Advertisers Plan More Spending on Data Driven Linear TV: Xandr

53% increase in OTT and CTV budgets

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Advertisers plan to spend more ad dollars on a variety of advanced advertising and new media options over the next 12 months, according to a new report from AT&T’s Xandr advertising unit.

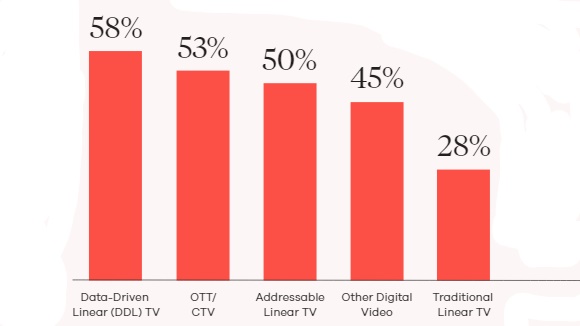

According to a survey conducted for Xandr by Advertiser Perceptions, 58% said they would increase spending on data-driven linear TV.

The survey found 53% putting more ad dollars into over-the-top and connected TV, 50% planning to boost addressable linear TV spending and 45% increasing spending on other forms of digital video.

Just 28% said they plan more spending on traditional linear TV.

Also Read: Advertisers Mostly Dissatisfied With Media Measurement, Survey Finds

Employing less-traditional forms of video isn’t easy for many advertisers.

“It is the golden age of premium video content for viewers, and the height of complexity for advertising decision-makers and their partners,” said Xandr’s 2021 Relevance Report covering the State of Convergence and Advanced TV.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The report said that buyers look at data-driven linear as a way to make traditional TV, often representing their largest budget, more efficient, partially for top-of-the-funnel marketing.

Three of four advertisers believe data-driven linear gives them the very best of TV and digital advertising.

"Some of the reported barriers to adoption of data-driven linear—unclear benefits, confusion about how data-driven linear works—are easily mitigated by partnerships with experts,” the report said.

Nearly every advertiser in the study saw benefits to automating OTT buys. The biggest benefits were earlier campaign targeting and optimization and better pricing.

But only about half of OTT/CTV budgets are allocated to programmatic buys. Respondents cited building and growing direct relationships with publishers, and the less familiar process as key challenges to programmatic OTT/CTV.

All 357 respondents had to be buyers actively working with over-the-top, connected TV or linear television.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.