Streaming Penetration Rises to 80% as Smaller Services Grow: Analyst

Super Bowl, Olympics give Peacock a boost

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

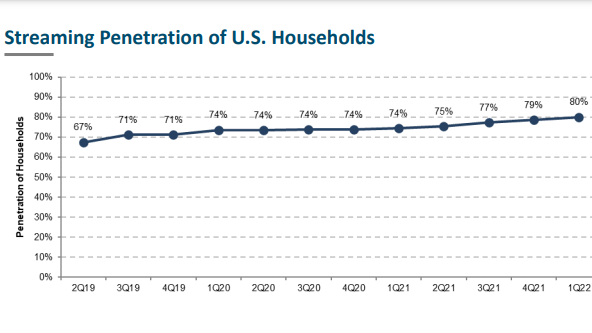

The penetration of streaming in U.S. households has expanded to 80% in the first quarter from 79% in the fourth quarter of last year, according to a new report from MoffettNathanson analyst Michael Nathanson.

A year ago, in the first quarter of 2021, streaming penetration was 74%, according to data Nathanson uses from a monthly survey by HarrisX.

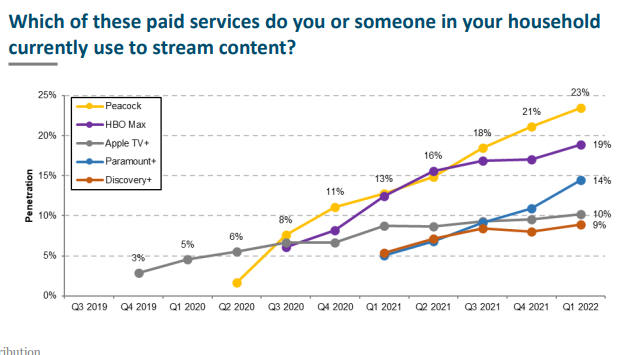

Nathanson said the growth in penetration came because of increases in subscriptions to newer, smaller services like Peacock and Paramount Plus, while OG streamers like Netflix, Hulu, Disney Plus and Amazon Prime Video were relatively flat as a group.

In the quarter those established services appeared to step down the increase in new episodes of original programming. By contrast, newer services are ramping up with new series on Paramount Plus and the Olympics and Super Bowl on Peacock.

Peacock’s penetration was up 235 basis points quarter over quarter. Paramount Plus’s penetration increased 350 basis points quarter over quarter, while HBO Max was up 185 basis points.

Discovery Plus’s growth wasn’t exceptional, but its subscribers’ daily usage was a month the highest in the industry, trailing only Netflix and Hulu.

The increase in streaming penetration came from consumers who don’t have a pay TV subscription. Penetration in homes that do have a pay TV subscription was flat.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Nathanson said the shift to streaming will continue to be a problem for legacy media.

“We see a problem brewing in the data,” Nathanson said. “When asked why consumers cut the cord and moved to streaming, the issue of ‘Pay TV being too expensive’ may be quickly bypassed by the rationale that ‘all the shows I currently watch are on streaming.‘

“As more linear network owners (e.g., Disney, Comcast, Paramount and now Warner Bros. Discovery) shift more and more original content to their streaming services they are potentially creating a ‘tragedy of the commons’ moment when all these individual actions end up collectively damaging a common good — in this case, the linear TV bundle,” he said. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.