Pay TV ARPU in Q2: How the Top Operators Stack Up

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

During earnings season for media, telecom and technology companies, publications like B&C are usually full of subscriber numbers, a dynamic accentuated by the acceleration of cord-cutting.

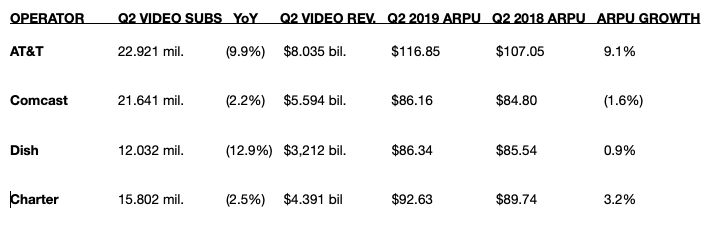

But an often overlooked metric is average revenue per customer (ARPU) for pay TV operators. It’s a volatile era. AT&T has lost nearly 10% of its pay TV base over the last 12 months. But it’s insisting that it’s cutting customers off of steep promotions that once fueled growth. It also, of course, raised pricing on its virtual MVPD product, the erstwhile DirecTV Now.

According to our calculations, which divided revenue across linear and OTT service by their total subscribers, we found that AT&T’s average revenue per user increased by 9.1% this year. (This figure doesn’t include advertising revenue).

Charter Communications has similarly pledged to reduce the amount of promotional offers it plies to video service subs, and it saw ARPU climb 3.2%.

We measured just the top companies with at least 10 million subscribers.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!