While Cord-Cutting Accelerates, Streaming Growth Slows: Analyst

Direct-to-consumer reaches 585 million subscribers, revenue of $14.2 billion

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

In a worst-case scenario for the media world, cord-cutting accelerated in the first quarter, depleting the pay TV universe, while streaming subscriber growth slowed, according to Wells Fargo media analyst Steven Cahall.

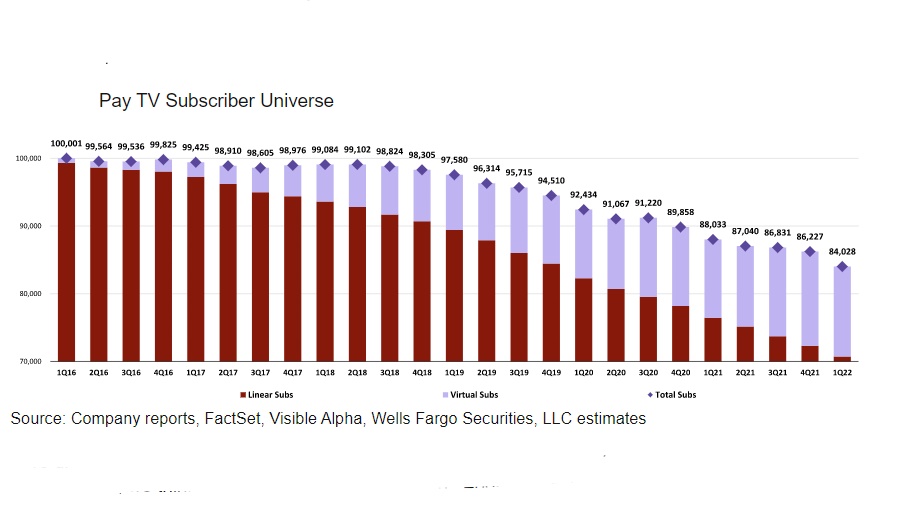

Looking at the reports issued by media companies and distributors this earnings season, Cahall calculated that first-quarter pay TV subscribers were down about 4.5% compared to a year ago, 50 basis points worse than in the fourth quarter.

That translates to a loss of about 2.2 million subscribers, or 100,000 more cords cut than in the first quarter of 2020 and 400 more than in Q1 2021.

Also: Disney Grows Streaming Business To More than 205 Million Subscribers

That leaves about 84 million pay TV homes in the U.S., he estimates.

Cahall blamed slower additions among the virtual multichannel video programming distributors (vMVPDs) for the decline. Some vMVPDs have raised prices, resulting in sub declines for Hulu Plus Live and Sling TV.(He estimates that YouTube TV lost 200,000 subscribers).

Also: Netflix Shares Crater Around 25% as Service Loses 200,000 Subscribers in Q1

The smarter way to stay on top of broadcasting and cable industry. Sign up below

For all of 2022, Cahall is estimating that pay TV subscribers will be down 5.8%, falling 1 percentage point faster than in 2021.

“While industry sub declines may be worsening we think that is largely expected by investors and companies given all the content going onto streaming,“ Cahall said. ”We don't think traditional Media assets are priced to expect cord cutting to remain stable or improve long-term. We view sub declines that are down mid-single-digits as remaining stable.”

Also: IAB: Connected TV Advertising Will Rise 39% to $21.2 Billion

Meanwhile, as the media industry turns to streaming, Cahall detected a slowdown in net added customers for subscription and ad-supported VOD.

Cahall’s figures show direct-to-consumer net adds of 29 million in the first quarter, compared to 42 million in the first quarter of 2021.

The 12 streamers Cahall tracks had 585 million subscribers at the end of the first quarter, up 5.2% from the fourth quarter. But that represents slower growth than the 9.5% increase registered in the fourth quarter.

For the rest of 2022, Cahall estimates that streamers will have net adds of 144 million to reach 701 million subscribers. He sees that increasing to 808 million by the end of 2023.

Subscription and advertising revenue direct-to-consumer services $14.2 billion, up 5% from the fourth quarter and 28% from a year ago. But that compares to the 8% to 9% pace seen since from early 2019 through the first quarter of 2022.

Adding in revenue for free, ad-supported television (FAST) and connected TV players like Pluto TV, Tubi, Roku (platform) and Vizio (platform), total revenue is $15.4 billion, up 29% in the first quarter of 2022 compared to 41% growth a year ago.

Cahall notes that Netflix still has the largest market share among the DTC services with 38% in Q1. But Netflix’s share as down 2% compared to the fourth quarter and compares to the 47% share it had a year ago, when many new rivals were launching or getting ready to launch. Disney’s market share remained at 15%, while Paramount’s share increased to 7% from 6%. Peacock’s share also increased to 5% from 4%. Share for all other services remained flat sequentially, he said. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.