Broadcast Nets Show Gains in Ad Impressions Despite Strikes, iSpot Study Finds

Ad loads fell 2% at Big 4

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

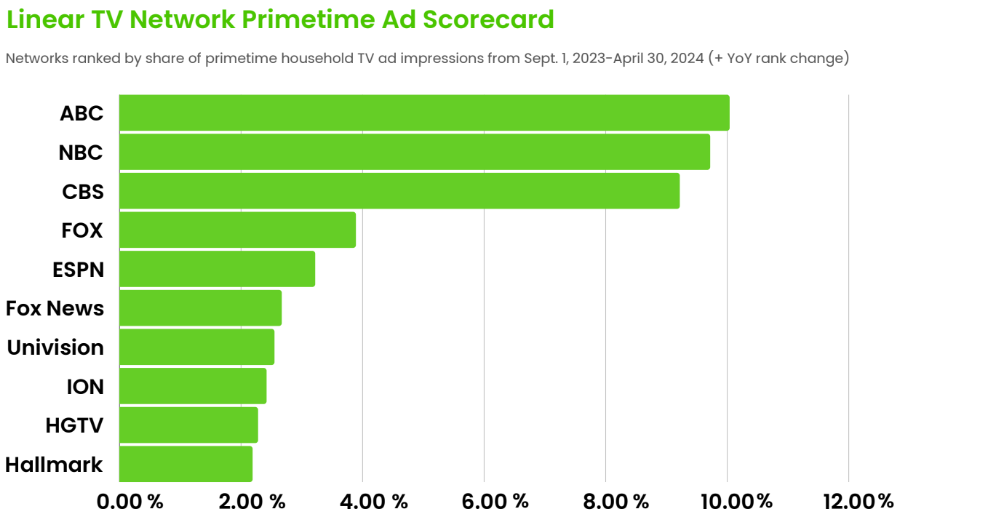

Despite strikes that wiped out original programming last season and a narrative about viewers streaming more and watching less linear TV, the big broadcast networks largest retained their reach, according to a report from measurement and analytics company iSpot.tv.

Ad impressions for national linear TV networks were down 1.2% during the broadcast season, but the Big Four registered a 6.2% increase in impressions, iSpot said.

There was also a disparity between all of national linear and the Big Four — ABC, CBS, NBC and Fox — in terms of ad loads.

The Big Four networks aired 2% fewer ads over the course of the season, while across all of national linear TV, ad loads increased 2%.

For all the talk of declines in TV viewership, the broadcast networks have found a way to hold and even grow linear ad audiences without increasing ad loads — all while growing streaming behaviors,” iSpot executive VP, media partnerships Stuart Schwartzapfel said.

“It's not a surprise networks continue to deliver so much reach, but seeing just how resilient some of these networks are during such an era of fragmentation is a testament to the power of TV, especially in perishable formats such as sports, news and talk shows,” Schwartzapfel said.

Among the individual networks:

The smarter way to stay on top of broadcasting and cable industry. Sign up below

ABC

ABC generated 313.1 billion TV impressions, up 14% and 113 billion impressions in primetime, up 28%.

It showed 2.1% more ads in primetime, but 6.8% fewer overall.

iSpot said much of ABC’s gains came from putting more sports in primetime, most importantly simulcasting ESPN’s Monday Night Football games on ABC. The NFL represented 8.6% of ABC’s ad impressions. College football represented 9.4% of impressions.

CBS

With the Super Bowl, CBS’s TV ad impressions were up 11% to 367.5 billion, with primetime impressions up 8.4% to 104.1billion.

In addition to the Super Bowl, CBS registered a 62% increase in college football as the network moved from showing SEC games to a Big Ten package. (Last season was CBS’s last with the SEC and the start of a multiyear deal with the Big Ten.) The NFL still represented 16.6% of CBS’s ad impressions.

CBS raised the number of ads it aired by 3.4%, with a 5.2% increase in primetime.

NBC

NBC racked up 253.7 billion impressions, down 2.9% overall, while primetime was down just 0.8% to 109.8 billion impressions.

NBC reduced its ad load, airing 8.5% fewer ads overall and 2.6% fewer ads in primetime.

Sunday Night Football was NBC’s top show, delivering 16.3% of its impressions. That was up 6.5% despite reduced ad load in NFL games, according to iSpot.

NBC lost impressions during the Today show and daytime programming, iSpot said.

Fox

Fox ad impressions fell 4% to 133.1 billion during the past season, with primetime impressions down 4.2% to 43.9 billion.

Overall, the network showed 6% more ads, while in primetime the number of ads was down 0.1%

More than half of Fox’s ad impressions came in sports, with the NFL accounting for 37.6% of them. Fox’s other top shows in terms of ad impressions were college football, Major League Baseball, WWE Friday Night Smackdown and men’s college basketball.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.