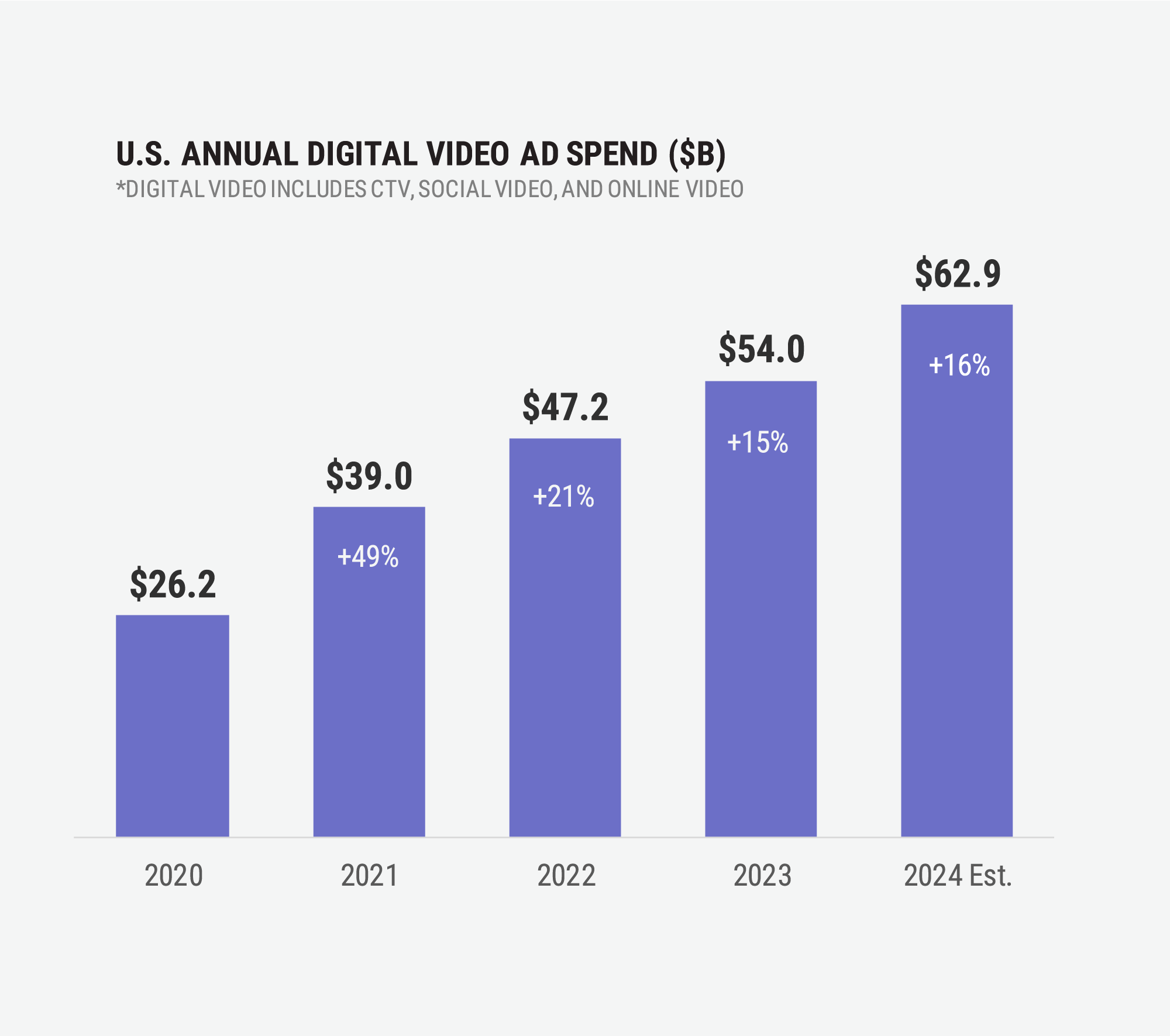

Ad Spending on Digital Video Expected To Grow 16% in 2024

IAB forecast calls for CTV to jump 12% to $22.7 billion

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Advertiser spending on digital video is expected to grow 16% to $63 billion in 2024, according to a new forecast from the Interactive Advertising Bureau.

The figures include connected TV, which exceeded $20 billion in ad spending for the first time in 2023. CTV is expected to grow 12% to $22.7 billion, the IAB said, just before the start of its NewFronts.

The bulk of the ad dollars streaming into CTV come from traditional media, including linear TV, but 31% of revenue comes from expanding advertising budgets.

“Among the largest ad spenders, CTV (69%) and social video (70%) are considered ‘must buys’ because of their ability to deliver both scale for branding at the top of the funnel and performance outcomes at the bottom of the funnel,” said Chris Bruderle, VP, industry insights & content strategy at the IAB.

Social video is expected to grow 20% year over year to $23.4 billion in advertising revenue.

Digital media has been growing, increasing its share of the overall advertising pie, while traditional media’s portion has been shrinking.

In the last four years, the share of ad spend has shifted by nearly 20 percentage points from linear TV to digital video, which is now 52% of the total market share, according to IAB.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Advertisers go where consumers are, and today that means digital video,” IAB CEO David Cohen said. “The challenge ahead is this: in a crowded landscape, who can deliver the best viewing experience, with the best content choices and the most innovative advertising options? That competition is ultimately good for consumers and good for the industry.”

To create the report, IAB worked with Guideline and used data from an IAB-commissioned Advertiser Perceptions quantitative survey of advertising decision-makers and other market estimates.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.