Local Broadcast TV Advertising Seen Rising 5.9% in 2024: Borrell Forecast

Connected TV weaker than previously expected

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

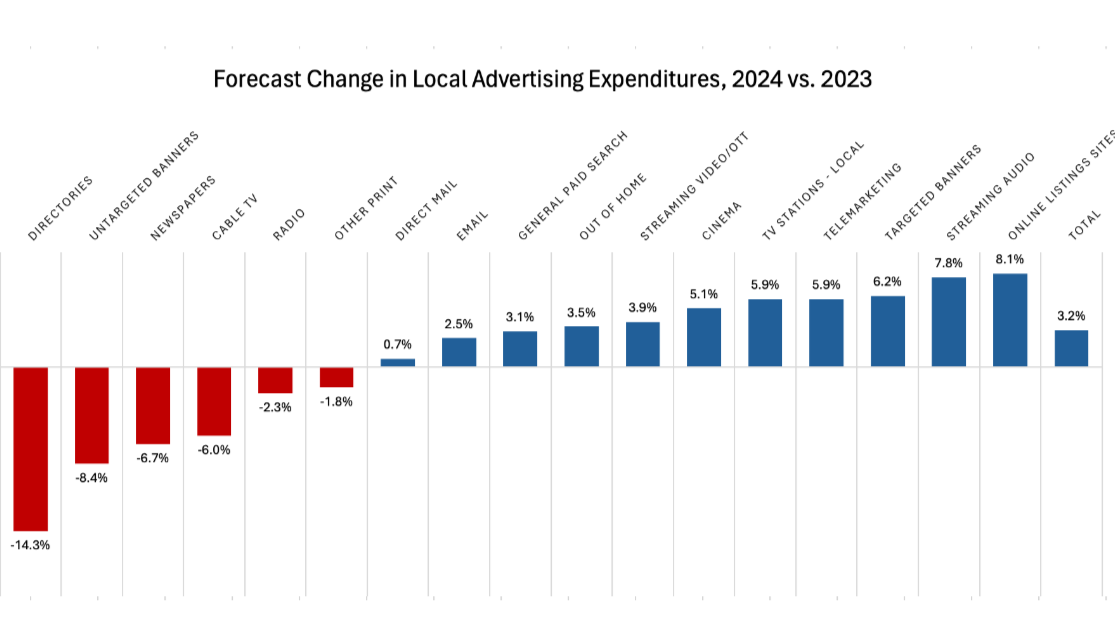

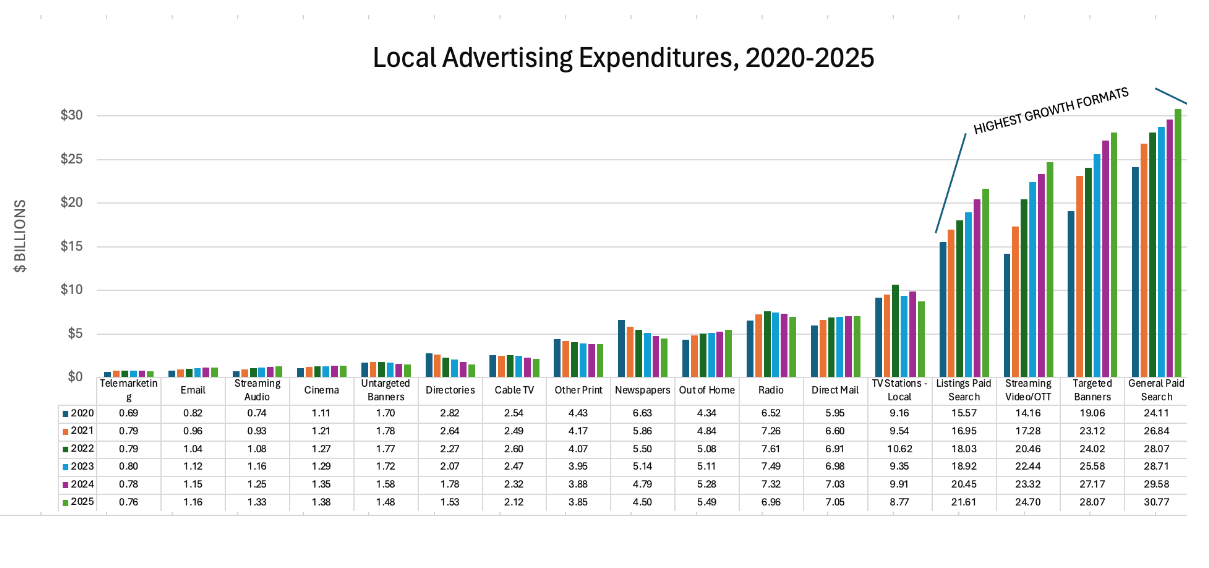

Local broadcast television advertising spending is expected to grow 5.9% to $9.91 billion in 2024. according to a new forecast from Borrell Associates.

After the election year, Borrell expects local broadcast advertising to drop to $8.77 billion, its lowest level since at least 2020.

Local cable-TV spending is expected to drop 6% to $2.32 billion in 2024 and continue to fall to $2.12 billion in 2025.

Streaming video advertising (over-the-top and connected TV) among local buyers is predicted to increase by 3.9% to top $23.3 billion. That’s less than Borrell expected in its last forecast.

The dip in the growth rate for local streaming video came as a surprise to Corey Elliott, executive VP of local market intelligence and Borrell’s chief forecaster.

“While there’s a lot of passion around digital video, it presents a bit of a challenge for local businesses,“ Elliott said. “They’ve been telling us in surveys that they don’t know how to purchase it or how it fits into their marketing plan. They aren’t even aware that it’s cheaper than broadcast TV. That all points to a more subdued ramp-up for OTT spending.”

“That being said,” he added, “the OTT jackrabbit is still outpacing everything else. It’s the fastest-growing form of advertising and is already the fourth-largest among the 18 different formats we track.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Borrell forecasts local streaming advertising will reach the $24.7 billion mark in 2025.

Overall, local advertising is expected to increase by 3.2%, which Borrell described as a “healthy” rate despite being slower than its earlier forecast of 4.4% growth.

The downward adjustment was triggered by new information from Borrell’s principal sources, including the U.S. Bureau of Labor Statistics, Woods & Pool, D&B, IBIS World, and Borrell’s quarterly SMB Business Barometer, the forecaster said.

Over the next five years, Borrell sees total local advertising increasing at a compound annual rate of 2.2%.

“For the past three quarters, we haven’t seen a lot of variation in SMBs’ [small and midsized businesses] attitudes about the economy and their plans to invest in advertising,” Elliott said. “They’re mostly neutral and slightly positive about the economy, but we’re still not seeing anything that would signal the bigger spring-back that many are hoping for.”

Since Q3 of last year and continuing through Q2 of this year, Borrell’s barometer survey has consistently shown that 50% of small and medium-sized businesses consider it to be harder to sustain a small business than it was six months prior.

Among individual local markets, the biggest gainers were Rapid City, South Dakota, up 32.9% to $190.61 million; Springfield, Missouri, up 30.4% to $515.71 million; Missoula, Montana, up 14.1% to $209.51 million; Dothan, Alabama, up 11.3% to $96.41 million; and Flint-Saginaw-Bay City, Michigan, up 11.1% to $389.08 million.

According to Borrell, the biggest declines are being seen in Watertown, New York, down 5.1% to $76.2 million; Miami-Ft. Lauderdale, down 3% to $3.140 billion; Orlando, Florida, down 2.6% to $2.192 billion; and Gainesville, Florida, down 2% to $152.55 million.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.