Local TV Ad Spending to Dip After Strong 2018

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Local TV advertising is expected to drop 10.6% in 2019, a non-election year, according to a new forecast by BIA Advisory Services, which sees overall local advertising growing slightly more than in its previous reports.

BIA increased its estimate of political spending during 2018, which contributed to a 12% increase for TV in 2018. But 2019 TV spending will be down slightly more than previously expected because of the revised 2018 numbers, despite an early start to 2020 election spending.

In addition to the drop in political spending, TV will see lower revenue from the automotive and retail industries, according to Mark Fratrik, senior VP and chief economist for BIA. The health care category could be among those growing over the next few years, he added.

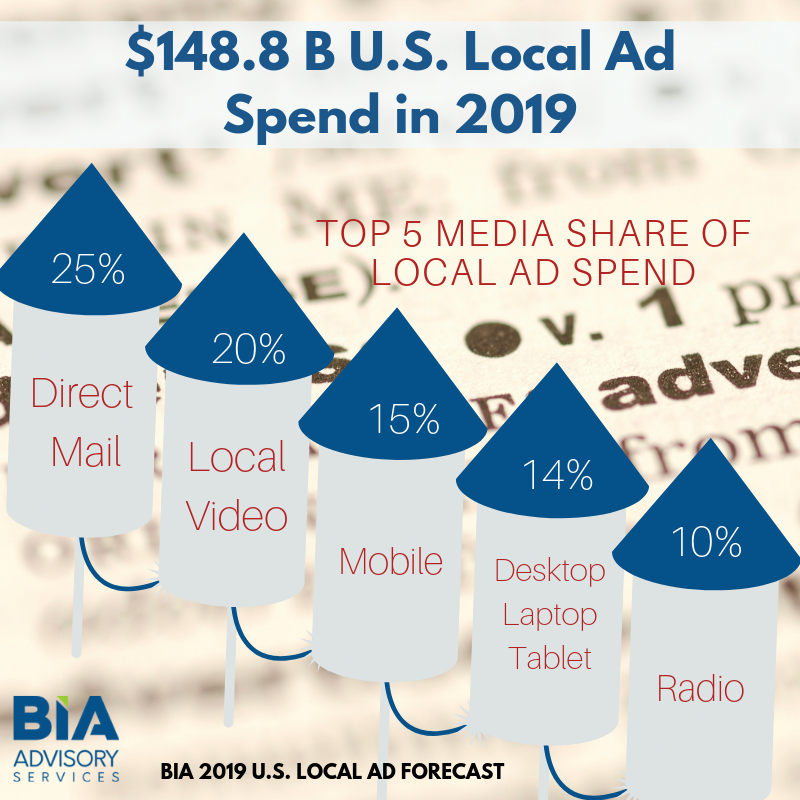

Overall, local ad spending is expected to grow 2.7% to $148.8 billion in 2019, with traditional media accounting for about 60% and digital spending representing 40%.

Between 2018 and 2023, BIA expects online and digital advertising to post a compounded annual growth rate of 9% while traditional media shrinks by 1.4%.

Local video--including over-the-air TV, local cable, local online video, out-of-home video and mobile video--is expected to account for $29.5 billion or a 19.9% share.

“The local video ad market is becoming very competitive,” BIA said in its report, with over-the-air remaining dominant in capturing local video advertising, even without substantial political advertising.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Direct mail will have a 25% share, mobile will capture a 14.6% share, desktop/laptop/table online and interactive media will have a 13.6 share with local radio accounting for a 9.8% share.

“It can be surprising to see that direct mail continues as such an important medium,” said Fratrik. “However, it directly targets more households than any other channel and mobilizes local consumers to make purchases, especially when combined with campaigns that make use of digital platforms. The key for revenue growth (and protection) today is not just to look at the media in your sector, but across all local media because you compete across all ad channels today.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.