Streaming’s Share of TV Usage Grew to 53.8% in Q2: Inscape

Viewing of FAST channels up 70%

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

More evidence that streaming has become the dominant way people are consuming video comes from Inscape, the data unit of smart TV maker Vizio.

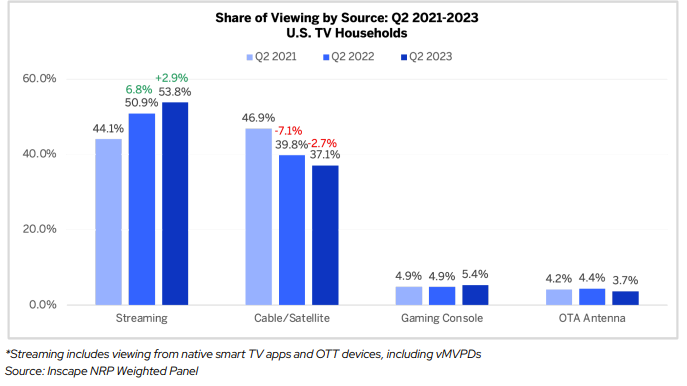

Inscape said that in the second quarter, streaming’s share of viewership hit 53.8%, up 2.9% from 50.9% in Q2 2022 and a 44.1% share in Q2 2021.

The streaming total includes viewing of virtual multichannel video programming distributors like YouTube TV and Sling TV. Nielsen reported that in July, cable and satellite accounted for less than 50% of viewing.

Streaming supplanted cable and satellite as the most-viewed TV source in early 2022 said Inscape, which uses data from 22 million opted-in TV devices and makes adjustments based on data from the U.S. Census and other sources.

The growth of streaming has been fed by the increase in penetration of smart TVs, which are now in 80% of U.S. homes.

Correspondingly, the share for cable and satellite has dropped to 37.1% from 46.9% in Q2 2021. The share of TV time going to gaming and over-the-air broadcast has been relatively flat, Inscape said.

The proliferation of free ad-supported streaming TV (FAST) channels has been a big contributor to the growth of streaming.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Inscape said FAST viewing time increased by 70% from Q2 2022.

Sports and news programming bucked the streaming trend, with the vast bulk of viewing in those genres taking place via cable, satellite or over the air. Inscape said that just 23.1% of sports viewing was streamed, while 14.7% of news was streamed.

Cord cutting was 5% from Q1 to Q2 of 2023. That’s up from the previous two quarters.

Inscape also identified a group of viewers it calls “quiet quitters,” who have not fully cut the cord, but have reduced their cable/satellite viewing time by 75% or more. Those “quiet quitter” accounted for 9% of cable/satellite households in the second quarter.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.