Local OTT Ad Spending To Top $2 Billion in 2022: BIA Report

43% two-year jump makes OTT fastest-growing local advertising platform

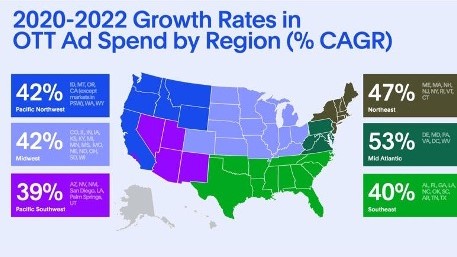

Local over-the-top ad spending is expected to exceed $2 billion in 2022, growing at an annual compounded rate of 43% since 2020, according to a new report from BIA Advisory Services.

The huge increase makes OTT the fastest-growing local ad platform, according to the report, titled OTT–The Rising Star in Local Ad Spending: Regional and Business Vertical Trends.

“The increasing volume of OTT impressions has elevated this channel from a fill-in audience reach extension play targeting audience segments hard to reach in linear TV, to a full-fledged marketing channel capable of delivering ad impressions at scale across demographics and market geographies,” the report said. “At this point, it’s fair to make the claim that the sheer number of impressions makes local OTT competitive with, but also complementary to, both linear TV and digital advertising.

Also: Advanced Advertising: Local OTT in Growth Mode

BIA defines OTT ad spend as comprising ad spending targeting local viewers of long form premium video content delivered via the internet. It notes that OTT gives marketers some of the best features of traditional and digital media.

"First, as with linear TV, OTT buyers can select ad inventory in premium video and brand safe environments with data-driven audience targeting joining first and third-party data in both direct and programmatic trading," the report said. “Second, digital campaign management tools for optimization and attribution further help marketers create, manage, and evaluate campaigns to achieve both branding and activation KPIs.”

BIA forecasts that ad spending across all local advertising media platforms will increase to $167 billion in 2022 from $138 billion in 2020, a 10% compounded annual growth rate. It notes that spending is shifting from traditional media to digital media, expected to capture 47.5% of spending in 2022, up from 41.7% in 2020. Behind OTT in terms of growth are digital radio, mobile, magazines and PC and laptop ads.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The top advertiser categories in terms of OTT spending in 2022 are general services at $337.2 million, automotive at $273.2 million, restaurants at $202 million, health at $202.8 million and finance and insurance at $182 million.

BIA also expects political campaigns to spend more on OTT.

“The sheer growth and volume of OTT impressions has taken the local OTT channel from a fill-in audience reach extension play to a full-fledged marketing channel,” said Rick Ducey, BIA's Managing Director and the author of the report. “Now, OTT is recognized as a channel capable of delivering local ad impressions at scale across demographics and market geographies, making it a highly competitive channel across all media.”

The report was sponsored by Vevo, the music video service.

“The data and insights that BIA provides in the report show the efficacy of local OTT as a competitive and powerful marketing channel,” said Liz Baxter, director of local advertising at Vevo. “As OTT continues to show itself as a win-win for advertisers, brands and agencies that want to target local audiences have a valuable new media channel to add to their advertising mix.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.