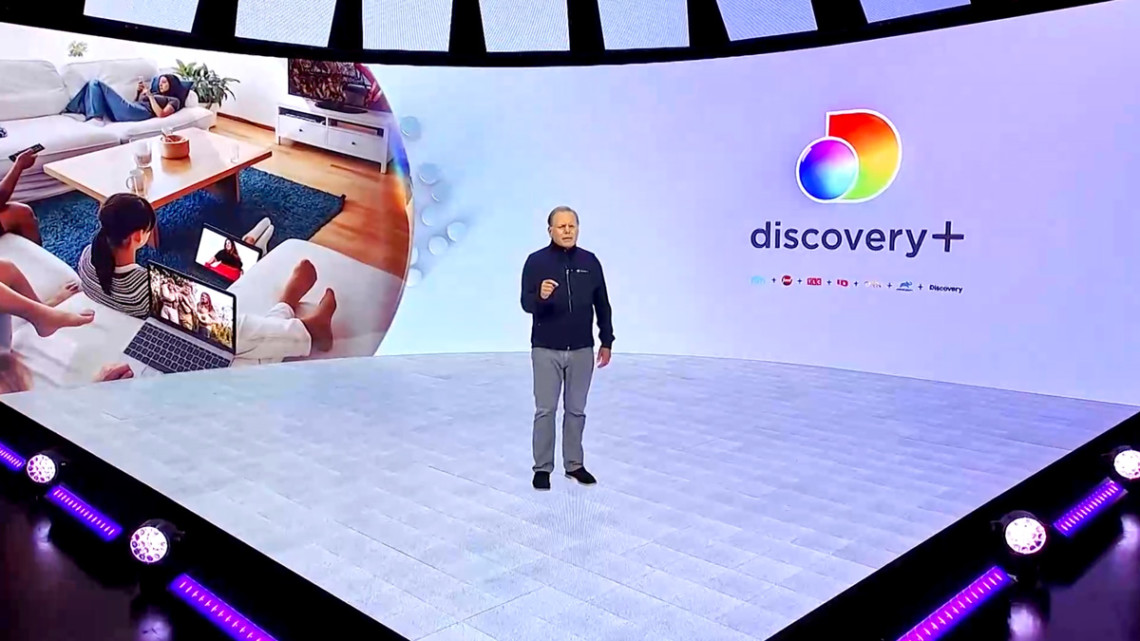

The company didn't break out how many people have signed up for Discovery Plus, but CEO David Zaslav, on the company's earnings call Monday morning said that the "vast majority" of the added subscribers were attributable to Discovery Plus. With nearly 7 million added subscribers, that would nearly double Wall Street expectations for Discovery Plus.

He added that more than half of the new subscribers are paying customers and that Discovery Plus had barely started to roll into international markets.

"Discovery exceeded DTC expectations by a wide margin in our view," said analyst Steven Cahall of Wells Fargo. "Results also came in ahead and support a year that looks to be characterized by a strong subscriber ramp. Investors will likely underwrite continued investments if this is the case."

Also Read: Discovery Plus May Have Added 3.5M Subs: Analyst

The Wall Street consensus was that Discovery would reach 10.5 million subscribers by the end of the first quarter, including 3.5 million Discovery Plus subs.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Discovery stock jumped more than 5% in Monday morning trading on the news.

The early success for Discovery Plus is likely to lead to higher than planned spending on marketing and other expenses, leading to losses that could be “a couple of hundred million more” than expected, added CFO Gunnar Widenfels said. He said that losses from Discovery Plus would still peak in 2021.

Also Read: Discovery Plus Offers 50-Plus Original Series

Net income fell 43% to $271 million, or 42 cents a share, down from $476 million, or 67 cents a year ago. Costs increased as the company prepared to enter its new entry into the streaming sweepstakes.

Revenue was flat at $2.866 million. In the U.S., ad revenue was flat at $1.048 billion and distribution revenue rose 5% $709 million. International ad revenue was down 1% and international distribution revenue was down 4%.

Discovery launched Discovery Plus, its new streaming service in January, after the end of the fourth quarter.

"2020 was a year of change, challenge, and opportunity, and our company has shown incredible resilience, creativity and focus as one global team,” said Zaslav. “We finished with strong operating momentum and great command and control across our global businesses, uniquely positioning us to balance our core and next generation businesses. We are off to a promising start in 2021 with the successful launch of Discovery Plus.”

More than a month and a half after the Discovery Plus launch, Zaslav said the company has surpassed 11 million total paying direct-to-consumer subscribers globally and is on pace to be at 12 million by the end of the month.

Zaslav said that there 100 advertisers on the Discovery Plus and that he expects that to double by the end of the second quarter. The company has launched contextual key word targeting and will have pause ads and binge ads up and running in the second quarter.

Also Read: Everything You Need to Know About Discovery Plus

The data that Discovery Plus generates, combined with first party data owned by advertisers presents a great opportunity, Zaslav said. One benefit is that the streaming service is extending campaigns by reaching non-pay-TV subscribers.

He said revenue per user already exceed that of the company's linear subscribers.

“Our unmatched global scale and ability to serve consumers everywhere with a truly differentiated offering across platforms, as well as our robust cash flows, even amidst the significant investments in our next generation initiatives and the ongoing COVID-19 pandemic, position us to achieve sustainable long-term growth and drive long-term shareholder value,” Zaslav said.

Discovery’s U.S. networks unit had adjusted operating income before depreciation and amortization of $946 million, up from $925 million.

First quarter advertising revenue could be down because of macroeconomic factors and using more commercial inventory to promote Discovery Plus, Widenfels said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.