Digital Revenue Is Profitable for Local Media, Survey Finds

Gross profit margins of 41.6% reported

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

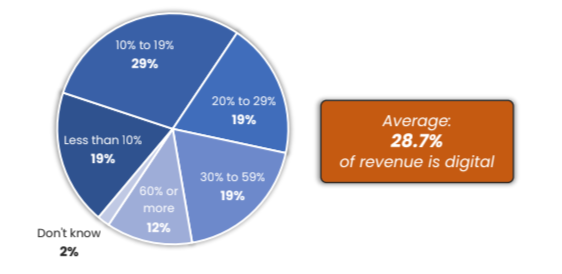

As local media companies build up their digital businesses, a new survey finds that the revenue from those businesses generates healthy profit margins.

The survey, conducted by Borrell Associates and the Media Financial Management Association, found that the average gross profit margin was 41.6% and the margin for earnings before interest, taxes, depreciation and amortization (EBITDA) was 32.8%.

Broadcast media tends to have EBITDA margins in the 35% to 45% range, so digital is less profitable than its traditional business. For prime media, digital is far more profitable, according to Gordon Borrell, CEO of Borrell Associates.

In the early days of the internet, traditional media companies were concerned about trading media dollars for digital dimes. The new survey offers a look at how the gap has closed.

“There’s been a lot of skepticism about the profitability of digital operations at traditional media companies,” Gordon Borrell, CEO of Borrell Associates, said. “It’s great to see CFOs are providing insights on the digital profit factor so the industry can gauge a true bottom-line value.”

The survey also found that companies are carefully tracking the performance of their digital businesses, with 71% of the companies participating saying they have a formal framework for calculating digital profitability and 57% expressing strong confidence in the accuracy of their calculations.

“This helps pull back the curtain on digital profitability," said Joe Annotti, CEO of the Media Financial Management Association. “It shows that financial managers have their eyes on it and are in fact tracking margins for overall digital sales revenue, as well as a great number of individual digital products.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The survey also found that on average, companies report revenue from 11 digital products. For the survey, profit margins were calculated for seven.

The most profitable products were email newsletters, mobile advertising banners and geofenced ads.

The report notes that most of the responding companies did not include all expenses and shared resources when calculating the margins for their digital operations.

The online survey was conducted between October 24 and November 2 with 58 companies that are members of the Media Financial Management Association or clients of Borrell Associates participating. Most of the responses came from newspaper and radio companies.

Among respondents, 61% held C-suite titles, with 31% being a GM, president, VP or director.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.