Magna Forecasts 13% Drop in National TV Ad Spending

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

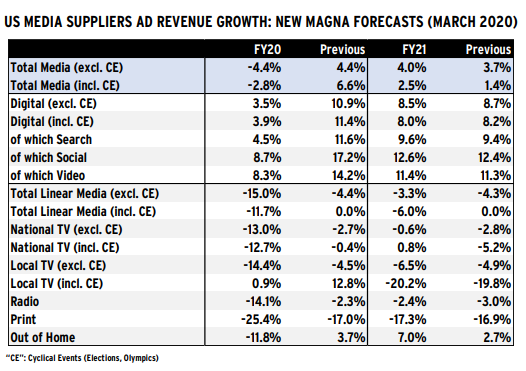

National television ad revenue will drop 13% this year, hurt by the coronavirus crisis, according to a newly revised forecast from Magna Global, a huge media buyer.

Including digital ad sales slightly improves the picture for broadcasters, Magna said.

For 2021, Magna expects national TV ad revenue to be up 0.8%, including cyclical events like the Olympics and elections.

Local TV’s non-political ad sales will also “decline massively” this year, Magna said, but nearly $5 billion in political spending will stabilize full-year revenues, leaving stations with a 1% gain for the year.

Related: COVID-19: The Story of a Lifetime

Next year, local TV, including election year spending, will be down 20.2%.

Overall Magna expects ad sales by linear, or traditional media, to decline 20% in the first half of 2020 and 2.5% in the second half of the year, finishing down 12% overall.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Digital sales are expected to finish up 4%, with a 2% decline in the first half and a 10% increase in the second half. Digital video will grow by high single digits.

Total media sales might decrease by 2.8% this year, Magna said, with political spending leading a “v-shaped rebound in the second half.”

For 2021, Magna sees spending increasing 2.5% partly because of the lower 2020 spending, delayed consumer spending and the rescheduled Olympic gains.

“The current situation is totally unprecedented, but the closest historical equivalent would be a combination of the Great Recession and 9/11; a brutal economic downturn and a 'Black Swan' national disaster,” said Vincent Letang, executive VP, global market research at Magna. “Its effects on supply, demand, and media consumption are more complex and widespread than in any ‘normal’ economic recession in the past, and some of them will outlast the current crisis. Nevertheless, there will be an 'after'. At this stage, Magna anticipates ad market stabilization and rebound in the second half of 2020, and moderate growth in 2021.”

Magna notes that the impact on business and marketing activity will vary by industry. The most severe impact will be felt by the travel, restaurant and theatrical movie industries. The retail, finance and automotive categories face significant disruption. The situation could be a net positive for e-commerce and home entertainment.

The agency said that its analysis of brand performance in previous downturns suggests that brands that were able to maintain advertising activity, or increase their share of voice during the crisis, outperformed the ones that “went dark” during the recovery.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.