Magna Sees Video Ad Revenues Down 7.9% in 2023, Up 7.2% in 2024

AVOD/CTV growing 7.2% in 2023, 14.3% in 2024

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The U.S. video advertising business is weaker than expected, according to media agency Magna, which released an updated forecast.

Video revenue is expected to snap back next year, with the Olympics and an election bringing in incremental dollars.

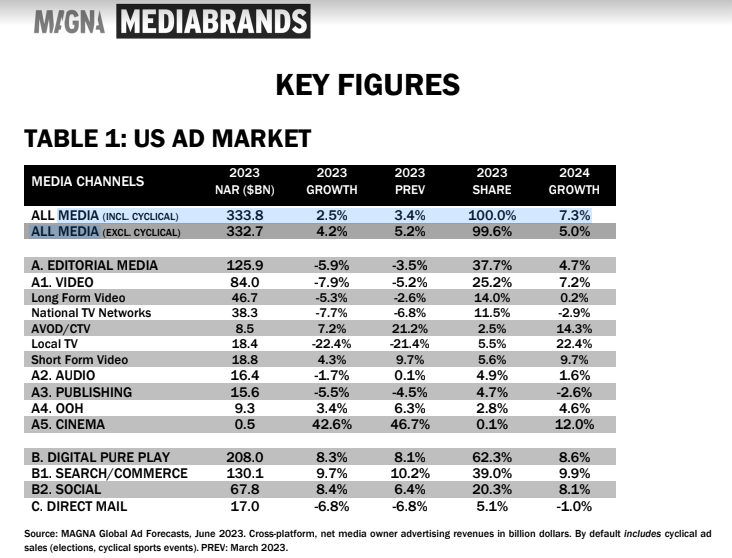

For video advertising, ad revenues are expected to fall to $84 billion in 2023, down 7.9% from 2022, a bigger drop than the 5.2% Magna decline forecast last year.

Revenue for national TV networks is seen falling 5.3% to $38.3 billion (Magna’s previous forecast was for a 6.8% drop) and local TV is seen plunging 22.4% in a non-election year, compared to Magna’s earlier forecast of a 21.4% decline.

While traditional TV is down, ad-supported streaming VOD and connected-TV revenues are expected to rise 7.2% in 2023. That increase is much smaller than the 21.2% jump Magna forecasted earlier.

For 2024, Magna sees video ad revenue increasing 7.2% with national TV networks seeing a 2.9% decline while local TV rebounds to a 22.4% gain.

AVOD and CTV are expected to increase 14.3% in 2024.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Magna said that in 2024 “economic stabilization and the return of major cyclical events (U.S. presidential elections, Paris Olympics, Euro Football championship) will re-accelerate ad spend: 6.1% to $892 billion globally, and 7.3% in the US. Traditional media owners’ ad revenues will recover by 1% while digital pure players’ ad sales will increase by 8.”

Retail media betworks are expected to generate $121 billion in advertising sales this year (up 12%), “The bulk of these ad sales will come from e-commerce pure players, but traditional retailers are developing their media capabilities and their advertising sales will grow by +24% to reach $21 billion,” Magna said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.