Consumers Complain About Streaming, But They Can't Live Without Netflix

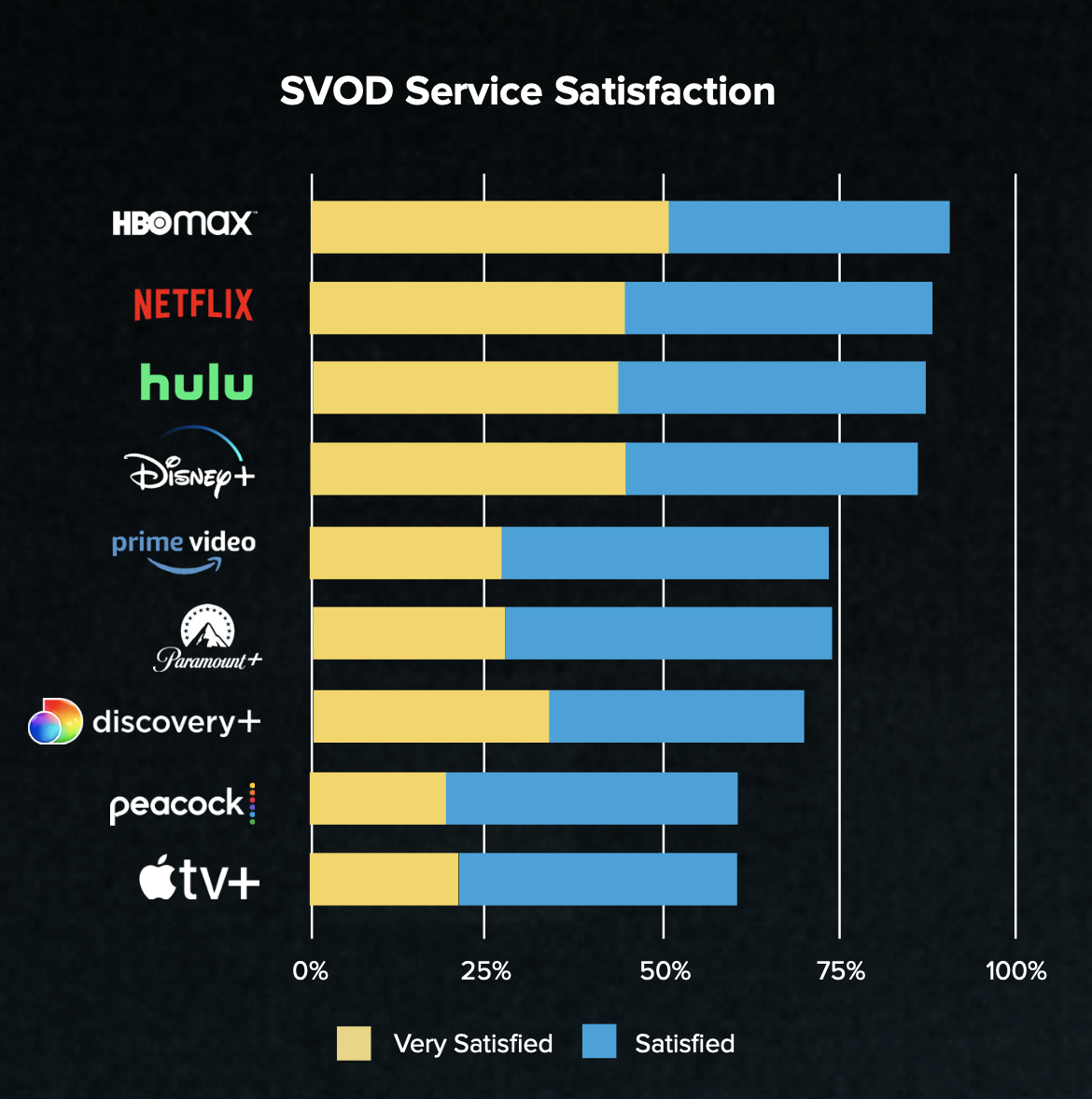

HBO Max has highest level of satisfaction in new Whip Media Survey

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Consumers said there are too many subscription streaming services and that they cost too much, but according to a new survey by Whip Media no service has a cancellation rate higher than 6%.

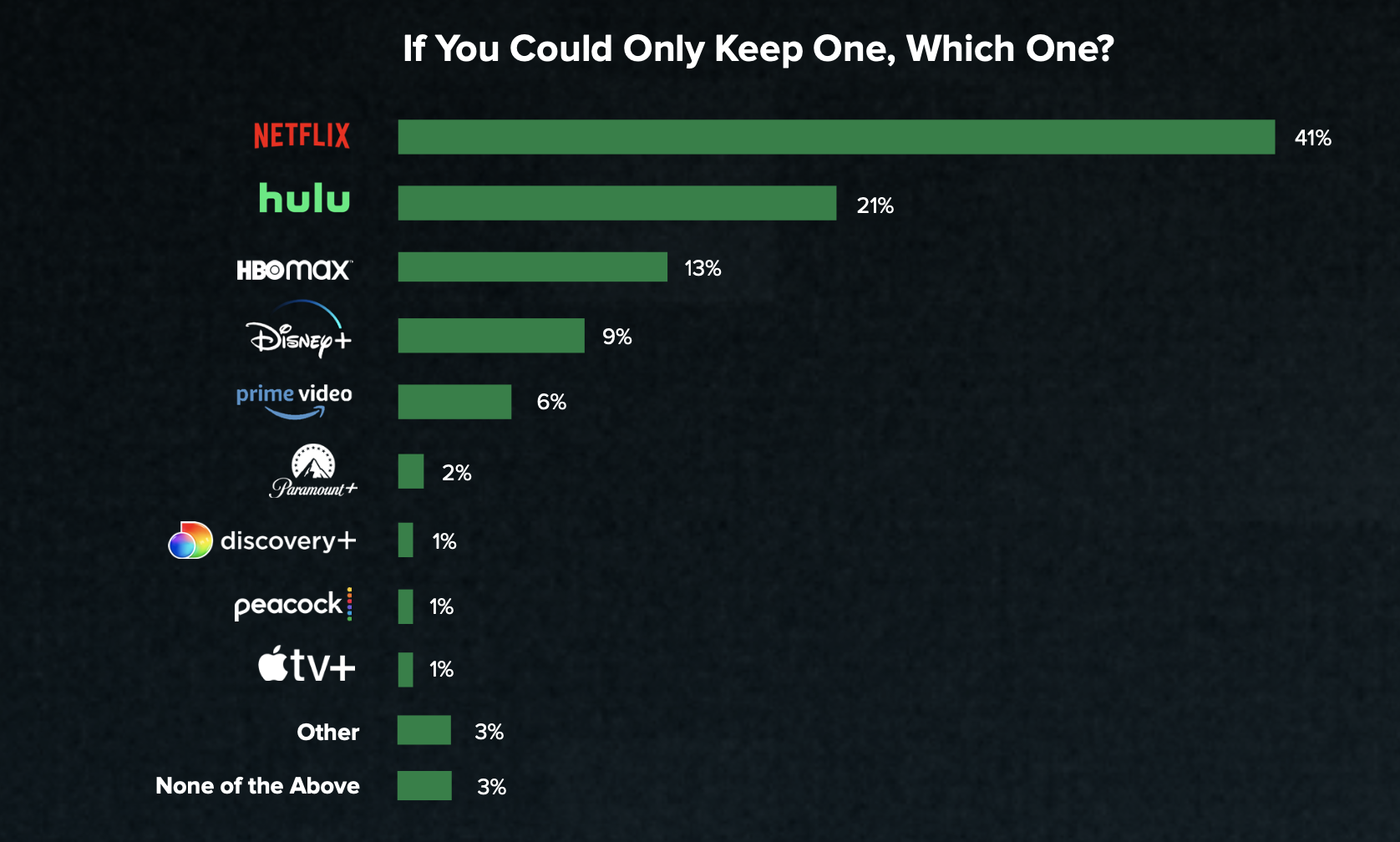

If they could keep just one streaming service, 41% of survey respondents said they’d keep Netflix. Asked which service left them most satisfied, HBO Max was tops with about 90% of respondents.

In the survey, respondents subscribed to 4.7 services on average and said they plan to add only one more. At the same time, 70% of them said there were too many subscription services on the market and 85% said streaming is getting too expensive.

Other complaints about streaming included that it’s annoying to switch between services, there are too many accounts to set up and manage, it’s too complicated to find the shows and movies I’m looking for and there’s not enough time to watch it all.

Despite the problems, 60% said they prefer to pay for a subscription service with no ads.

Whip Media said its data supports the idea that five is likely the limit as to how many services the average consumer will have. In the top five now are Netflix, Amazon Prime Video, Hulu, Disney Plus and HBO Max.

Staying in that group will depend on having an abundance of both compelling original content and evergreen library content to satisfy users when certain originals inevitably decline in popularity. “Of those five, Amazon would appear to be in the most dangerous position based on lower customer satisfaction with its video content,” the Whip Media report said. “But Amazon is likely to hold its position for its other features that are included along with Prime Video. The purchase of the MGM library should also help maintain their competitiveness.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The most “intriguing” challengers to the current Big 5 are Paramount Plus and Peacock, according to Whip Media.

“They have the libraries to compete with the big boys, and a few originals, but they need more and are planning to make them. Discovery Plus occupies a more narrow niche with lower production cost programming, and is less expensive than the others’ ad-free tiers, so it may not need to be in the top five,” the report said, adding, “the recent merger with Warner Media also clouds its future: Does it continue in its current form, or integrate into HBO Max?”

If there’s to be a shakeout in the streaming war, Netflix appears to be safe for now. Asked which service they would keep if they could have only one, 41% said Netflix. That was followed by 21% for Hulu, 13% for HBO Max, 9% for Disney Plus, 6% for Amazon Prime Video, 2% for Paramount Plus and 1% for Discovery Plus, Peacock and Apple TV Plus.

HBO Max recorded the highest level of customers who said they were either satisfied or very satisfied with the streaming service. Following HBO Max on the satisfaction question were Netflix, Hulu, Disney Plus, Amazon Prime Video, Paramount Plus, Discovery Plus and Peacock, with Apple TV Plus again bringing up the rear.

In the survey, 32% of respondents said they’d canceled a service, but no one service was hit particularly hard.

Not surprisingly, Apple TV Plus was among those most often named when consumers were asked which services they’ve canceled since May 2020. Apple TV Plus was named by 6% of those surveyed, along with Disney Plus and Netflix; HBO Max and Hulu were dropped by 5% of those surveyed; and Amazon Prime, Paramount Plus and Peacock were canceled by 4%. Discovery Plus was dropped by just 2%.

What do streaming consumers think is important? Library content is very important to 51% of them and original content is very important to 42%. But the importance of original content is on the rise, getting 68% in the fall 2019 survey, 71% in the spring 2020 survey and 78% in spring 2021.

The Whip Media White Paper on The Streaming Landscape is based on a survey of 3,960 U.S. TV Time app users between June 9 and June.13.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.