Post-Election Local TV Ad Revenues Expected To Drop 15%, BIA Reports

Excluding political, spending seen rising 3% to $18.2 billion

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Local TV advertising revenues are expected to fall 15% in 2023 to $18.5 billion from $21.8 billion in 2022, according to BIA Advisory Services.

The drop reflects record spending on political advertising during the 2022 midterm elections. In 2021, total local TV ad revenues were $17.2 billion.

Excluding political advertising, local TV, including over-the-air and digital TV spending, is expected to increase 3% to $18.2 billion in 2023 from $17.6 billion in 2022. Local TV spending excluding political spending was $17 billion in 2021.

Local digital TV revenue is expected to increase 17.3% and over-the-top is expected to grow 12.3%, BIA said.

“When it comes to advertising in the business vertical market, education offers a tremendous for the local advertising marketplace,” said Nicole Ovadia, VP forecasting & analysis at BIA Advisory Services.

“Supply chain issues continued to plague the first couple of quarters of 2022 making it difficult for local media sellers. In the summer, we had higher hopes for the remainder of the year; however, inflation issues and recession fears started to set in and that stalled anticipated rebounds in key verticals such as automotive,” Ovadia said. “For our 2023 forecast we lowered near-term expectations to reflect the current economic climate that we anticipate will stay with us into next year.”

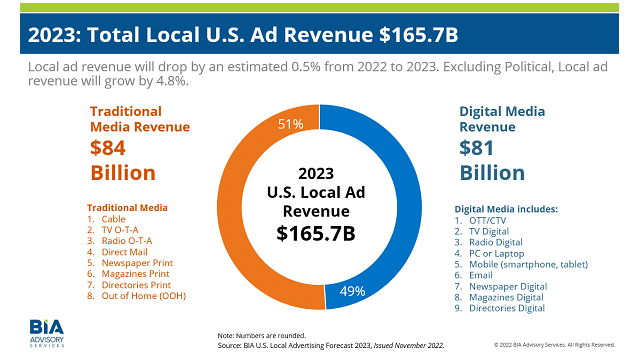

Overall local U.S advertising revenues are expected to reach $165.7 billion in 2023, down 0.5% from 2022. Removing political advertising from the equation, BIA sees overall U.S. ad revenue rising 4.8% to $165.2 billion.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

BIA sees growth being more bullish starting in mid-2023, as concerns over the economy and supply chain issues subside.

Digital continues to grow its share versus traditional media. BIA expects digital to account for 49% of overall local advertising spend, or $81 billion, in 2023.

Traditional media ad revenues are expected to be $84 billion, or 41% of the total.

BIA said it has been slightly decreasing its digital estimates over the last couple of forecasts because of opt-in privacy measures on Apple and Android devices that have slightly impacted mobile advertising growth.

The fastest growing local advertiser categories in 2023 are expected to be education, up 9.7%; retail, up 87%, and restaurants, up 7.5%. Declining categories include political, down 78% following the midterms; leisure and recreation, down 4.9%; and real estate, off 1%.

Automotive spending is expected to grow 4.9%, with most growth coming in the latter part of 2023.

“When it comes to advertising in the business vertical market, education offers a tremendous opportunity for local media in 2023, with companies offering opportunities for employees to improve their training and with people who are experiencing a job transition often enrolling in classes to advance their education,” said Ovadia. “For other verticals, too, I believe they will pop potentially faster if we see the Fed slow or stop raising interest rates, inflation tamed and a smaller than anticipated recession. Even with the economy in flux, the continuing strength of the labor market and corporate profits makes me feel confident that key verticals will show growth in the year ahead.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.