‘Quiet Quitters’ Haven’t Cut the Cord, but Are Watching Less Pay TV, Inscape Finds

5% of homes with pay TV subscriptions have stopped tuning in entirely

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

A lot has been said about how cord-cutting decimates traditional linear television's viewership.

But according to Inscape, the data division of Vizio, many of the people who haven’t cut the cord have also reduced their viewing of satellite and cable TV.

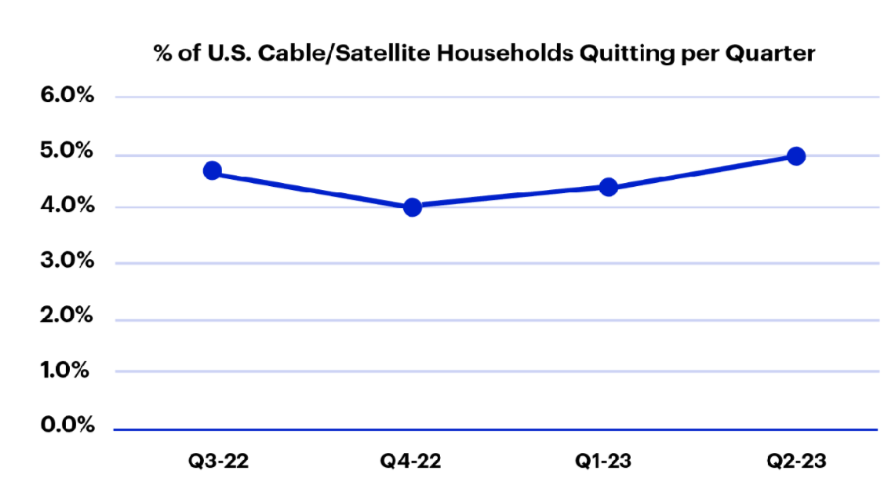

In its Q2 2023 TV Market Trends report about 5% of U.S. pay TV households have stopped viewing content via cable and satellite. That’s up from 4% in Q4 2022.

Others have cut back significantly.

Inscape calls these viewers “quiet quitters” who continue to pay for cable and satellite but aren’t tuning in.

Inscape found that 9% of pay TV households reduced cable and satellite viewing by 75% or more from Q2 2022 to Q2 2023. Another 8.4% of traditional pay TV households reduced their satellite and cable viewing time by 50% to 75% over that same period.

Pa yTV providers and networks are still getting revenue from these folks, but they aren't likely to be high lifetime value customers. Also, cable and satellite operators and programmers are looking at lower-than-expected ad revenue in these quiet-quitter households because of lower ratings.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“This quiet-quitting trend emphasizes the reality that not all TV viewership stats are created equal,” Inscape VP, data licensing & strategy Ken Norcross said. “While overall viewership data suggests a broader movement between formats, closer examination of specific programming categories like sports and news illustrates how legacy formats remain viable options.”

What are those quiet quitters still watching on cable and satellite? Cable, satellite and over-the-air broadcast accounts for 43.6% of TV viewing time, but 76.9% of sports viewing and 85.3% of news viewing.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.