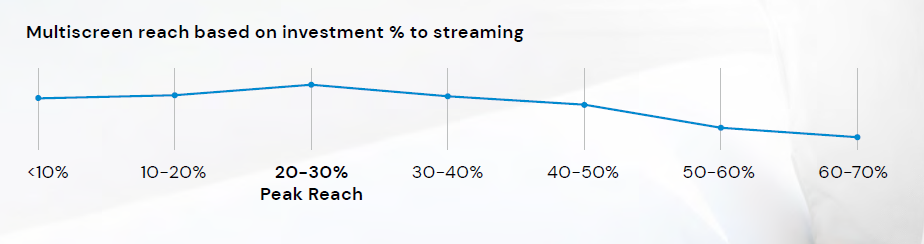

Comcast Finds Campaign Reach Highest When 20% to 30% of Spending Goes To Streaming

Programmatic transactions on the rise

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Comcast Advertising found that multi-screen campaigns achieved maximum reach when 20% to 30% of spending went to streaming.

According to the 2022 Comcast Advertising Report released today, when spending on streaming exceeded 40%, reach declined because while streaming can provide incremental reach, it is still traditional TV that serves as the foundation for the 20,000 campaigns it studied.

“As viewership continues to fragment across devices, advertisers should increasingly focus on 'following the audience' wherever they choose to watch. Advertisers who rely only on traditional ‘standbys’ like primetime and top networks will see their campaign reach decline, as consumers spread out their consumption. By using ever-increasing data on viewing across all endpoints, marketers will help foster an ecosystem driven by audiences and outcomes, rather than content," the report found.

The report, which contained information from both Comcast Advertising’s Effectv sales division and its FreeWheel ad tech unit, said that ad views bought programmatically have grown 80% year over year as advertisers see programmatic buying as a way to reach specific audiences more efficiently.

Even as they turn to automation, advertisers still want the security of guarantees. Comcast reports that in the second half of 2021 guaranteed programmatic accounted for 60% of programmatic video impressions.

At the same time, sellers are working with over 60% more programmatic partners on average compared to a year prior, working with up to 30 different companies.

“Buyers today also have the opportunity to be better connected with their media partners – both figuratively and literally, thanks to technology. A direct connection from buyer to seller allows for more flexibility and fluidity and is a must in today’s multifaceted advertising environment," according to the report.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The report also put in a good word for the effectiveness of addressable campaigns.

Comcast Advertising recently worked with a luxury automotive brand, that achieved three times higher conversion rates with in-market car buyers who were reached through addressable advertising. “This makes sense as these buyers were previously identified as having a high likelihood of purchasing,” the report said. The brand also committed to a broader data-driven traditional TV campaign which helped to reach more buyers. Nearly one-third of those who ultimately purchased were not identified as having been in-market.

“Advertisers should use a combination of tactics to achieve their goals: Reach more potential buyers with traditional data-driven TV and then use addressable advertising as a tactic to reach those more likely to buy sooner,” the report said.

“This has been an incredible year for TV advertising’s progress and innovation, and this is clearly evident in the discussions we’re having every day,” said Mark McKee, general manager of FreeWheel. “From addressable, to programmatic, to first-party data – the opportunities are there for advertisers to do more with their budgets and connect better with sellers. It’s critical for them to look at the industry from all sides to understand where the opportunities lie, and this report can help them do that.”

The report concludes with predictions about the ad market:

■ Streaming will increase -- as will its importance to advertising.

■ The shift to audience-based buying will give way to new measurement currencies.

■ The importance of first-party data will grow.

■ Addressable advertising will finally scale.

“The TV advertising landscape is incredibly complex now, and there are more players in the space than ever,” said Marcien Jenckes, managing director, Comcast Advertising. “While most reports focus on a single view of this complexity, Comcast Advertising is in a unique position to see it from all angles – how viewers are viewing, buyers are buying, and sellers are selling. With this perspective, we are able to truly see what works and what doesn’t in today’s landscape, and provide fact-based insights and predictions about how advertisers can optimize their spend.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.