Nexstar Risks $6.7 Million Per Month in Lost Fees During Fios Blackout

$5.9 million in monthly ad revenue also could be lost, S&P Global Market Intelligence estimates

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The blackout of Nexstar Media Group stations in households served by Verizon Fios TV is putting $6.7 million in retransmission and distribution fees per month at risk, according to an analysis by S&P Global Market Intelligence.

Nexstar’s retransmission-consent agreement with Verizon Communications expired on Friday and the two sides were unable to reach an agreement on an extension.

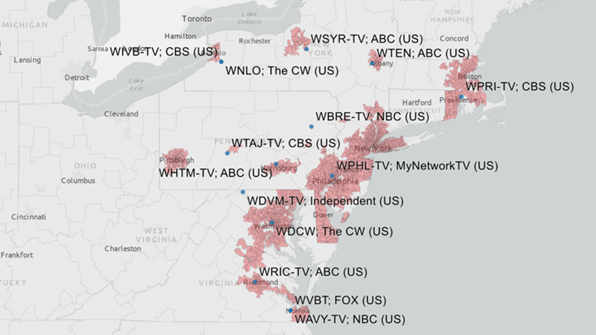

The dispute impacts 14 full-power Nexstar stations in 11 markets. S&P estimates Verizon serves about 22.3% of the 11.3 million TV households in the market.

Also blacked out is NewsNation, Nexstar’s cable news network.

Kagan also estimates that in the second quarter, the affected Nexstar stations averaged $4.19 a month per subscriber in fees. Those fees are expected to go up in a new agreement. If Nexstar gets $4.25 per month, it would generate $79.4 million in revenue annually.

Nexstar advertising revenue is also in jeopardy, with both the midterm elections and holiday-shopping period approaching.

Kagan estimated the affected stations would generate $316 million in ad revenue in 2022, with $70.5 million coming from the blacked-out homes. That’s $5.9 million a month.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

It is harder to estimate what Verizon Fios has at risk. The pay TV business is already declining at a precipitous rate and it’s hard to tell, even during football season, how quickly subscribers will pull the plug and switch to another provider.

But once a pay TV distributor loses a subscriber, it’s difficult to get them back, which puts pressure on cable operators, satellite companies and telcos during retransmission disputes.

In contrast, station ad revenue usually returns to pre-blackout levels shortly after a new distribution agreement is reached. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.