How Steve Harvey Plans to Make His Move to L.A. Work

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

After a year of pushing for it, Steve Harvey got his wish: His daytime talk show will pack up, depart Chicago and relaunch as a new celebrity-driven program in Los Angeles.

The move could add buzz to the show, which currently shines its spotlight on everyday people. It also capitalizes on Harvey’s A-list status as the star of top-rated programs including Debmar-Mercury’s Family Feud and ABC’s Celebrity Family Feud, both produced by FremantleMedia North America, and NBC’s Little Big Shots, hosted by Harvey and coexecutive produced by him and Ellen DeGeneres. Harvey is also working with MGM Television president Mark Burnett on a business-focused reality show for ABC.

On the other hand, the move raises the costs to produce a show that will air in many of the same 2 p.m. time slots in top markets next fall. That will make it more challenging for its new producer—WME-owned IMG, taking over from Endemol Shine North America—to make money.

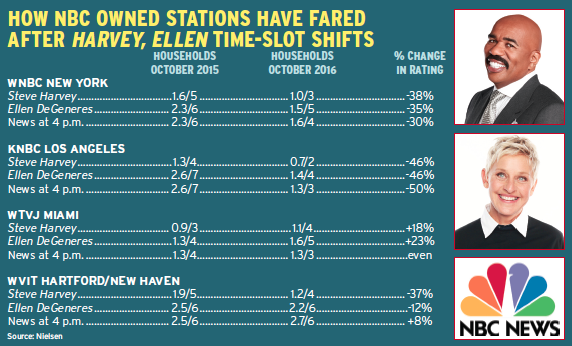

Last year, NBC decided to move both Steve Harvey and Warner Bros.’ The Ellen DeGeneres Show an hour earlier in four of its owned markets and add a local newscast at 4 p.m. On both WNBC New York and KNBC Los Angeles, Steve Harvey and Ellen have declined significantly this October compared to last (see chart). Both shows are doing better on WTVJ Miami, while it’s a mixed bag on WVIT Hartford/New Haven, Conn.

Among key demographics—women 25-54 and adults 25-54—Steve Harvey is down 44%, to a 0.5 from a 0.9, and off 50%, from a 0.6 to a 0.3, respectively across the NBC Owned Stations group, according to Nielsen. Nationally, Harvey is holding up better, declining 9% in households this year compared to last year season-to-date through Nov. 6, and dipping 4% among women 25-54.

What that means is that Harvey’s revamped show needs to earn higher ratings in order to be profitable. It’s a tall order for any syndicated program, and industry hesitation over whether that can happen is one reason it took a year to find the right deal for Harvey, even though sources said ABC and Tribune also kicked the tires on the new program.

In the end, NBC—which will distribute the revised show for a fee—made Harvey and his team the best offer, with sources saying the group will continue to pay approximately $300,000 per week for the show.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Once NBC clears the program in the rest of the country, it could pull in as much as $500,000 per week in license fees, for a total of $26 million annually. With barter advertising figured in, which at the current ratings level is approximately $18 million, the updated show could earn $44 million annually.

One person who will definitely make more money is Harvey. According to several sources, the host’s salary could be as high as $10 million, and he will have an ownership stake in the new program. But should the show not be able to make enough money to cover its costs, IMG, not Harvey, will be left holding the bag.

And that bag could hold a host of issues. For one, Harvey is a client of IMG’s owner, WME. Should IMG decide it needs to cancel the show for financial reasons, informing one of WME’s star clients could be tough. That said, industry sources say IMG and WME work hard to keep church and state separated.

Another challenge Harvey could face is booking celebrity guests, a very competitive field that starts with the network morning shows—Today, Good Morning America, CBS This Morning—and goes all through the day, finishing with the late-night shows. And Harvey will be competing for guests directly against Ellen, which it is paired with in many top markets.

Those issues aside, the retooled show offers new opportunities. Celebrity-driven shows tend to have more ability to drive ratings bumps. When then-Democratic presidential nominee Hillary Clinton appeared on The Steve Harvey Show, the program got a viewership pop. Celebrities can also make it easier to market a show.

Branded integrations also are becoming an increasingly strong revenue stream for daytime shows, and it’s an area in which IMG is adept. The Steve Harvey Show as currently produced does not air much branded integration, but that’s likely to change. Like DeGeneres, Steve Harvey—currently at the top of his game—should be in a strong position vis-à-vis brands.

Contributing editor Paige Albiniak has been covering the business of television for more than 25 years. She is a longtime contributor to Next TV, Broadcasting + Cable and Multichannel News. She concurrently serves as editorial director for The Global Entertainment Marketing Academy of Arts & Sciences (G.E.M.A.). She has written for such publications as TVNewsCheck, The New York Post, Variety, CBS Watch and more. Albiniak was B+C’s Los Angeles bureau chief from September 2002 to 2004, and an associate editor covering Congress and lobbying for the magazine in Washington, D.C., from January 1997 - September 2002.