Study Finds Addressability Growing in Importance to Advertisers

55% said they’ll increase spending on CTV

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Addressable advertising is becoming a more important tactic to advertisers and media buyers, according to a survey conducted by Advertiser Perceptions for WarnerMedia Ad Sales.

In the study, 32% of those surveyed called addressable TV a must buy, up from 25% in a similar survey a year ago and 44% called addressable a complementary buy, up from 41%.

Just 18% called addressable a discretionary buy, down from 24% and only 6% called it an experimental buy, down from 10%.

Addressable TV was called a reliable way to reach audiences by 85% of the advertisers and media buyers questioned, and 79% said they were satisfied with the results of their addressable TV campaigns.

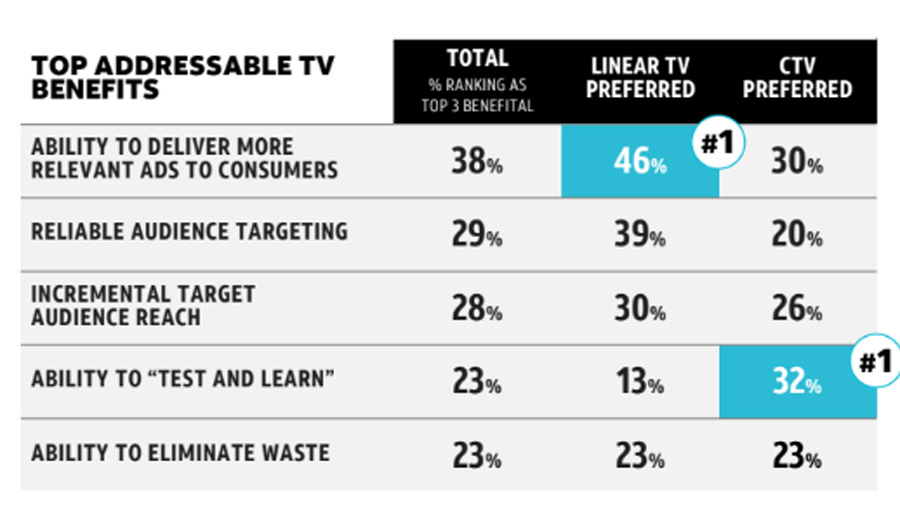

The biggest benefit for addressable TV was the ability to deliver more relevant ads to consumers, cited by 46% of those polled.

Connected TV offered a complimentary set of benefits, headed by incremental target audience reach at 40%.

The bottom line is a lot of advertisers said they planned to increase their spending on more targetable video, with 55% saying they expect to boost spending on CTV and 47% saying they’ll raise spending for addressable TV.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Data is a key component of addressable TV and nine in 10 advertisers said they’ve increase their investment in data and analytics over the last 12 months and will do so again in the upcoming year.

The survey found that 77% of those asked said they’ve experimented with a new ad channel in the next 12 months because of their investment in data and 75% say there investment in data have affected budget allocations across media type.

The study is based on 20 minute online surveys conducted in June with 200 brand and agency executives responsible for spending more than $1 million on TV, CTV or OTT.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.