Viewing of Ad-Supported CTV Apps Up 55% Since 2020, TVision Reports

Average home uses 7.3 apps

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Viewing of ad-supported connected TV apps was up 55% in the second half of 2022, compared to the second half of 2020, according to a new report from measurement company TVision.

TVision’s The State of CTV Advertising report says that as consumers move to CTV, advertisers are looking for strategies for using CTV to reach viewers no longer subscribing to traditional TV.

“While CTV presents a massive opportunity to reach TV viewers, it can be an extremely frustrating and opaque environment for advertisers, due to walled gardens and their own proprietary metrics,” TVision CEO Yan Liu said. “With the data from our single source panel, we are able to report universal metrics across hundreds of apps, which tell the real story on who advertisers are reaching and how well they are engaging those audiences.”

TVision says that 83% of households are CTV enabled. The average home used 7.3 apps and nearly 30% of homes use 10 or more apps.

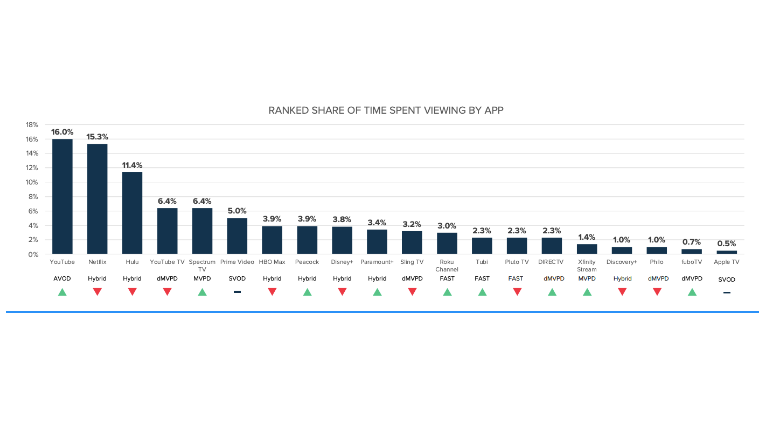

Corroborating an earlier report from Nielsen, TVision says that YouTube has supplanted Netflix as the streaming app with the biggest share of time spent viewing, Netflix’s household reach dropped to 61% in the second half of 2022, from 66% in the first half 2022, but it still reaching more households than any other app, including YouTube.

In the report, NBCUniversal’s Peacock stacks up surprisingly well. According to TVision, Peacock has a 3.9% share of time spent viewing, which puts it ahead of Disney Plus, Paramount Plus and tied with HBO Max.

The report notes that Disney Plus and Netflix now offer advertisers new opportunities to advertise and connect with hard-to-reach audiences. The best combination for reaching CTV viewers is Netflix with the Roku Channel, which have an audience overlap of just 41.9%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

TVision is well known for measuring attention. By that metric, Netflix and YouTube TV are tops among streamers, followed by Amazon Prime Video, HBO Max, Peacock and Hulu.

TVision also noted that FAST apps including The Roku Channel, Tubi and Pluto increased their share of viewing in the second half of 2022 compared to the first half of the year. But the report says that in the second half, FAST viewers were older and paid less attention than CTV viewers historically.

The entertainment, legal, health and retail industries are responsible for the largest share of CTV ad volume. The government sector, spurred by election-cycle spending, and automotive advertisers dramatically increased their investments in the second half of 2022. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.