Local Advertising Expected to Grow in 2021: BIA

OTT spending seen growing 20% to $1.2 billion

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Local advertising is expected to grow in 2021, a non election year, but traditional media, including TV is expected to see its share of spending drop, according to a new forecast from BIA Advisory Services.

BIA sees local ad revenue rising 2.5% to $134.1 billion as businesses start to adapt and rebound from the pandemic as vaccines become available.

Traditional media revenue will get 55.3% of local spending, or $76.1 billion, down slightly from 2020, as digital media increases its share by 3.7% to 44.7% or $61.5 billion.

Over- the-top, locally activated advertising is expected to grow 20% to $1.2 billion in 2021.

“The OTT TV and the Connected TV segment are game changers for the broadcast industry because it is now very easy to purchase fragmented inventory and do audience targeting," said Rick Ducey, BIA Advisory Services managing director. "These improvements will help sellers better justify local OTT buying, and we expect local audience share gained in Q2 and Q3 of 2020 will be maintained and expanded going forward, presenting a tremendous opportunity for the industry,”

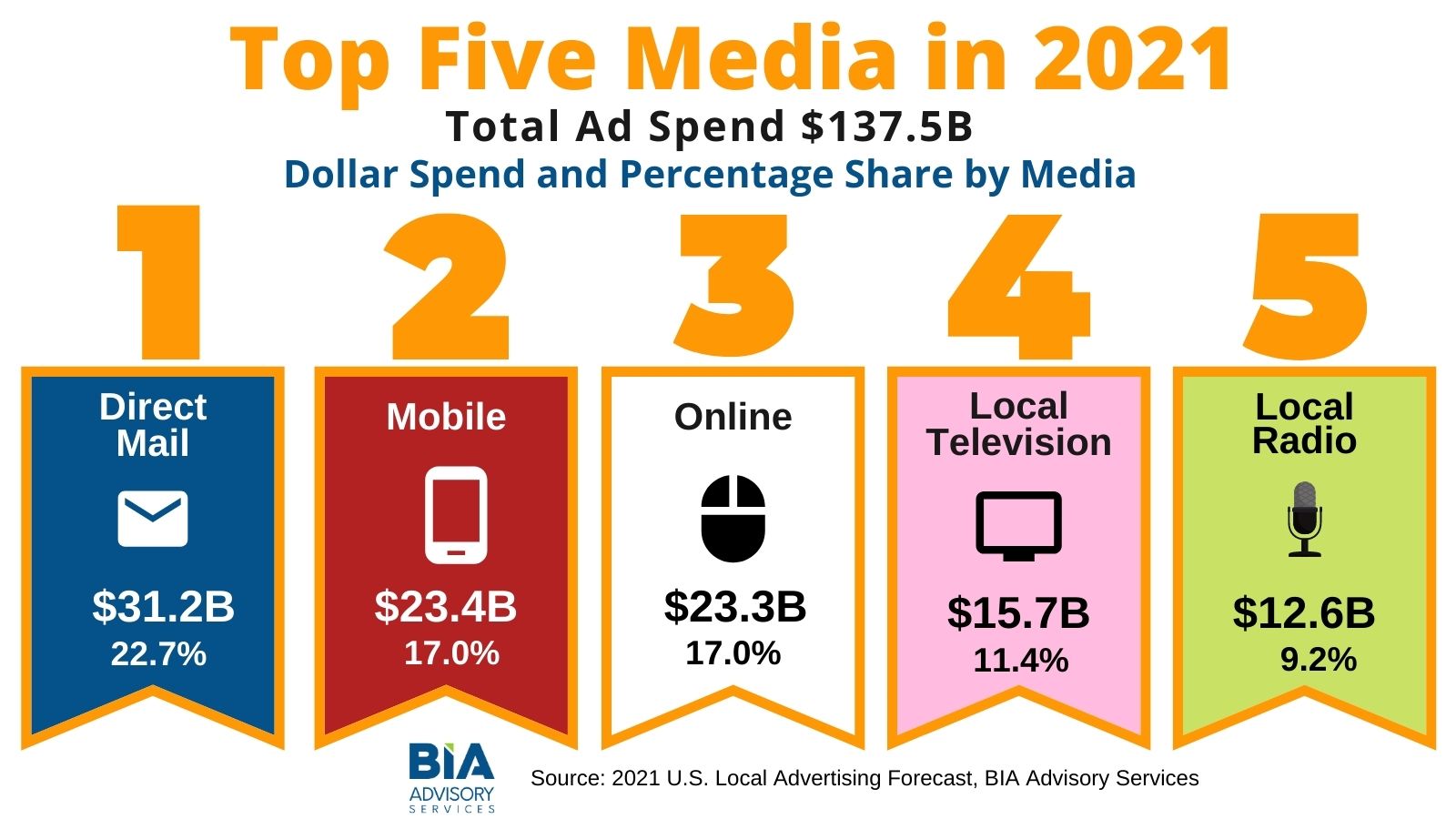

Local TV will attract $15.7 billion in spending, or an 11.4% share. Direct mail gets the biggest share with 22.7% or $31.2 billion, followed by mobile at 17% or $23.4 billion. Online spending also drew a 17% share and $23.4 billion in spending.

“Although we are estimating an overall increase in total local advertising next year, we do not expect spending to recover to pre-COVID (2019) levels until 2022,” said Mark Fratrik, chief economist, and senior VP at BIA Advisory Services. “The availability of a vaccine early in the new year will be a key factor to a much stronger year for almost all vertical advertising as the economy rebounds and consumers start moving around more freely and even going back into the office.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.